Make sure you’re paying what you should be for your gas and electricity

Energy bills for most people are set to rise by almost 10% on October 1 when the new price cap is introduced.

The average bill will increase to £1,717 a year from £1,568 for the average home on a standard variable tariff paying by direct debit.

Many of us will be paying significantly more, so here’s everything you need to do to make sure you’re being charged correctly.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

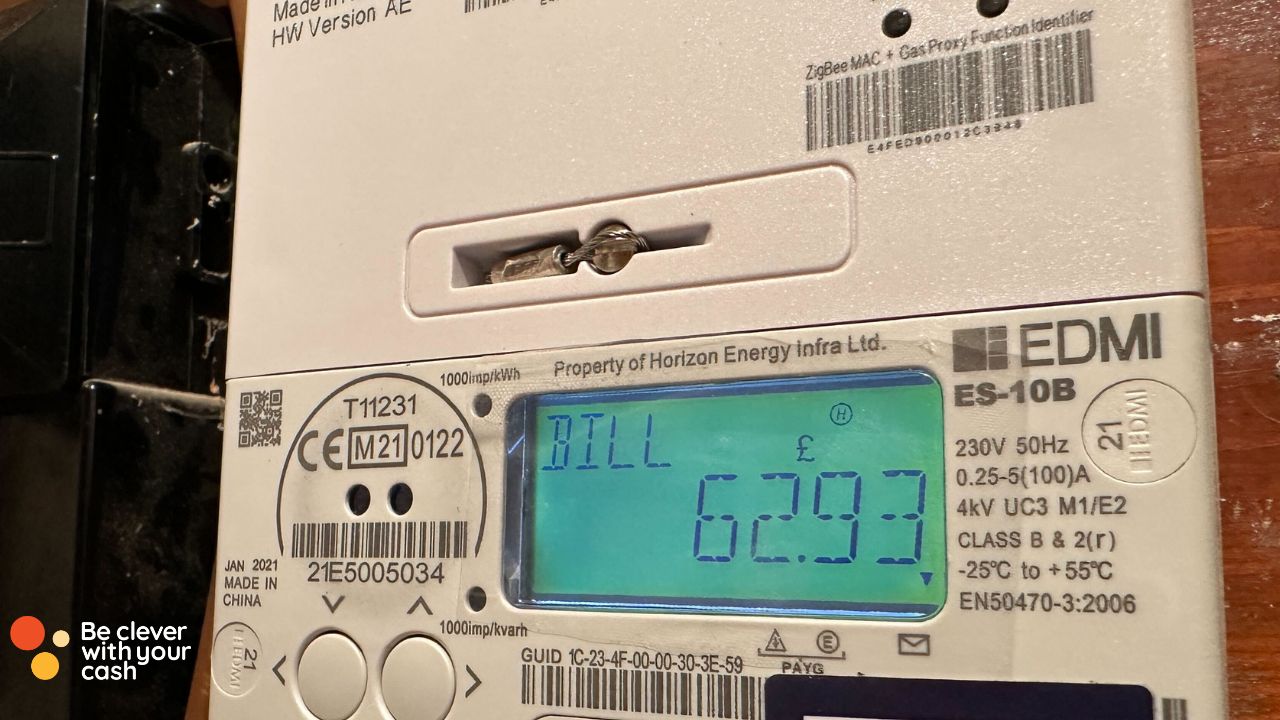

Take a meter reading

If you don’t have a smart meter, which records your usage and updates your supplier automatically, it’s a good idea to take regular meter readings so you’re being billed accurately and not relying on estimates.

A new price cap is introduced every three months and it’s especially important to take a meter reading just before so your supplier knows how much energy you used before and after the prices change. Ideally you take the reading the day before the new price cap, but you can also do it a few days before or after.

Many providers, including British Gas, EDF and Octopus Energy, will let you backdate the meeting reading to October 1 up until a certain date. Do check with your supplier what they allow.

And don’t think you can take an inflated meter reading before prices rise so you’re charged for more usage at a lower cost. Because that, my friends, is fraud.

Are you in credit or debit?

It’s not always clear from your account whether your energy supplier owes you money, because you’ve not used all the energy you’ve been charged for, or the other way around.

Setting up a direct debit to pay your energy bills can save you about £100 a year. But it’s based on a year’s estimated usage split across 12 months.

And as it’s a fixed monthly payment, your supplier could set it too high or too low. That means you could end up with loads of credit in your account or having to cough up extra cash at the end of the year.

Again, make sure you’re taking regular meter readings to ensure you’re being billed accurately.

When should I claim an energy credit refund?

As we typically use more energy in the winter months and less in the summer, your bills can average out. However, it doesn’t always even out.

Early November is when you should have maximum credit in your account – around a month or two – to see you through the colder months.

In May, you should be in maximum debt, before you start building up your balance again. If you’re in a lot of credit at this time of year, it’s likely too much and you should claim it back from your supplier.

Some firms will automatically refund your credit when it goes above a certain amount or on the anniversary of when you joined, but others don’t – so you’ll need to request it.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Be careful switching suppliers

Your bill should tell you the dates you’ve been charged for – so make sure you’re not being charged twice for the same period when you move to a new supplier.

If you leave an energy company and you’re in credit, you are due all of it back. However, this may not be done automatically, so make sure you ask. They must refund you the money they owe no matter how long ago you left them.

Challenge your bills

If you think your bill is too high, take a meter reading and send it to your supplier. They should then send you an updated bill.

If you’re still not satisfied, make an official complaint to the company. If the matter isn’t resolved to your liking, there’s always the Energy Ombudsman who deals with disputes between customers and suppliers.

> “The average bill will increase to…”

> “Most of us will be paying significantly more…”

It’s not possible that MOST will pay significantly more than the AVERAGE!