With free cinema tickets and up to 6.25% interest on savings, is it worth opening this current account with Lloyds?

Regular readers will know I’ve got a lot of current accounts as I like to take advantage of the offers and benefits they each provide. But you don’t need to have as many as me – you’ll be fine with three or four.

So how do you decide which ones to go for? The Club Lloyds account is definitely a contender right now thanks to a choice of free cinema tickets, Disney+ or magazines. Plus, there are regular switching offers worth around £175.

Here’s what you need to know about the account.

What is Club Lloyds?

Club Lloyds is a current account from Lloyds Bank with some extra benefits over the standard classic account. It comes with a fee – though you can easily avoid paying it.

If you are going to get an account with Lloyds, this is the one you’ll get the best value from.

How much does Club Lloyds cost?

It’s not a free account. There’s a monthly £5 fee (increased from £3 on 2 June 2025).

However, if you pay in £2,000 every month you will get that £5 refunded. £2,000 a month is roughly what you’d get paid if you earn £30,000 a year (not including pensions or other contributions).

That means it’s affordable for most people, which means there’s really no reason why you should pay the monthly fee.

Can you get a switching bonus?

Lloyds regularly offers switching bonuses between £100 and £175 for the Club Lloyds and Club Lloyds Platinum accounts. There tend to be three or four a year.

New and existing customers are usually able to claim the offer if they open a new account and switch to it from a different bank. I’ve shared more details on the latest offer over on this page.

Club Lloyds Lifestyle benefits

When you open up a Club Lloyds account you can claim a free gift each year. You get to choose from four different ‘Lifestyle Benefits’.

You need to select your choice within 30 days of opening the account and this gift remains fixed for 12 months. You can swap to a different benefit once that period ends, or stick with the same offer.

There’s also the ability to earn up to 3% interest on savings, access a 6.25% monthly saver and get cashback on some purchases.

Free cinema tickets

You can select six tickets to use at either Odeon or Vue. You’ll get all six tickets at the start of the year and they’re valid for 12 months.

These tickets are valid for 2D and 3D showings. At Vue you can also use them at VIP or Xtreme screenings. Odeon will let you use them for Premier or recliner seats and some Luxe screens. You can’t use them at the BFI Imax, Odeon Luxe & Dine or screen 1 at the Odeon Luxe Leicester Square.

Though technically you can’t use them with another offer, I’ve seen them combined with things like Meerkat Movies – doubling your saving.

They can be used any day of the week – so they’re probably best to save for expensive days like weekends, if you want to see a movie in 3D or at pricier upgraded locations.

Free Disney+

Alternatively you can choose a year of Disney+ with Ads, the streaming service with Disney, Marvel, Fox and Star Wars content. This is worth £59.88 a year.

You aren’t able to upgrade to a Standard or Premium tier without adverts or additional features.

Free magazine subscription

There’s a decent choice of 29 print or digital titles available. All are Hearst Magazine or Bauer Media publications (full list below). You won’t get the first issue for up to eight weeks which can making it a challenge to know when to stop buying copies if it’s something you already read.

Club Lloyds magazine choices (print or digital)

- Bike

- Bird Watching

- Car

- Classic Cars

- Cosmopolitan

- Country Living

- Country Walking

- ELLE Decoration

- ELLE

- Empire

- Esquire

- Garden Answers

- Good Housekeeping

- Harper’s Bazaar

- House Beautiful

- Improve Your Coarse Fishing

- Landscape

- Men’s Health

- Modern Games

- Mojo

- Practical Classics

- Prima

- Red

- Runner’s World

- Spirit & Destiny

- Steam Railway

- Today’s Golfer

- Trail

- Women’s Health

Free Gourmet Society membership

This restaurant discount card will give you 25% off your bills, including drinks at selected restaurants. There are also extra discounts available like cinema tickets, theme parks and movie rentals.

Which freebies are the best value for money?

Here’s a quick summary of how much it would cost you to buy those freebies yourself:

The value of the cinema tickets freebies depends on where you live as tickets can really vary in price. I’d say it’s within a range of £30 to £90. But if you choose to go for 3D and VIP seats then they could easily be worth more than £100.

Disney+ with Ads is £4.99 a month, so its worth just under £60. Though this saving assumes you’ll actually watch Disney+ every month. If you have other streaming services it makes sense to mix and match over the year, paying only for ones you’re actually watching.

The magazine value obviously depends on which title you get and how many issues there are a year (e.g. Esquire has only six issues). But to give you an idea, a year’s subscription to Empire is currently discounted to £59.99 via Great Magazines.

The Gourmet Society membership could cost you as much as £79.99 a year, but it’s easy to find offers reducing it to £35 for a year.

Which lifestyle benefit should you choose?

Andy’s Analysis

Ultimately it comes down to which one you’ll actually use – and how much you’d spend on it.

It’s possible to save money on tickets most days, but it is harder to get discounts on weekends or for posh seats. So if you go to the cinema at least six times a year (or three times if you’re a couple), it’s likely this is the best option.

Or if you know you’ll have Disney+ all year around, no matter what, picking that is a locked in saving.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Club Lloyds savings rates

You can earn interest on money held in the account and in a separate regular saver.

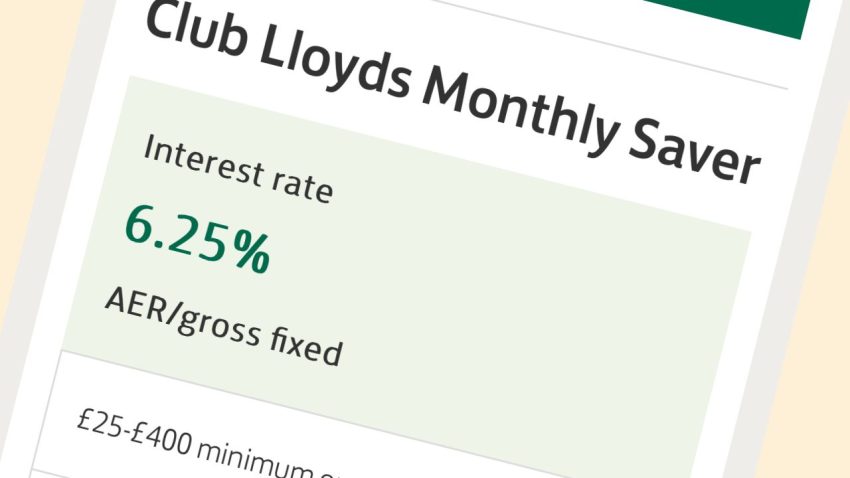

6.25% Monthly Saver

Pick of the bunch is a monthly saver that’s exclusive to Club Lloyds customers. This offers 6.25% and you can pay in between £25 and £400 a month.

The 6.25% is fixed for 12 months when the interest is paid and the savings account closed. It’s really easy to open this via your account. I did it via the app. You can’t access the money More details here.

You can also open a standard Lloyds Monthly Saver if you have more to put away. This has a lower rate of 5.25% and the max you can add it £250 a month.

Up to 3% interest in your account

There’s also some in-account interest. To get it you must pay out two direct debits every month.

For the first £3,999 you hold in your actual current account you’ll get 1.5% interest. Then you’ll get 3% on the next £1,000. So if you always have £5,000 in your account you’ll earn the equivalent of just under 2%.

Linked 3.25% Advantage Savers

You also get access to an ISA or normal savings account paying 3.25% – as long as you make three or less withdrawals in a year.

Is Club Lloyds worth it for the interest?

The monthly savings account is a great option, especially since it’s fixed for a year. But the in-account interest and other ‘Advantage’ savers can be easily beaten by savings rates elsewhere.

Other Club Lloyds perks & features

Free spending overseas

You can use your card abroad for spending and cash withdrawals without any charge. That means it’s a decent pick for your holidays, though a handful of alternatives will earn you cashback on top.

Club Lloyds overdraft

With a Club Lloyds account, you get a £100 interest-free overdraft. Beyond this you’ll pay 39.9%. Here’s more on your alternatives.

Cashback on purchases

All Lloyds accounts also give you access to Everyday Offers, worth up to 15% off when using your debit card.

You will be offered retailers based on your spending and will need to activate them before spending. I’ve only really used this for LNER trains, otherwise my experience of these offers with other banks, is that it’s very hit and miss. Plus the deals are often available elsewhere.

But it’s worth checking to see what you are offered. And where these do work is that you can use them in combination with cashback site savings.

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

Lloyds app

The app is effectively the same one as Halifax, and it’s relatively easy to use. In fact, it’s one of my favourite ones outside Starling, Monzo and Chase. If you want to see how it compares to apps from other banks, check out this guide.

Here are some of the features worth knowing about:

Account details and management

An important feature for me is the ability to copy and share account details from the app – and Lloyds let you do this. You can also amend your address.

Card details and controls

You can see your PIN, long card number, expiry date and security code in the app. You can also copy the long card number to paste into online shops.

There are a handful of controls too. You can set your own contactless limit and freeze the card for a handful of reasons (overseas, online, in person, gambling and contactless).

Cheque payments

Lloyds is one of a handful of apps that lets you pay in cheques via the app. More info on how this works here.

Save the change

This is available to all Lloyds current accounts and it’s pretty cool. You may have seen it already via digital banks such as Monzo.

The idea is every time you spend money with your debit card the bank will top up the amount to the nearest quid from your account, and move it to a separate savings account.

So, say you spend £2.80, an extra 20p will be taken from your account. It’s a nice way to automate your savings and put money away without any effort.

You do need to activate the feature so it won’t happen unless you give permission.

However you won’t be earning any interest on this money so I’d get in the habit of transferring it across to a better paying account on a regular basis – which kind of defeats the purpose of making it something that happens without you doing anything.

Budgeting and tracking

It’s relatively limited but you can see where your spending goes via a spending insights option. You’re able to view upcoming payments, to help you ensure there’s enough money in your account.

As with more and more apps, you’ll get notifications of spending and money coming in via the app.

Subscription Monitoring gives you the ability to cancel subscriptions within the app. You’ll also be told when subscriptions are due to end. It’s a handy way to avoid overpaying for services you don’t use or stopping subscriptions where it’s a nightmare to get through to someone on the phone. But it’s not a reason to get the account.

Multiple account hack

You’re only allowed one personal Club Lloyds account, but you can get another as a joint account. That means if you’re in a couple, between you there are three accounts up for grabs, and three ‘lifestyle benefits’. You can only get one Club Lloyds Monthly Saver each though, not a third joint one.

Summary – should you get it?

Club Lloyds Current Account

| Rewards | ‘Lifestyle Benefit’ giving you a choice of 6 free cinema tickets, Disney+, a magazine subscription or Gourmet Society membership Limited cashback |

| Monthly Saver | 6.25% AER up to £400 a month (must apply separately) |

| Interest on savings | 1.5% on balances between £1 and £3,000; 3% on balances between £4,000 and £5,000 |

| Overseas | Fee-free spending and cash withdrawals abroad |

| Fee | £5 a month (£0 if you pay in £2,000 a month) |

| Requirements | The account requires two active monthly Direct Debits to earn interest |

| Overdraft | £100 interest-free buffer Then 39.9% |

Andy’s Analysis – Is Club Lloyds a good account?

The Club Lloyds account is a decent all-rounder. Not the best reward, best interest rate or best banking app. But all are still better than what you’d get from most accounts. If you already have it, I’d keep hold of it.

Personally, I think you should open one up as a spare account rather than a main account. It’s always useful to have another account as a backup, and you can claim the lifestyle rewards even if this isn’t your main account.

And you can get that freebie year after year for free as long as you transfer in £2,000 a month – which is easy to do. The same goes for the monthly saver.

But should you switch from another bank to get it? Well if there’s a switching bonus then it’s definitely worth it. But if not, then no, I wouldn’t switch. There are better accounts out there to priotitise, including some offering an incentive to switch.

Hi,

Could you comment on Club lloyds August change? It seems that monthly fee waiver with credit of 2000 is being removed.

You’ll still be able to waive the fee when it increases

Your summary still mentions the old pay in requirement of £1,500 the rest of the post has updated to £2,000.

Hi Andy, I’ve just opened a club Lloyds and received the £175 switch offer-I want to switch to another bank to receive their bonus. How long do I need to stay with Lloyds to not pay the £175 back?

Many thanks

Steve

Hi. I realise on the club lloyds current account you need 2 direct debits to earn interest but as you can earn higher interest elsewhere it makes sense to move the money out to higher paying savings account but can you open the club lloyds monthly saver at 5.25% and earn interest without these direct debits?

ThanKS

Just come off the phone to Lloyds about this, it doesn’t impact any of the other interest accounts just the monies you have in your Club Lloyds account.

Hi. I realise on the club lloyds current account you need 2 direct debits to earn interest but as you can earn higher interest elsewhere it makes sense to move the money out to higher paying savings account but can you open the club lloyds monthly saver at 5.25% and earn interest without these direct debits?

ThanKS

I switched from barclays to club Lloyds 2 months ago and have received their £125 switch incentive payment. I now want to switch again to a different bank for another switch incentive….. will I have to payback Lloyds?? If so how long do I need to keep my Lloyds club account before I can switch again without having to payback Lloyds??

Hi Andy,

How long does the £1500 have to stay in the account so you don’t incur the £3 fee ? Can I transfer in and transfer out within in a day ?

TOP TIP

You don’t have to keep the £1,500 in the account if you don’t want to. When you get paid you can transfer the cash in and then transfer it back out to another account.

Magazine subscription

We would like to change from Good Housekeeping

to House Beautiful please with immediate effect.

Hi Jonathan, you’ll need to wait for Lloyds themselves to email you on your account anniversary to change your offer.

Dear Andy, I am also a serial switcher and perform financial gymnastics in order to meet various minimum funding requirements to enjoy the perks. I already have a Halifax Reward account requiring £1,500 funding. Would I be able to recycle this amount if I open a Club Lloyds account or is there a Lloyds Group tie up whereby Lloyds account funding requirement can’t be satisfied by Halifax accounts and vice-versa? I can’t find anything obvious in the small print of either T&Cs and would be grateful for your advice or contributions on the subject.

Hi Steve, yes you can move money from Halifax to Lloyds all ok!

Thanks Donna, good to know. The freebies are certainly worth keeping if you can!

I still have last year’s benefit cinema vouchers as because of COVID cinemas closed . Can I have double benefit this year to compensate for no possible benefit from last March?

I’ve just googled and Odeon say they’ve extended them to July 21 https://help.odeon.co.uk/hc/en-gb/articles/360014538800-Club-Lloyds-Vouchers-Claimed-Before-20th-July-2020

Dear Andy, Thanks for this. Ironically, I tried to open up a joint ClubLloyds account , just before this article. It was an unmitigated nightmare. I tried to switch, which as I wanted a joint account, I could not do, I had to open a single account and then book an appointment at a Lloyd’s branch. Sounds easy! On the ‘phone for an hour and a half trying to sort this out. Gave up after getting them to delete my application. If that’s the level of service then they can forget it. Strange to say that I am trying to give them money!

I have a Lloyds Club account-they haven’t told me about the further interest rate cut so thanks for the heads up Andy!

Had not bothered with the 2% saver account (though have had these in the past when rates were higher) but things are so dire now I am now re-considering.

I switched to Club Lloyds on their recent cash promotion (£100) and on the application I was given the standard £500 overdraft. Switched from HSBC with £2200 overdraft. But when the account became active, there was no offer of the overdraft. I contacted them and was told the overdraft to approval and was advised to re-apply. I was rejected. I made a complaint and they rejected my complaint based on eligibility. I am now stuck with this bank with zero overdraft. I gave up a £2200 overdraft with HSBC for a zero one! Nightmare of a bank! Any advice?

How often do you use your overdraft? Rates are so high right now, mainly around 40%, that they’re the worst way to borrow money. Ideally, set up notifications so you are told when you get close to zero and can avoid going overdrawn. If you don’t have enough even a credit card would be cheaper (often around 20%) – but don’t forget to clear it when you get paid to reduce how long you owe money on it

Been with Lloyd’s bank for many years now and can’t fault them really . I have switched my secondary account many times to get the bank bribe deals but always kept my Lloyd’s account as my main one for direct debits .