Easter is only a few weeks away and the supermarkets are adding more and more chocolate goods to the shelves. Are they worth buying, or are you being ripped off?

Plus, your chance to win Hotel Chocolat easter goodies!

This week myself, seven other money bloggers, journalists from the Telegraph and Mirror and the teams at Quidco and CheckoutSmart took part in a blind taste testing. It was all part of my UK Money Bloggers community, and Quidco very kindly sponsored the event.

Our mission: To find the best value Easter Eggs.

It was a lot of fun, with some big surprises. Lindt – which I normally like – was one of my least favourite, and big brands like Thorntons and Cadburys were pretty average. One of my favourites turned out to be a Free-from egg from Asda, and their own brand Extra Special Egg was really tasty too.

When we looked at the prices, it had a huge affect on our faves. The Divine Fairtrade egg and Heston by Waitrose egg both scored highly for taste, but when their huge prices were revealed (£20 for the Heston one! A crazy amount even if it was painted gold) they became the two worst value for money eggs of the 12 we tested.

>> Read the full results of the UK Money Blogger / Quidco Easter Egg blind taste test

Overall, the winner for both taste and value was a Mars bar egg. It tasted good and was pretty cheap – but that’s not always the case with Easter Eggs.

Do Easter Eggs give you value for money?

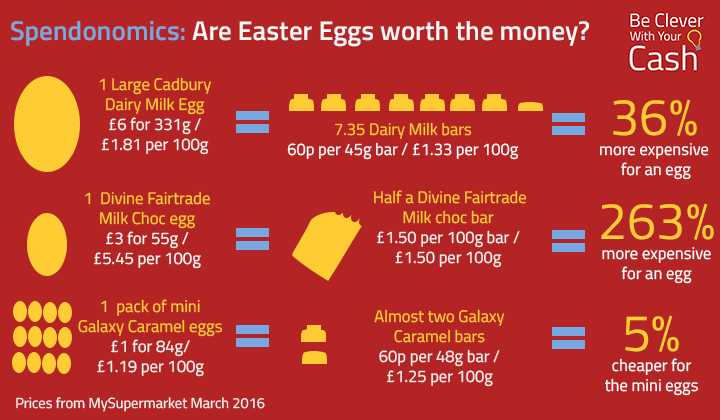

I’ve taken a look at a few of the popular options to give you a sense of whether you’re getting value for money.

As you can see, buying a Cadbury Dairy Milk egg is 36% more expensive than buying the equivalent in Dairy Milk Bars. It’s a similar story for most eggs of this size and brand.

When you go premium, it’s jaw-droppingly outrageous just how much more you spend for an egg. Divine is generally pretty tasty, and many are happy to pay a little extra for the ethics of Fairtrade. But buying their egg is 263% more expensive than a bar of the same chocolate. TWO HUNDRED AND SIXTY THREE! You could have two bars and four times as much chocolate for the same price. Or just save yourself some cash and calories by buying one bar.

There are exceptions. I looked at a few mini eggs and they actually worked out pretty good value. The Galaxy Caramel eggs were 5% cheaper than buying the same amount in Galaxy Caramel bars.

Offers just in time for Easter

Of course, special offers can make a big difference. But with Easter Eggs you really need to make sure you don’t get caught up in the excitement of the offer.

A few weeks back Tesco offered “Buy two, get two free” on most of their eggs. Great! Except do you really need four eggs?

And remember, part of the reason we see the Easter chocolate on the shelves straight after Christmas is so they can be sold at a higher price long enough for “special offers” to kick in when people want to buy them. I may be slightly cynical here, but there’s no need for the supermarkets to discount the eggs as loss leaders. People will buy them anyway.

They expect you to buy two for £7 or three for £10. They don’t expect you to pay the full price.

>> My guide to deciphering supermarket deals and special offers

It’s not just about the taste

I’m happy with my chocolate in bars rather than egg shaped, but most people like unwrapping the foil and smashing the egg. It’s a treat to have it like this once a year. I get it.

So my tip for you if you want to buy an egg but don’t want to get ripped off is to compare the price per unit on the shelf label. This will include any extras, such as Buttons or Mars Bars, but it’ll help you compare the different options for value.

And don’t forget to see how we all rated the different eggs at our taste test!

I’d definitely avoid the show off eggs such as Heston by Waitrose. Yes it’s gold and has “edible” straw (basically tasteless rice paper), but you can get good tasting eggs for far more reasonable prices. My top tip is the Asda Extra Special Belgian Chocolate Egg. Just £2, the egg was really thick and creamy and the packaging makes it feel like you’ve picked it up from a posher place than the supermarket.

Easter chocolate competition

Quidco have very kindly given all the bloggers in my UK Money Bloggers community these delicious Hotel Chocolat Easter goodies as prizes. It’s free to enter and closes at midnight on Sunday 20th March 2016.

If you like the idea of Hotel Choc treats (they are pretty expensive!) you can get 12% cashback right now on Quidco, which helps to justify some luxury choc a little!