Put money aside each month for more than £100 in interest

Though it’s not as good as last year’s 10% offering, this is still a hard to beat savings account – as long as you have a current account with the bank.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the Virgin Money Regular Saver?

The Virgin Money regular saver pays 6.5% AER. The rate is fixed until 30 October 2026 so you’re guaranteed to earn this until then.

However, on that date the account will also mature, so if you open it in late November 2025, for example, you’ll only get 11 months at this rate, and so on. However it’s likely it’ll be withdrawn by the end of October.

How much can you add each month?

You can add money each month up to a maximum of £250. You don’t have to add anything if you don’t want to, and you can make multiple deposits in the month.

If you do go over the £250 in a month you will have the money returned to you.

You’re not able to carry over unused allowances to future months. So if you can’t afford to add any cash one month, you can only add up to £250 the next month.

Money can be added to the saver via bank transfer only.

Can you only have one account open?

Yes — you can only open one regular saver at a time with Virgin Money. This is even if you’re not saving the maximum amount.

If you’ve more to save you could open another regular saver with another bank.

Can I make withdrawals from my Virgin Money Regular Saver?

Yep! This is not always the case with regular savers, however if you withdraw any cash you won’t be able to add it back in.

When is the last chance to open it?

As the regular saver has a locked in end date, it’s likely it’ll close to new applicants on or around 30 October 2025.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

How much interest can you earn?

You’ll earn the interest on the cash you deposit each month rather than the total deposit. This is where people sometimes get confused. It’s easy to think if you add £3,000 to an account over a year, that 6.5% interest would be £195.

But you’ve got to remember that your money isn’t in the account all year. Only the first deposit will be there for 12 months. Money added in month two will only be there for 11 months and so on. Here’s more on how regular savers work.

Andy’s analysis

Here are some examples of what you can earn if you added the same amount on the first of each month, assuming you open it on 1 November 2025. If you open it earlier it’d actually be a little more as you’ll have the interest for the previous two weeks on top.

| Amount saved monthly | Annual interest earned | Total amount after the term |

| £250 | £105 | £3,1105 |

| £100 | £42 | £1,242 |

| £25 | £10 | £310 |

Interest is calculated daily, however, it’s not paid until the end of the account in October 2026.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Who can get it?

This regular saver is only for people with a Virgin Money current account. You can be a new or existing customer, but bear in mind if you’re opening the current account brand new there will be a credit check. Once you have this account you can open the regular saver.

You need to be aged 16 plus, and you can open it in branch or online, though 16 and 17 year olds will need to open it in the branch.

There are occasional bank switch deals from Virgin Money. If one is running you’ll see it listed along with all bank switch offers here.

What if you already have a regular saver?

Sadly you can’t have more than one regular saver with Virgin Money at any time. So if you opened the 6.5% paying option in May or August 2025, you’re ruled out this time.

Should you open a regular saver with Virgin Money?

This is a good rate, giving you the opportunity to get a 6.5% return on your cash – even if it’s only on up to £250 a month.

Of course, if you have a lump sum, putting it in a 4.5% paying account for a year you’d need £2,300 to earn a similar £105 in 12 months. So that might be just as easy to do, especially if you have similar or larger amounts of cash you won’t need access too.

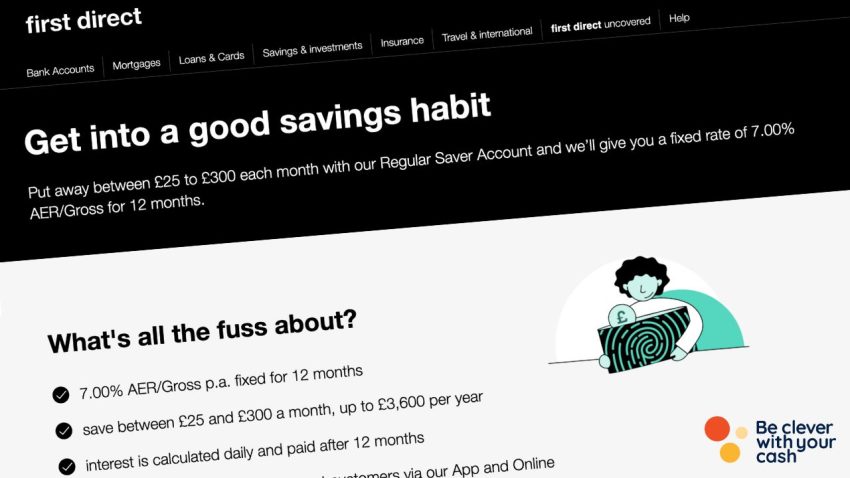

For new money you’re putting aside each month, this is one is hard to beat. That’s because it’s fixed so you know you will get this rate, unlike some other variable rate regular savers that might pay the same or higher. Only First Direct offers a higher 7% fixed on deposits up to £300, while Lloyds offers a lower 6.25% fixed – but you can add £400 each month. We’ve more on the best regular savers here.

However, if you are only able to save small amounts each month, your return over the year will be much smaller, so you need to decide if opening a new current account (and being credit checked for it) is worth it. You might get other benefits from other banks, especially if a switching deal is running.

Customer reviews

Over on our sister site Smart Money People, customers have rated Virgin Money’s regular saver 4.09 out of 5.

Summary

Virgin Money Regular Saver

| Account name | Virgin Money Regular Saver Exclusive |

| Interest rate | 6.5% AER fixed |

| Min monthly deposit | £0 |

| Max monthly deposit | £250 |

| Carry over unused allowance? | No |

| Interest paid | Annually |

| Account closes | 30 October 2026 |

| Withdrawals allowed? | Yes |

| Requirements | Must have a Virgin Money current account |

Andy, you seem to ignore the advantage of drip feeding from an Easy Access account to a higher paying regular saver if you already have the lump sum. This would pay you more interest than just dumping the lump sum in the EA account (or even a 1 yr Fixed rate saver) and leaving it there for the year.

Exactly. Omissions like this just reinforce the “BuT tHe ReAl RaTe Is OnLy HaLf ThE aDvErTiSeD rAtE” nonsense spouted by people who failed their GCSEs.

Thanks for sharing!

This is brilliant, thank you.