How to make the most of these saving and investment accounts.

For a good number of years ISAs were the best places to put your savings. And then they weren’t! But with decent savings rates and changes to tax free allowances on investments, they’re well worth a look again.

And that’s prompted lots of questions over in our Facebook community, particularly about the annual allowances. So here’s everything you need to know about the limits on how much you can save.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the ISA allowance?

The ISA allowance is the most you can add into one or more ISAs each year.

How much is the ISA allowance?

The ISA allowance was just £7,000 when the accounts launched in 1999, but over time they increased. First in 2010 to £10,200, then gradually to the current level of £20,000, which was set in 2017.

2024/25 ISA allowance:

The allowance was £20,000 in 2024/25.

2025/26 allowance:

Once again, the £20,000 ISA is staying the same for the new tax year.

Could the ISA allowance change?

It’s unlikely to increase, with the total £20,000 cap expected to remain in place until 2029/30.

But there have been plenty of rumours in early 2025 about the £20,000 limit changing. One of these is that Labour might reduce the allowance of the Cash ISA to £4,000 a year to encourage more people to invest.

And while nothing was announced regarding ISAs in March’s Spring Statement, Rachel Reeves has confirmed changes are on the agenda. So we could hear more in the Budget next autumn, and potentially changes from the next financial year.

At the start of January, we also saw the Treasury Committee launch a public enquiry into Lifetime ISAs to decide whether the account, which was launched nine years ago to replace Help to Buy ISAs, is still fit for purpose. We’ve yet to hear anything on this yet, but we’ll keep you updated when we do.

What are the different ISAs?

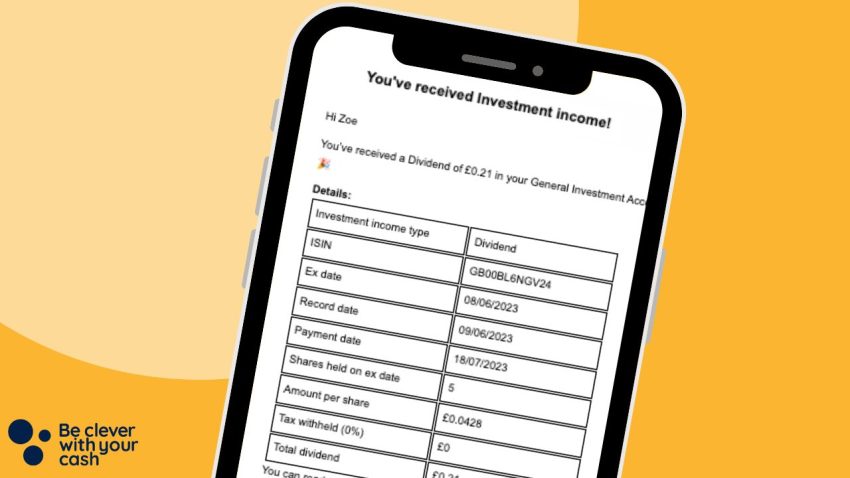

ISA stands for Individual Savings Account. It’s basically just a type of account where you can save or invest your money but the interest you earn from savings or gains and dividends paid by investments are all tax-free.

There are four main types of ISA, and the annual allowance covers all of these collectively:

- Cash ISA

- Stocks & Shares ISA

- Lifetime ISA (either Cash or Stocks & Shares, but limited to £4,000 a year)

- Innovative Finance ISA

There’s also a separate ISA just for under 18s, which has it’s own separate, but lower, annual allowance

- Junior ISA

You can read about the differences between these different ISAs in our guide, along with information about Flexible ISAs – which can apply to some Cash, Stocks & Shares and Innovative Finance ISAs.

That £20,000 is across all your ISAs combined. So it can all go into a single ISA, or it can be split across the different types of ISA – Cash, Stocks & Shares, Lifetime or Innovative Finance.

So for example if you wanted to pay into both a Cash ISA and a Stocks & Shares ISA in the same year, you’d need to make sure you don’t go over £20,000 in total. How you split it is up to you.

Does a Lifetime ISA count towards the ISA allowance?

The Lifetime ISA has it’s own £4,000 annual cap. However that is within the overall £20,000 ISA limit. That means if you put the full amount into a LISA, you’d have a cap of £16,000 to pay into any other types.

What is the Junior ISA allowance?

The Junior ISA annual allowance for 2025/26 is £9,000 a year. This is completely separate to the main ISA allowance.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

When does an ISA allowance reset?

The ISA year is the same as the tax year, which runs from 6 April to 5 April the following year. So you get a brand new allowance to use when that year restarts.

That means you could potentially put £20,000 into an ISA in the first week of April, and another £20,000 in a week later. But if you put £20,000 in on April 6, you’d need to wait a full year before you can add more money to your ISA.

Watch out for though for deadlines set by individual banks and investment firms who might require deposits and transfers to be in the account by late March.

What happens to an ISA allowance after a year?

Though the ISA allowance is for a year, it doesn’t mean your cash is only tax-free every 6 April. Money already put into an ISA retains it’s tax-free status year after year.

Is the ISA allowance only for new ISAs?

No it’s not. You don’t have to open up a new ISA to take advantage of each year’s ISA allowance – but you can if you want.

New rules introduced in April 2024 mean that you can open up as many different ISAs as you like each year and split your allowance among them and your old ISAs. Before this you could only open one new ISA of each type each tax year and pay into one ISA of the same type during that time.

The exception to these new rules is the Lifetime ISA – you can only pay into one each tax year.

When deciding whether you want to use a new or existing ISA particularly Cash ones, it’s well worth comparing the interest rates available. In most cases the better rates are for brand new accounts.

What happens to your allowance when your ISA matures?

If you’ve put your money into a fixed rate Cash ISA, this could mean your money is locked away for anything from one to seven years. But it’s still the case that the interest or gains are protected from tax even when the ISA matures.

What will happen is the money will likely be moved to an account with a much lower rate, but it’ll still be an ISA. If you want to get a better rate (that’s still tax free) you can transfer it over to a new ISA. Just don’t withdraw it as you’ll lose the tax shield if you do!

Does transferring an ISA use my allowance?

No, it doesn’t. Though there’s the limit of £20,000 that can be added to an ISA each year, this is just for new contributions. If you have money in other ISAs from previous years you can transfer them over into new ISAs (via a transfer process) without it affecting the current year’s allowance.

So for example, if you have £15,000 in one ISA from last year, and £15,000 in a new ISA you opened and paid into this year, you can choose to transfer all or part of the old ISA over (perhaps for a better rate) and still be able to add in £5,000 more to the new ISA this year.

You don’t even need to transfer the old ISA cash into your new ISA. You can open a brand new separate ISA and transfer into that – just be sure not to add in any new cash to this additional ISA. You also need to check the new ISA you open accepts ISA transfers.

A quick warning. If you instead withdrew the £15,000 from your old ISA to a standard savings account, you’d only be able to add the further £5,000 to your ISA for the current financial year, unless your ISA is flexible.

What happens if you don’t use your ISA allowance?

You’ll lose it if you don’t use it. Once the new financial year comes around and the allowance resets, the previous allowance ends for new deposits. That means you can’t carry over any unused allowance to put more cash in the following year.

What happens if you go over your ISA allowance?

It’s actually quite easy to overpay into your ISA and the good news is it can be easily rectified.

If you pay more than £20,000 into a single or mix of different ISA types in a financial year it’s best to speak to your provider and the excess will likely be returned to you. But you won’t receive any interest or gains made (if any) if that happens.

If it’s not spotted – perhaps it’s across both a Cash and Stocks ISA, it’ll be down to HMRC to spot. They’ll let you know what to do and potentially claim any money due back from you (such as tax on some of the interest earned).

You need to make sure you don’t withdraw the cash manually if you realise you’ve made this mistake – contact HMRC on its ISA helpline 0300 200 3300.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

Can I put £20,000 in an ISA every year?

Yep, and if you can afford to add the full amount on a regular basis it’s not a bad idea to do so. With such large amounts of cash in savings or investments outside of an ISA, you’re likely to be paying tax on a fair chunk of your money. So putting the maximum in an ISA could help reduce this.

Plus, rules could change. Right now there’s the PSA on savings and various allowances on investing, but they could be reduced or scrapped, which we saw on investing allowances last year. If things do change, it means the returns on more your money outside of an ISA would be taxable.

So moving it into ISAs could be prudent as the future interest and gains will stay tax-free. Of course there’s no guarantee ISA rules won’t change too, and we know it’s on the Government’s agenda right now, but if they do it’d hopefully just be to new rather than existing contributions.

How much can you put in an ISA?

Though there’s the annual £20,000 limit, you can keep paying into existing or new ISAs each year. So if someone started with the full £20,000 at 18, and repeated this each year for 50 years, they’d have £1 million saved up – and that’s before the interest or growth that will have been compounding over the same period!

If you are adding lots to the same ISA year after year do check that your ISA itself doesn’t have its own cap on how much you can put in.

What happens if I have more than £85,000 in an ISA?

Though you can only save £20,000 in a year you can built up larger amounts over the years. Money in Cash ISAs is protected by the Financial Services Compensation Scheme (known as FSCS) up to a total of £85,000 (£170,00 for joint accounts) per financial institution (more on how FSCS works here).

If you go above this and the provider goes under, you’ll lose the excess cash. So if you do have more it makes sense to transfer some of the money into an ISA at a different bank or building society.

Don’t forget to also check statements to see if interest payments take you over the limit!

Any up to date comments ???? These are all 2024 !!

budget March 24 increase£ 20000 maximum plus £5000.00 in stocks&shares British Company ?

The interest on my ISA is paid daily and as it is added to the previous balance, it has gone over the 20k limit. Is interest over the 20k limit allowed or am I breaking an ISA regulation?

If you have over £85,000 in your S&S ISA. Let’s say double, so £170,000. Is it possible to transfer £85,000 to another provider into another ISA account? Or would you only be able to transfer in increments of £20,000 each year?

Does the £85,000 cap apply to S&S ISAS too? The whole point of a S&S ISA is that it can grow. Exponentially over time, so it’s annoying if you have to open a new one just because you’ve reached this limit. And keep skimming off any new profit over £85,000, which could quickly become cumbersome.

Unfortunately it does. You could invest via life insurance, which gives 100% protection.

In 24/25 you will be able to open and pay into multiple ISA’s, this was announced in the Autumn budget.

I think you’ll find that’s not the case. The idea was put forward, but didn’t materialise in the recent budget.

On further looking into it, you might be right. It’s not well publicised and it’s unclear when it will start.

To add to my comment, you need to look out for what is called a portfolio ISA. These allow you to open numerous different ISA products in the same year with the same provider. Whether there are any that offer 4 and 5 year ISAs, I don’t know.

I’m a great fan of fixed interest ladders where I set up money in 1,2,3,4 and 5 year fixed bonds to buffer myself from reducing interest rates, and as the nearest one matures then I review rates and decide whether to reset the furthest rung again. But the interest earned attracts tax.

Does anyone know whether I can do this with cash ISA fixed interest products? I understand that I can only open 1 cash ISA a year, but is this because of the new money rule? Or can I open 5 cash ISAs in one year which are 1,2,3,4 and 5 year ISAs and transfer old ISA money (not new) into them using the transfer process? Can’t seem to get a clear answer about this, thanks for any views.

With some banks/building societies, eg Nationwide, you can pay into as many of their different ISA accounts as you like within the same tax year. I’ve been opening different 1 and 2 year accounts with them over several months.

Nationwide don’t offer beyond 2 year products, so you’d to shop around. Also remember that not all banks offer this facility. With some, you can only open one ISA product per tax year.

You could also transfer old ISA money from another provider into as many fixed interest products as you like, but it would be a long winded process if you did it too often.

One disadvantage of the portfolio system is that there may be better rates elsewhere with non portfolio providers. I suppose you could transfer, but again, very long winded.