Artificial Intelligence (AI) transfers can help you build up your savings without noticing.

One of the biggest reasons people who try to save but fail is that they don’t prioritise the act of saving.

The money sits in their current account alongside all their other cash, making it hard to distinguish between what’s needed for bills and what is available for other spending.

The easy solution is to set up a standing order to move money to a separate account just after payday, but it’s possible to save even more thanks to fintech innovations.

Using rules and algorithms based on your spending habits, apps like Plum, Chip, Monzo and Starling can automate the transfer of cash from your current account into separate savings pots.

My favourite is the artificial intelligence or AI savings app. I’ve written about Chip before, but now it charges you to use this function, I wanted to take a look at the free alternative – Plum.

What is Plum?

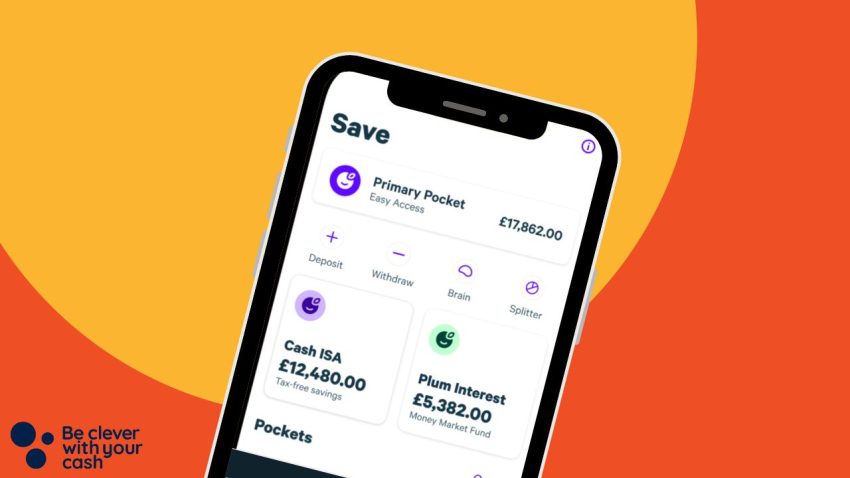

Plums describes itself as “The AI assistant that grows your money”. Though it offers a few extras, it’s primarily about helping you boost money for savings via automation.

It also acts as an entry level investment platform, but I won’t cover this element in the review.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How much does Plum cost?

There are three tiers with Plum, ranging from free to £2.99 a month.

- Basic – Free

- Plus – £1 a month

- Pro – £2.99 a month

Personally I’d stick with the free Basic option, and that’s what this review will focus on.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsFree gift card ends 27 February

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account. Offer ends 3pm 27 February 2026

Setting up Plum

Plum is an app-only service, so you can’t take advantage of these if you don’t have a smart phone.

You connect Plum with your bank via Open Banking, giving the app read-only access to your account details. It’s a pretty simple process to connect as long as you already have your bank’s app installed on your phone. You need to reauthorise the connection every 90-days, which takes just a few clicks.

It’s possible to add more than one bank, though money will only be transferred from the account you designate. Unlike Chip you can change which bank this is whenever you want.

You can add credit cards too, but these won’t be used for the auto-savings features.

Plum currently works with the following banks:

- Barclays

- Danske Bank

- First Direct

- Halifax

- HSBC

- Lloyds

- M&S

- Monzo

- Nationwide

- Natwest

- Revolut

- RBS

- Santander

- Bank of Scotland

- Starling

- Tesco

- TSB

- Ulster Bank

Autosaves with Plum

This is the big selling point with Plum for me. These features help you build that savings pot without actually doing anything. The money is transferred via a Direct Debit that is set up when you link your account.

To access these savings features you need to find the ‘Brain’ option, which should appear on the home screen once you’ve connected to your bank.

The free tier of Plum has three ways to automatically move money from your bank to your Plum account:

- Automatic

- Round Ups

- Pay Days

The Pro version also has Rainy Days and 52-Week Challenge options but I’ll ignore these here. Mainly because you’ll have to pay, but also because if they’re of interest then they’re available alongside even more options for free via Monzo.

Here’s more on each of these savings rules:

Automatic

This is my favourite of the three. As with Chip, an algorithm analyses your bank account, looking at your balance, spending and forthcoming regular payments in and out.

Based on this Plum works out how much you can afford to put aside. You can also adjust the ‘mood’ of your savings level, from the default option. The lowest level ‘shy’ will reduce that amount by half, while the top level ‘beast’ increases it by 75%.

Money is moved once a week from your connected bank account to your Plum account. You can pause these transfers, or turn them off completely whenever you want.

Round ups

Every time you make a purchase with a linked debit or credit card you can choose for the transaction to be rounded up to the nearest full pound, with the difference moved once a week to your pocket.

Be careful here though as these will continue even if you’re overdrawn, though you can switch this off in the app’s ‘brain’ under ‘overdraft deposits’.

Pay Days

This is essentially a standing order which automatically moves money from your bank account when you get paid. You set the date and the amount.

Personally I’d set up an actual standing order for this and move your money to an account where you’ll earn the best interest right now. Or opt for a regular savings account.

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

Interest with Plum

The basic free version of Plum offers an interest pocket offering 0.25%.

You can beat this amount right now, but if you are using Plum then it makes sense to turn this feature on and put your cash there. You can choose where your money goes in the ‘brain’ part of the app.

It’s easy-access though if you move money into one of these pockets then you have to give one-day notice to withdraw the cash.

The rate is variable, so it could change (in fact it dropped in late January). If that happens Plum will give you 14 days notice.

The Plus and Pro versions increases this to 0.4%, but you’ll likely spend more to upgrade than you’ll make with the increased interest rate. For example, £1,000 at 0.4% for a year earns you £4. That’s £1.50 more than the Basic account, but at a cost of £12 (Plus) or £35.88 (Pro).

Is your money safe?

Any money in your main Plum ‘Pocket’ is held in something called an E-Wallet, meaning it’s not covered by the Financial Services Compensation Scheme. If something was to go wrong, or if Plum went bust, your money should still be fine, as it’s actually held at Barclays. But if Barclays went under then you’d lose your money.

The savings accounts are with Investec Bank and these are protected by the FSCS. It’s only up to a total of £85,000 and that’s across all accounts you might have with Investec.

Other features

The app also offers a handful of extra features on the basic option.

Free features

The Lost Money tab is the only significant extra on the Basic Plum account. It’s meant to analyse your bills to highlight where you’re overspending. However, since it can only see your payments, it’s not really that useful.

And though it’ll send you through to a comparison site to help you find better deals, you can do that yourself without the aid of the app.

Other paid features

I don’t think any of these are worth upgrading for, but just so you know what is on offer

Plum Plus

- Access to 0.4% interest account

- An extra Easy Access Interest pocket

- The ability to use Plum Investing

Plum Pro

- Cashback

- Budgeting tools

- Unlimited pockets

- 52 week challenge and Rainy Day savings rules

Plum alternatives

You can get the AI algorithm savings feature with Chip and Cleo for a monthly fee. Tandem did offer this but has closed the feature.

Round up savings are more and more commonplace now, with Starling, Monzo, Nationwide, Lloyds and others offering this.

Monzo also offers you the option to automate the Pro savings features such as savings challenges, moving money if it rains and much more – and it won’t charge you for it (more on this here).

The PayDay feature is essentially a standing order which can be set up between any two bank accounts.

Conclusion

I’m a huge fan of auto-savings algorithms, and now that both Chip and Cleo charge for this, Plum is my top pick.

Link up your main current account and set the “brain” to the savings rules and levels that work for you, and you should slowly but surely see the amount saved grow.

Of course you’re not earning much right now with this account so you might want to move the money on a regular basis to one that pays a little more.

I’d stay clear of the paid versions – you don’t get enough extra for your money – and the other features don’t really offer much.

CAN i INVEST £20k DIRECTLY INTO pLUM?

Does the pay days feature mean that you don’t get a direct debit? I am thinking of using this purely to set up a quick DD for a bank switch bonus. Thanks

I was looking to do the same thing. Did you find out in the end – is it only the round ups that are taken via DD?

Thanks for this helpful article. Where is the best place to get an updated referral code for this app please. I believe in installing when there are a number of reasons to do so!

Sadly there aren’t any right now that’ll earn you money. Though if you’re signing up and use this link I *might* get something https://friends.withplum.com/r/VKH8kH

Signed up using link on 25th Feb, have been actively using the app for more than 30 days and yet no mention of the £5 credit.

Starting to think some of these links are sponsored and you get the benefit as this is the second one I have tried to follow and the reward promised does not materialise.

I’ve downloaded the app but no mention of the £5 offer for downloading it through the link you sent..

Yes, they couldn’t create a separate landing page for this. If you signed up before the 28th February and followed the instructions on the article then you’ll get the credit.

Nice article. I like the way Plum sets up a direct debit from my bank account as it not only allows me to save automatically but also adds to the number of direct debits I have (at no extra cost to me!) which helps to qualify for things like rewards accounts and switch terms.

Good shout about the direct debit!

Hi Andy

Helpful article thanks,

Can I use the Direct debit set up and link this to several banks then transfer money back into my account from different accounts……to cover me for bank switches.

Thanks