From unused Oyster cards to old bank accounts you could have some handy spare cash ready to claim.

I spotted an advert on the tube the other year from Nandos – revealing there were 1.8 million unclaimed rewards sitting on Nando’s cards. That’s a lot of chicken. But I wasn’t that surprised. It’s just another example of forgotten cash and rewards that we really should be using.

So this got me thinking – where else could people forgot they’ve got some money? Here’s a quick list of places to check, and how to make sure that money is going to better use.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Cashback sites

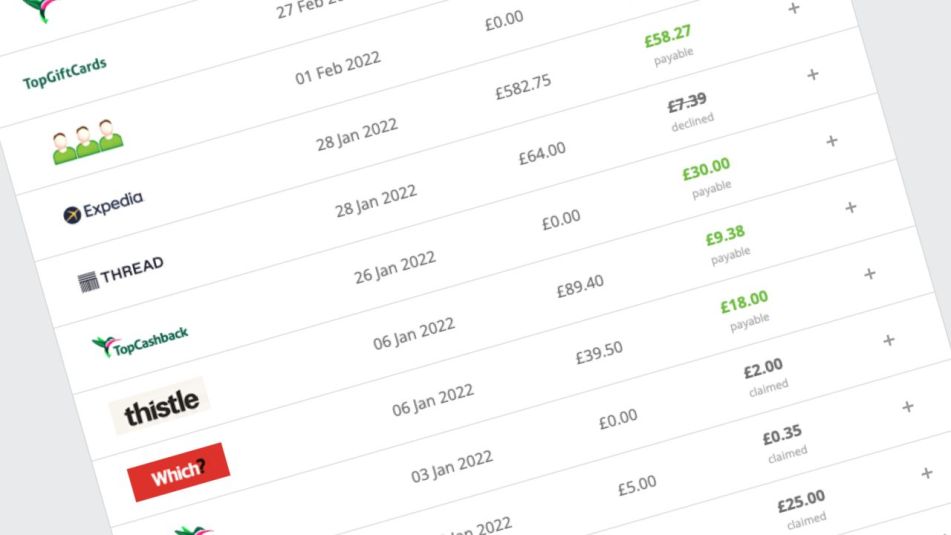

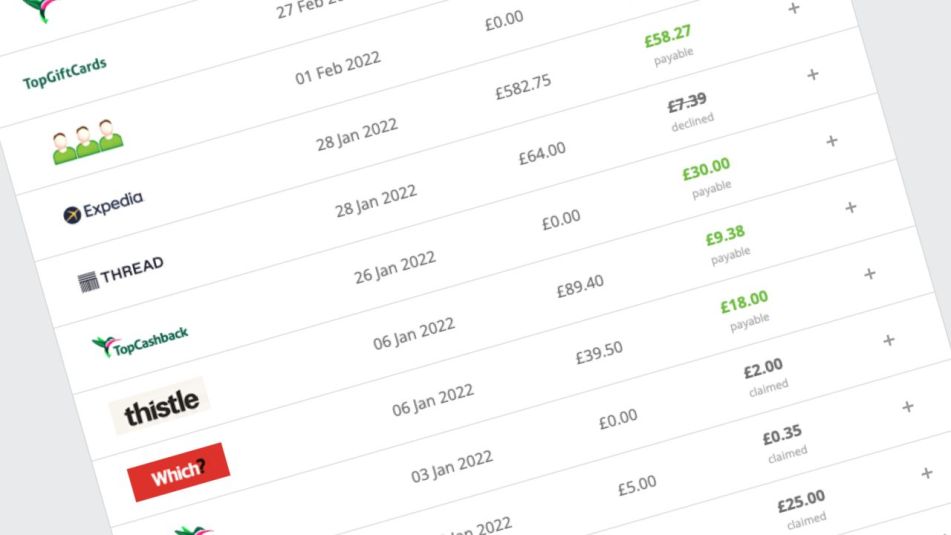

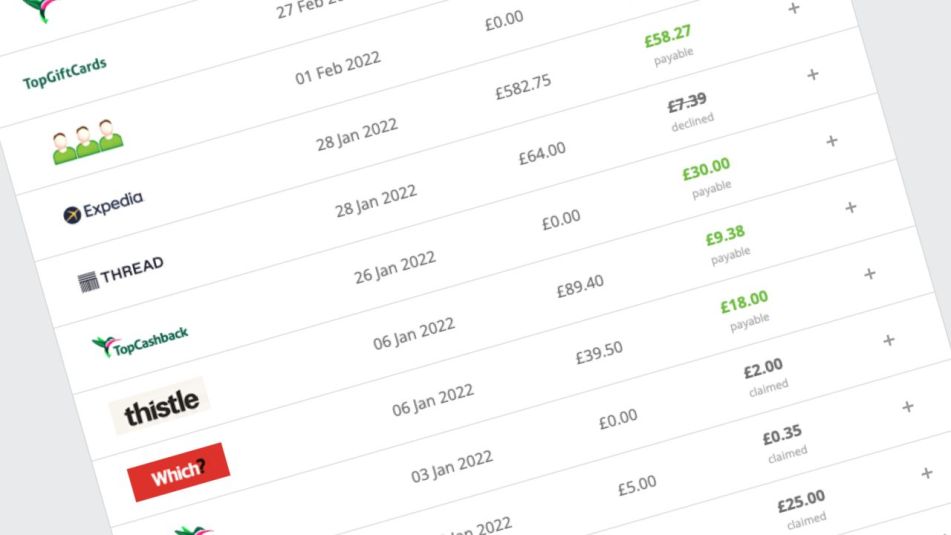

Regular readers will know I’m an advocate of using cashback sites to earn a little extra. By using Quidco or Topcashback as the first stop before going to most online shops you can receive money back on your purchase. Really easy.

But the cashback does take a while to be paid out. So if you’ve not used your account for a while, it’s worth looking to see if there’s anything ready to cash out.

Bank rewards

There are quite a few current accounts with extra rewards, from £5 a month from Halifax through to cashback on bills from Santander. If these aren’t your main accounts it might be those payments are stacking up, so transfer them through to your main current account or a savings account.

Old savings accounts

I remember a good few years back I found an old Post Office book that has been set up by my gran. There wasn’t much in it, but it has just been sitting there.

Similarly, a while back Becky had a letter from Virgin Money saying she hadn’t been in touch for a while. Turned out it had been four years and there was £4.41 of interest which had been added after she’d cleared the balance.

So take a look through your records. See if there are any accounts you’ve long forgotten – there could be cash lurking!

Auto-savings apps

Similarly, if you use Plum, Chip or the roundup feature with banks such as Starling and Lloyds then you could have squirrelled cash away bit by bit. Unless it’s the 5% bonus interest on roundups in Chase Bank, I’d move this money through to a better paying account or spend it.

Credit in online shops

With some online retailers, you’ll be refunded in credit which stays on your account, particularly if you’ve paid by gift card or voucher. So log in to Amazon, John Lewis and the rest to see if there’s any money sitting there. You can’t transfer this out to your bank, but you can use it.

Gift cards

Speaking of gift cards, take a look in your wallet, drawer or wherever you keep them. These are so commonly forgotten about that when found they’ve expired and all the money lost. Hopefully it’s not too late for any you have. Here are my rules for making sure you don’t waste your gift cards

Loyalty schemes

If you’re always tapping a loyalty card when you go shopping, log in to see how much you have racked up.

Tesco Clubcard points are usually posted as vouchers, but you can reorder any which you’ve lost or exchange them online for boosted deals.

With Nectar you need to check your account. You can spend these in Sainsbury’s direct from your Nectar card.

And don’t forget the rest – there could be a free coffee, donougt or chicken sitting at the back of your wallet.

Old phone, TV or energy accounts

When you switch supplier to get a better deal, make sure you aren’t owed any cash. Often with bills like these you pay in advance so could well be due some money back – and the companies won’t automatically send it to you. So chase it up!

Get the best of our money saving content every Thursday, straight to your inbox

+ Get a £20 Quidco bonus (new members only). More details

Oyster cards

Remember when you needed an Oyster card to get around London? Since we’ve been able to tap and go with Contactless cards on London’s tubes and buses, we’ve had no use for the official payment cards. So these cards have just been sitting there.

I had a quick look a few years ago and both Becky and I had a little bit of cash on our old cards. Just a few quid. A couple of clicks to cancel and apply for a refund then brought a welcome surprise. We were also due an extra £5 back. Each. We’d both forgotten that when we got the Oysters we had to pay this as a deposit.

Prepaid cards

It’s not just Oyster where you could have some balance left over. Have you ever had a prepaid card? Maybe on holiday? Check what the balance is and get that money back. And as with Oyster see if you had to put a deposit down.