In an ideal world I’d always stick to my principles, but it’s not always easy, especially with food.

Seeing as it’s currently Fairtrade Fortnight, a two-week celebration of the Fairtrade stamp and all the good the Fairtrade Foundation does, I thought I’d delve a little deeper into some of the foodie consumer choices we can make to see just how easy or hard it is to make a stand.

My ethical eating challenges

I’ve had spells where ethical decisions have heavily influenced how I ate, but I always seem to make compromises which water down my resolve. Sometimes it’s down to cost, other times it’s convenience.

But there’s also an aspect of feeling overwhelmed and even confused by the decisions that need making. This is the biggest challenge I find to eating ethically. Even when I feel I’m doing a “good thing”, there’s something I’m not doing which cancels it out.

I know it’s not realistic for me to get it right all the time, so I’ve reached a happy medium where I’ll do what I can.

I still try to do more, and over the last year I’ve moved to only Fairtrade chocolate (thanks to the delicious and good value Tony’s Chocolonely) and reduced my meat consumption.

If this sounds like something you’d also like to do more of, then here are a few of the ethical dilemmas to consider at the supermarket.

It won’t always be easy, and I can’t promise you answers – but it will hopefully help you focus on where to concentrate your efforts.

Fair pay and rights for producers

Brits are a caring bunch. Each year we give more and more money for humanitarian causes – basically helping people. With food, this often boils down to workers’ rights, pay and conditions.

Fairtrade

Fairtrade is probably the biggest help here. From bananas to coffee, and even things like wine and nuts, this stamp tells us the farmers are getting a fair deal. I like Fairtrade, and genuinely believe it’s a good thing, not just via the price paid to producers, but also in the wider work the Fairtrade Foundation does in communities across the world.

But it’s not perfect. Sometimes prices still aren’t enough. And I have concerns “greenwashing”. Some big brands, such as Nestle, appear to have a small number of products certificated by the scheme (though last summer they dropped Fairtrade choc from KitKats). This gives the appearance that they are an ethical brand, yet the vast bulk of their business carries on with normal, and often unfair, working practices.

However, the argument the other way is persuasive too. Even a small amount of big brand products certified as Fairtrade can make a big difference to producers due to the scale these products are sold at.

I’m not entirely convinced by this, but overall I think yes, buying Fairtrade does make a difference.

Other certification schemes

Recently there’s been a problematic development. A few big brands are replacing Fairtrade with their own schemes.

A few years ago, Green & Blacks (owned by Mondelez, which also owns Cadbury’s) released a new type of choc which, for the first time, wasn’t Fairtrade. Instead it’s under Mondelez’s own Cocoa Life programme, and other certified choc made by Mondelez will follow suit and drop Fairtrade.

Sainsbury’s also switched all its own-brand tea from Fairtrade to its own “fairly traded” scheme. And as mentioned, Nestle dropped KitKats to its’ own scheme.

I find these other schemes more difficult to trust. As a consumer I don’t know what the label promises, and without wider oversight how can we be sure it’s really any better than anything else.

Personally, I’d aim to stick to Fairtrade if you can, and it’s worth putting pressure on the manufacturers and retailers to do the same.

UK producers

But eating ethically to help people isn’t just about overseas farmers. You might remember the milk price wars from 2015, where farmers revolted at the price supermarket were forcing them to accept. The amount didn’t even cover the cost of production (and in some cases it still doesn’t).

It’s difficult to know when a fair price is being paid. As a rule Co-op, Waitrose, Marks & Spencer are better options, though Tesco and Sainsbury’s both promise a fair price to dairy farmers.

Animal welfare

Meat

Obviously the most ethical way to support animal welfare is to not eat meat.

About 15 years ago I briefly gave this a go. I was in Australia’s outback and I’d just seen a double-decker, double-length lorry transporting cows. Really distressed cows. Seriously, the noise they were making was just heartbreaking. Then the driver got out and started jabbing through the small holes in the truck with an electric cattle prod, and he did it with a lot of enthusiasm. It made me feel sick.

I’d always been concerned about animal welfare but this was what prompted me to take some action. I was now a vegetarian. Except it didn’t last. The very next morning, more out of muscle memory rather than a conscious decision, I ate a sausage roll! I’d lasted just 20 hours. No doubt that’s the most pathetic attempt at vegetarianism ever.

I spat the sausage roll out and started again, avoiding meat for a few more weeks before deciding I’d instead just eat high-welfare meat.

In the supermarket Soil Association certified organic is usually the highest standard, followed by free-range and then outdoor reared and RSPCA Assured certified (previously called Freedom Food). Some supermarkets, including Waitrose and Marks & Spencers, also have their own higher standards which are similar to the RSPCA requirements.

Of course, these all cost a lot more money so I tend to stock up on special offers and reduced food and whacking them in the freezer for later use.

What makes this rule difficult is eating out or going to a friend’s for dinner. I vividly remember eating a pea risotto on a date, while she tucked into a steak.

So for the last ten or so years I’ve instead gone for a more flexible approach. If I’m out, I’ll eat what is on offer – though I’ll try to pick an ethical option.

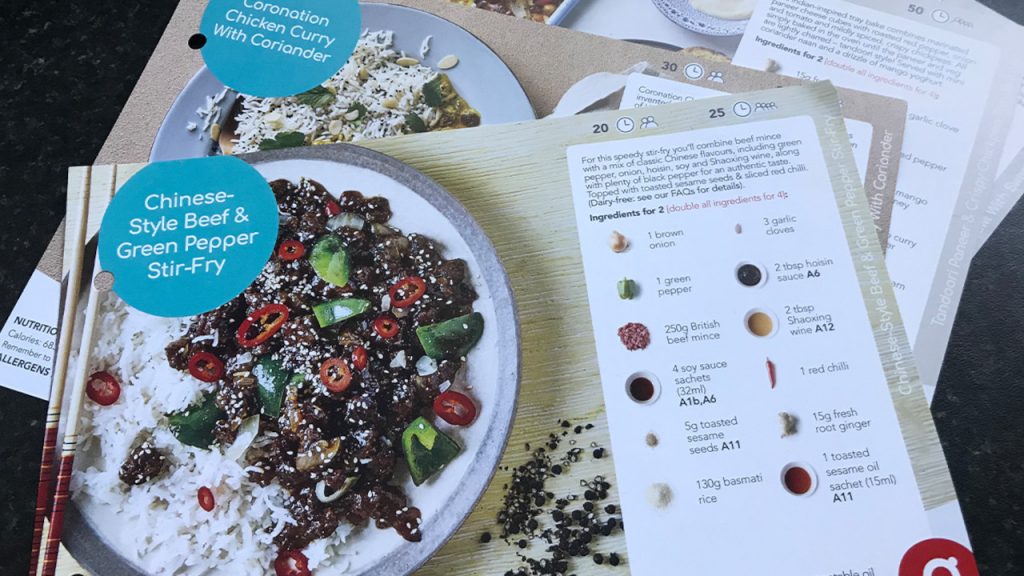

And at home or out it’s so much easier now veganism has become mainstream. There are some really good meat substitutes available from supermarkets, and of course just cooking veg based meals. We’re trying to have a couple of meat free days each week.

But importantly I’ve not had a KFC or dodgy late-night kebab since that day in 2006.

Fish

Look here for MSC certified fish (it’s a blue sticker), which means the stock levels in the sea are sustainable and ok for you to eat. Oh, and I know dolphins are mammals, but try to buy line-caught tuna rather than net caught.

Eggs

Really easy here isn’t it? Always buy free-range. Except even then it’s not all rosy for the chickens. This Guardian article is particularly enlightening. Soil Association certificed organic once more has the highest welfare standards. Still don’t buy anything that’s not free-range or above.

Dairy

A few years ago I watched a BBC Three comedy/documentary by Simon Amstell (off Never Mind the Buzzcocks). I didn’t realise he was a vegan, and this was his ode to giving up meat completely. It’s a weird watch, and (deliberately) disturbing at times.

But it did make me think differently about dairy farming. Though Soil Association has the best standards for the welfare of the cows, there are still ethical concerns – a big reason many people do go vegan.

If this is something you’d like to know more about, I’d recommend watching the programme on iPlayer.

Politics and the environment

I could write a lot more here on these topics, but I just don’t have the space in this article.

The environment

The hottest issue for the last few years (literally) and it’s been the biggest motivator in people trying veganism.

Buying local and seasonal certainly helps reduce carbon emissions, though they’re nothing compared to the pollution caused by farming meat.

Some argue that even veggie and vegan staples such as quinoa, soy and almond milk have an impact on the environment. Which is true, though no where near as much carbon emissions are produced, so eating less meat can be a good move.

Another easy way to help is to reduce food waste. Chucking away food you forget about or don’t finish means you’ll buy more grub. That doesn’t just cost you more money, it means more food miles, processing etc in the replacement food you buy. Your freezer can be your friend here.

Packaging and plastics are huge here too. Can you buy loose rather than packaged fruit and veg? Or meat and fish off the counter rather than shelves? Try to recycle and reuse as much packing as possible – or ideally avoid it. I don’t use those small bags for loose fruit and veg, and I’ll always bring my own tote bags for packing.

Your money can also actively help the environment if you pick things like Rainforest Alliance certified coffee.

But there’s so much more you could do, so it’s up to you where you focus your efforts. I still haven’t got into reading more about palm oil which seems to be in almost everything, but it’s one to avoid if you can.

Politics

Obviously your decisions will depend on your wider political views. A couple of the main issues I struggle with are:

So many brands owned by bigger conglomerates. Pringles are a good example – they were owned by Proctor & Gamble who test on animals (obviously not the crisps) until recently. And PepsiCo has been criticised for supporting modern slavery through its palm oil production (which also increases deforestation).

It means that it’s often impossible to know if I’m inadvertently buying something ultimately owned by a brand doing something I disagree with.

There also are groups that call for consumers to boycott produce that’s originated in Israel, as it could actually be from the occupied territories. Though equally it could be from within Israel. Or there are reports which connect avocados with Mexican drug cartels. It’s difficult to know!

Again, I think the answer is to find out about issues you are particularly passionate about and see if there are any real villains you need to avoid. And build from there.

How supermarkets measure up

As I said earlier, I try to stick with Waitrose and M&S Food, particularly for meat. Ethical Consumer magazine scores all the supermarkets on politics, animals, people, the environment and sustainability.

At the time of writing, Co-op, Waitrose and M&S all do well, with Asda and Tesco at the bottom of the table.