Wondering whether you should shell out for Amazon Prime? Here are the pros and cons.

Amazon Prime is a popular choice of subscription, but it comes at quite a cost. Here’s what you get if you sign up and our thoughts on whether it’s worth getting and when it should be avoided.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is Amazon Prime?

Amazon Prime is a paid-for membership to the online giant that gives you a series of benefits that normal customers don’t have access to or have to pay more for. There’s a long list of these extras further down.

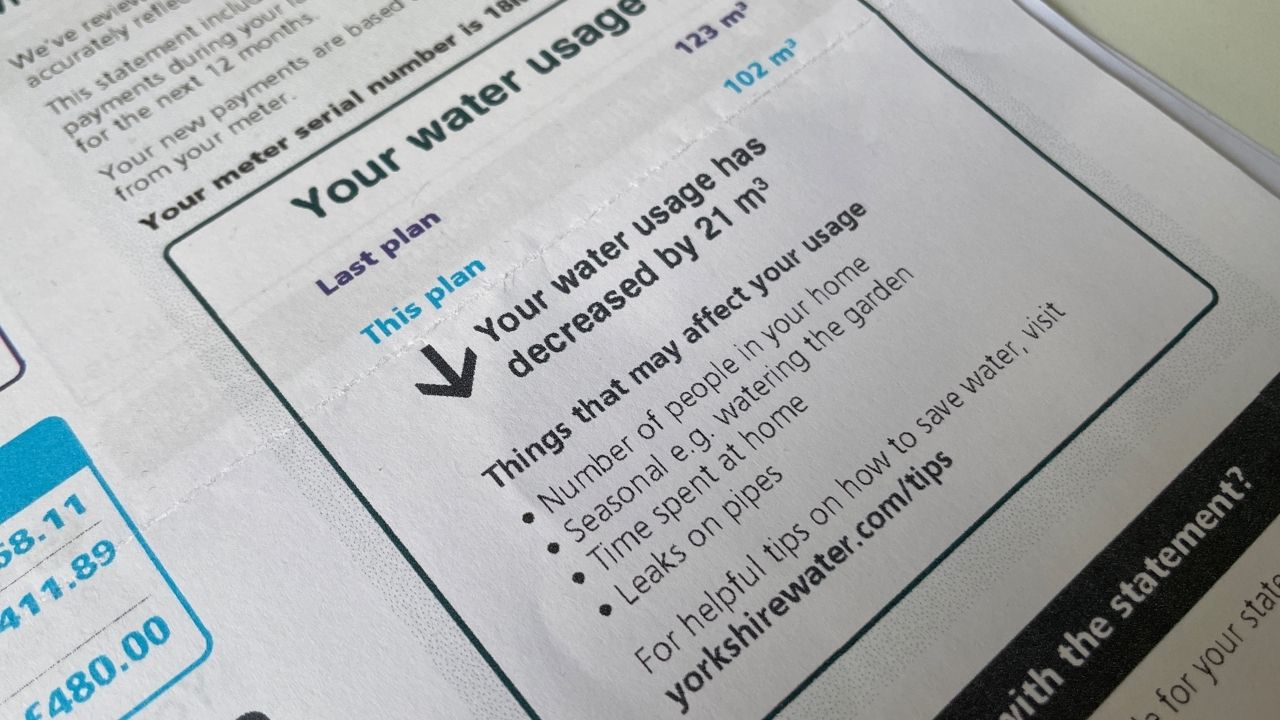

How much does Amazon Prime cost?

The free trial

Everyone can try Amazon Prime free for 30-days. It’s best to time your trial for when you think you’ll most need free delivery or when there’s a big promo event such as Prime Day, which tends to be in June or July each year; or Black Friday, which is on the fourth Friday of November each year.

Since every adult in the household can take out a free trial, if there’s more than one of you it’s possible to double up – or more. Once again, you can time these trials for times you’ll need to make more purchases, like ahead of an event or to prep for things like Christmas gifts.

You can repeat your trial a year after a trial has finished, so there’s the potential to do this every 13 months. And sometimes there’s even an offer earlier.

The annual membership: £95 a year

Amazon Prime costs a hefty £95 a year. This is a lot so you’ve got to use at least two or three of the perks for it to represent good value.

There used to be a couple of times a year where you could get the membership for around £59. These were usually in the run-up to Amazon Prime Day and Black Friday, though they’ve not happened in recent years. We always list these on our Amazon deals and discounts page, so bookmark it and check back!

The monthly subscription: £8.99 a month

If you don’t want to pay for the full year then you can opt for an £8.99 monthly subscription instead, which you can cancel whenever you want. It will work out cheaper than the annual plan if you pay for nine months or less, or practically the same for 10 months.

There’s a cheaper £5.99 option but this is just for the Prime Video streaming service and not the other features. This can be difficult to find so we have a guide to find Prime Video.

The student / young person discount: £47.49 a year

There’s a cheaper option for students or young people aged 18-22 who aren’t at Uni. They’ll get six months free, then three years at £47.49 a year. A monthly option costs £4.49.

To get this you need to have a student card or age ID (. Sadly, the loophole where anyone could get a student card is closed, though you might be able to get an alumni card.

Or if you’re 18-22 year olds will also get access even if they’re not at Uni.

Again, each household member can have the trial, so you can easily double up if you qualify.

What you get with Amazon Prime

Here are the key extras you’ll get as part of your subscription.

Free next-day, possibly same-day, delivery

There’s no minimum spend for delivery from Amazon when you’re with Prime, except if you want same-day delivery, where there’s a £20 minimum or a £1.99 fee. If you order from Amazon a lot, the free delivery can be pretty handy.

Normally you’d have to pay extra to get things sent through if the order is under £35, or £10 for books. The minimum amount quietly changed from £25 in June 2024, up 40%. This is standard delivery, so it takes a few days.

Generally non-Prime delivery will cost £3.99 for media (books, CDs, DVDs and games) or £4.99 for everything else. You can sometimes knock these down to £2.99 if you get your order sent to an Amazon “pickup location” such as a locker or newsagent.

So if you’re mainly thinking of Prime for delivery, you’ll need to make 20 orders under £35 in a year to break even with the pickup deliveries, or 16 at the higher £4.99 charge.

However, since not everything on Amazon is sold by Amazon, there will still be items that aren’t eligible for Prime delivery.

Two Odeon tickets for £10

Once per month, Prime members can get two Odeon cinema tickets for £10 or two recliner tickets for £15 at Luxe cinemas on Mondays to Thursdays. This can be stacked with discounted gift cards, so for example a 20% off gift card would mean the two tickets cost £8.

There are better Odeon deals and offers available, especially when you consider that tickets at some Odeon venues are typically £5 with myODEON anyway and can be booked with Meerkat Movies, making the tickets half the price.

Exclusive access to flash sales such as Prime Day

In the middle of July, Amazon marks its birthday with Amazon Prime Day. This usually features some big discounts on Amazon products like Kindles, Echos and Fire TV, as well as all sorts of other items. These deals are only open to Prime members.

The Black Friday sale which tends to run for about 12 days, if not longer, is another big sale with extra offers for Prime members.

We find that most of these deals are stock clearance or encourage you to buy things you don’t need. However, there are bargains to be found, especially if you utilise some of the extra vouchers to buy things you actually need.

Early access to ‘Lightning Deals’

As a Prime member, you can buy the daily deals 30 minutes earlier than everyone else. Since stock is usually limited, this could be the difference between getting the item and missing out. Here’s more about how Lightning Deals work.

TV and movies with Prime Video

There are some good exclusive TV shows such as The Boys and The Marvellous Mrs Maisel, and plenty of other box sets.

There are also some decent recent and classic movies. Amazon is making more original movies and has purchased the legendary studio MGM, so we’ll see even more films appearing just on Prime.

You can stream from your computer, smart TV or devices such as a Chromecast or Fire TV stick, or download to your phone.

Don’t forget though that Prime Video costs £5.99 a month on its own (without the other Prime benefits), which might be a better option for you.

You can’t get ad-free streaming, though. Amazon introduced an extra £2.99 monthly charge for ad-free Prime Video in January 2024.

Live Champions League Football

Amazon is also increasing the sports you can watch exclusively via Prime Video. Next season you can watch Tuesday night Champions League football with it, though it no longer offers selected Premier League matches.

You can read more about the cheapest ways to watch football in our summary.

Ad-free streaming with Amazon Music Prime

This included streaming service is better than it used to be. It’s ad-free and has grown to 100 million songs (similar to Spotify) so there’s plenty to keep you occupied if you don’t want to shell out extra for premium music streaming.

The problem is you can only shuffle your tunes. That’s ok if you’re mainly listening to playlists (which you can create), but it can be annoying if you want to hear an album from start to finish.

You can also listen to podcasts ad-free – including our one, Cash Chats.

There is an extra Music Unlimited service which you pay £10.99 for, and there’s a £1 discount for Prime members, however, there’s a trick to pay upfront for a year to get Music Unlimited even cheaper.

Digital books and magazines with Prime Reading

Every month Prime members get access to a few thousand ebooks and magazines to read via a Kindle, Kindle app, or even your computer. There are a few big titles, such as the Harry Potter series, but otherwise don’t expect to pick up all the novels on your reading list.

The magazine offering isn’t bad, but the titles change every month. It’s better instead to see if you can get digital magazines from your library.

There’s also “First Reads” where you can pick up a free Kindle book each month from a selection of six or so titles. But don’t expect any future award-winners. You can see previous ‘First Reads’ titles here.

Games via Prime Gaming

You’ll get a Twitch channel subscription each month, along with some free PC games to play.

Unlimited photo storage with Prime Photos

Amazon’s cloud-based storage will keep the photos you take safe if your computer or phone is lost or stolen. You also get 5GB of storage for other file types with Amazon Drive – the same you get with Apple iCloud, but less than the 15GB with Google Drive.

Free Deliveroo Plus

You can sign up for a year of Deliveroo Plus Silver, which will save you money on delivery costs, worth £3.49 a month. However, there’s still a minimum spend of £15 per order. Here’s more about Deliveroo Plus.

Access to Amazon Fresh grocery delivery services

Prime members also get to order food from their local Morrisons, Iceland or Co-op and from Amazon Fresh. It’s free delivery for baskets over £60 but charges you £2 for orders between £40 and £60 and £4 if the total is under £40 or if you want the delivery within two hours.

Free Hello Fresh delivery

Prime members get free delivery on their Hello Fresh orders for a year. Delivery usually costs £4.99 for each box.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

What you don’t get included with Amazon Prime

You’d be forgiven for expecting Prime to give you all the extra services Amazon offers. But no, you need to pay extra for the following:

- Amazon Music Unlimited – an extra £10.99 a month

- Kindle Unlimited – an extra £9.49 a month

- Ad-free Prime Video – there’s an extra charge of £2.99 per month for this

- Audible audiobooks – an extra £8.99 a month

- Amazon Channels – costs vary for extra TV channels such as Paramount+ and Discovery+

What’s good about Amazon Prime

People obviously love the next-day delivery, and it’s certainly a service that other retailers find hard to compete with. And there’s much more you can get on top.

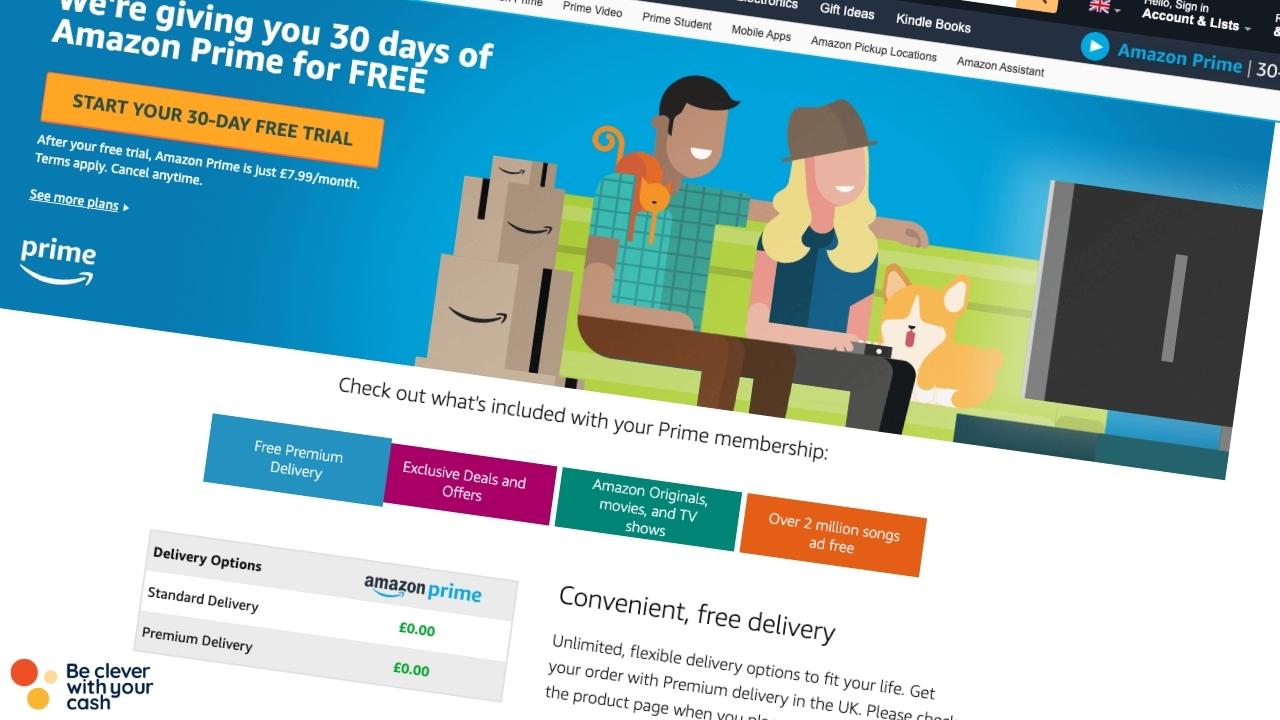

If you use most of the features that come with Amazon, you’re getting a lot for your money – effectively £7.92 a month if you pay for the year. Here’s a quick comparison of how this stacks up against some key competitors:

| Prime Membership | Cost with Prime | Alternatives | Cost of Alternative |

| Free next-day delivery | £95 | Paying for delivery charges elsewhere (three orders a month at £2 an order) | £72 |

| Prime Video | Included | Netflix (standard) at £10.99 a month | £131.88 |

| Amazon Music Unlimited | Extra £99 | Spotify Premium (annual subscription discount) | £120 |

| Total £194 | Total £333.88 |

We’ve assumed three online orders a month with a charge of £2. Often you’ll get free delivery from other retailers, but charges will also vary. And, you might order more or less, and delivery charges might be different too, but this gives you an idea.

With TV and film streaming, Prime Video is cheaper than Netflix, even when subscribed for full Prime rather than on its own.

And even with the extra charge for Music Unlimited, it’s cheaper than buying the same service with Spotify if you are also using the other parts of Prime.

Prime members can also get access to extra vouchers and discounts, which are great if you are going to spend the money with Amazon anyway.

What’s bad about Amazon Prime

There’s a reason that Amazon packs so much into the membership. It doesn’t want you to spend money elsewhere. If you’ve already paid for delivery with Prime, you’re not going to want to make orders with other retailers and pay for delivery, or get it later than you could with Amazon. This stops you from shopping around. And you could easily end up spending more money as a result.

In part, that’s because Amazon isn’t always cheaper. Across my year without Amazon in 2021 I actually saved money on his purchases – even when you factor in the delivery costs.

Plus, you’re much more likely to buy more because you have Prime. Not just because you’re more likely to be on Amazon more often and open to more temptation, but also because those extra discounts encourage you to make unnecessary purchases — such as on Prime Day and during Black Friday.

You also lose the friction that added delivery costs can add to your purchase, which might usually make you think twice before buying something you don’t need.

Let’s also look again at the table above. Yes, it’s potentially a huge difference in spending, but that’s assuming you don’t also pay for the other services elsewhere.

If you do want Disney+ or Netflix, then also having Prime for film and TV won’t be saving you cash – it’s an extra cost. It’s only cheaper if you ditch the others.

And if you need to shop elsewhere (not everything is on Amazon) you’ll pay for delivery on top.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

Is Amazon Prime worth it?

So, does Amazon Prime offer good value for money? Well, it can, as long as you use at least a couple of the services. Most people will get enough use from the free delivery and exclusive discounts on Prime Day and Prime Video to justify the £95 fee.

However, if you end up buying more and not shopping around because you have Prime, you’re likely to spend more money having Prime rather than not having it.

Don’t forget you can still shop at Amazon without Prime. Yes, you might pay between £2.99 and £4.99 for items under £25 (it’s under £10 for books). But you’d need to order something under that threshold roughly every fortnight to cover your £95 fee. Do you order low-cost items that often from Amazon?

And of course, you need to consider where else you shop. It ultimately comes down to whether you are dedicated to Amazon or happy to shop and stream elsewhere.

If you don’t want to stop completely, then maybe you could cancel your annual membership and go monthly. And then pick and choose the months you need to use it. So perhaps it’s just around Prime Day, Black Friday and when you want to binge on some new box sets. Just see how you go!

My year without Amazon

Why I cancelled Amazon Prime membership

I actively chose to go without Amazon in 2021, so I obviously cancelled my Prime membership – even though I was paying just £39 a year.

This was largely a step to proactively support other retailers (ideally on the high street). But I also wanted to make sure my money didn’t help Amazon continue to grow its profits while it manages to (legally) avoid paying a fair rate of tax here in the UK and elsewhere.

Of course, you might think that going without isn’t possible, but I’d urge you to give it a try. I found it so much easier than I thought I would, and I’ve been surprised by how much less I bought and how much less things cost at the same time.

You can read more about my year without Amazon and how much money I saved.

How to cancel Amazon Prime

Watch this video to see how you cancel – and why you might want to think about using Amazon less.

Other ways to save at Amazon

Make sure you check out our Amazon deals and offers. This is where we’ll list flash sales, gift card bonuses and other extras. For example, you can often get a free top-up when you buy a gift card. All this and more via the link below.