From credit cards to mortgages, it pays to get on the best deal possible on any debts or money you borrow.

Last week I shared the basics of fixing your finances, from working out what you really have through to identifying the easy places to trim your spending. This week I’m showing you how to better manage and reduce the cost of any money you borrow.

This can make a decent difference every month. Reducing the interest you’re paying will not just mean you’re shelling out less, but it gives you extra cash to clear any debts faster. And once that debt is completely gone, there’s even more money every month to save or spend as you want.

So here are a few steps to take:

1. Identify the state of your debts

In last week’s article I suggested you analyse all your statements and bills, and look for things like interest charges or fees on debts, from credit cards to overdrafts. It’s also worth totalling up all the different debts. How do they look?

It’s all a bit scary

If you are worried about the size and monthly cost of all your borrowing and think they are out of control, then the tips below might not be enough. It’s worth reading this guest post from the top debt blogger Debt Camel explaining a few methods to try and where to get help. Don’t, whatever you do, ignore the situation.

You can afford the repayments

Hopefully you think what you owe is manageable and not pushing you further into debt. Great. There’s no need to panic, though you should take it seriously.

Work out which debts are the most expensive. That’s generally the ones with the highest interest rate. These should be your focus, though don’t ignore any which could mean you end up in the courts or without power.

There are no debts… at the moment

Or you might not have any debts at all. Even better! But there’s a chance you might need to borrow money in the near future. And that’s not necessarily a bad thing.

Borrowing can be good too. It can be used to spread out the cost of expensive items we don’t have the cash for now. That’s not just things like student loans or mortgages, but even buying a car so you can get to work can be a “good debt”. The key is to make sure it’s as cheap as possible, more on this in a bit.

2. Are any of the costs avoidable?

Next up, a very simple exercise.

Have you got savings as well as debts? In most cases, it makes little sense to have lots of savings if you also have lots of debts. The interest you’re paying on your credit card bill or loan is likely to be a lot higher. So if you’ve got savings, use them to clear your debts. In the event of an emergency then you can still use your credit cards.

Have a think about why the debts are being built up. Some might just be down to bad management. You might only be going overdrawn because you’re not checking your bank balance regularly enough. Or your bills might be going out the day before payday rather than a few days after. These are easy to fix.

And, unless something is urgent, it’s better to save up and buy something later with no interest charges than to whack it on a credit card now. Basically don’t spend money you don’t have or can’t afford!

3. Find more money to pay the debts off faster

You’ll hopefully already be finding ways you can cut back on spending from last week’s article, and I’ll be sharing more ways to spend less on bills and shopping over the next few weeks. It really is worth using any extra cash you find or make to pay off debts.

4. Cut the cost of borrowing

If you can’t clear existing debts immediately or are likely to borrow money in the future the trick is to make it as cheap as possible.

Here are a few basic things you can do to reduce how much you pay on credit cards, overdrafts and mortgages, but similar principles apply for other money you owe.

Credit cards

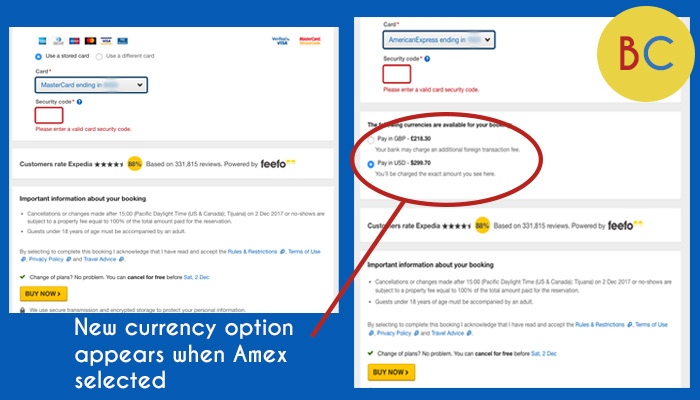

I’ve already written about clearing credit card debts fast, so do read that article for more details. But basically, it’s best to clear the cards as fast as possible, potentially with any savings. If not you can look to transfer your balance to a 0% card or a lower rate, long-term card. This will reduce the interest you are charged.

With new or existing credit card debt it’s good to pay off as much as you can each month, ideally the full balance. Avoid just making the minimum. it’s also worth, automating your repayments. The easy way to do this is via a direct debit. Just make sure you’ve enough in your account to you don’t hit your overdraft.

Zero per cent credit cards can also be useful to spread out the cost of big purchases – and can even save you money in some instances. The key here is only to use them for things you know you can afford but don’t have enough cash for now. For example, buying a new iPhone outright is usually cheaper than getting one via a contract. However, at a cost of around £1,000 it’d be tough for many to afford it in one go. So say it’s spread out over 20 months at 0%, then it’s a more manageable £50 a month. Just don’t overextend yourself.

With any type of 0% card make sure you have a plan to clear the full balance before the initial interest-free period ends. You’ll also need to make at least the minimum repayments every month.

Overdrafts

If when you went through your accounts you found you’ve gone into your overdraft, even once, then you’ll also probably have been charged. Yep, overdrafts are a debt. You’re borrowing from the bank, and charges can be very expensive. As with credit cards, it’s worth clearing this as soon as you can, and savings held elsewhere can do the job.

Another option is to switch banks to one which offers a 0% buffer. First Direct will give customers a £250 interest-free overdraft which is good if you occasionally dip into the red. If the amount is more substantial, and happening regularly, then look at Nationwide’s Flex Direct account. A larger fee-free overdraft (subject to approval) is available to new customers for the first year, which should hopefully be enough time to clear it without getting pesky additional charges.

If neither of these work for you, it’s worth comparing the fees at other banks for going overdrawn. Some charge a monthly fee, others charge each time you go overdrawn so the best option depends on the amount and how often you use the overdraft. You can also talk to your current bank to see if they’ll help with your existing overdraft.

Mortgages

Your mortgage is probably your biggest debt, meaning even at a low rate it’ll likely be your most expensive. And this means finding a cheaper deal can make a big difference to your monthly costs.

The lowest rates could well be with a different lender, though when I reduced mine a few years ago the cheapest was with my existing provider. Make sure you’re not just comparing the interest rate. Look for additional charges and restrictions on things such as the ability to overpay.

You also need to watch out for early repayment charges, which could make it more expensive to move your mortgage.

5. Build up your credit score

Credit scores are really important for borrowing money as they’re a key indicator of what rate you’ll get. So start doing what you can to improve it and in time you’ll be able to get even cheaper borrowing.

Next week, the third part in this series will help you get the best return from your savings.

Credit scores explained

How to quickly clear your credit card debt