The temporary boosted rate is falling to 3.5% on 16 January

If you were a Chase customer who got a 1% boost to their savings in July last year, I’m sorry to say it’s coming to an end.

Here’s what’s happening, who’s affected and what you should do once the rate drops.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Chase’s booster rate

Back in summer 2024, Chase introduced a temporary 1% savings bonus for existing customers. This boost lasted for around six months.

You could get it if you had a Chase current account as long as you didn’t have a Chase saver account as of 2 May 2024 or you had one or more saver accounts but the combined balance was less than £50,000.

At the time, its savings accounts paid a variable rate of 4.1%, linked to the Bank of England base rate, so customers could get 5.1% with the new bonus.

Falling rates

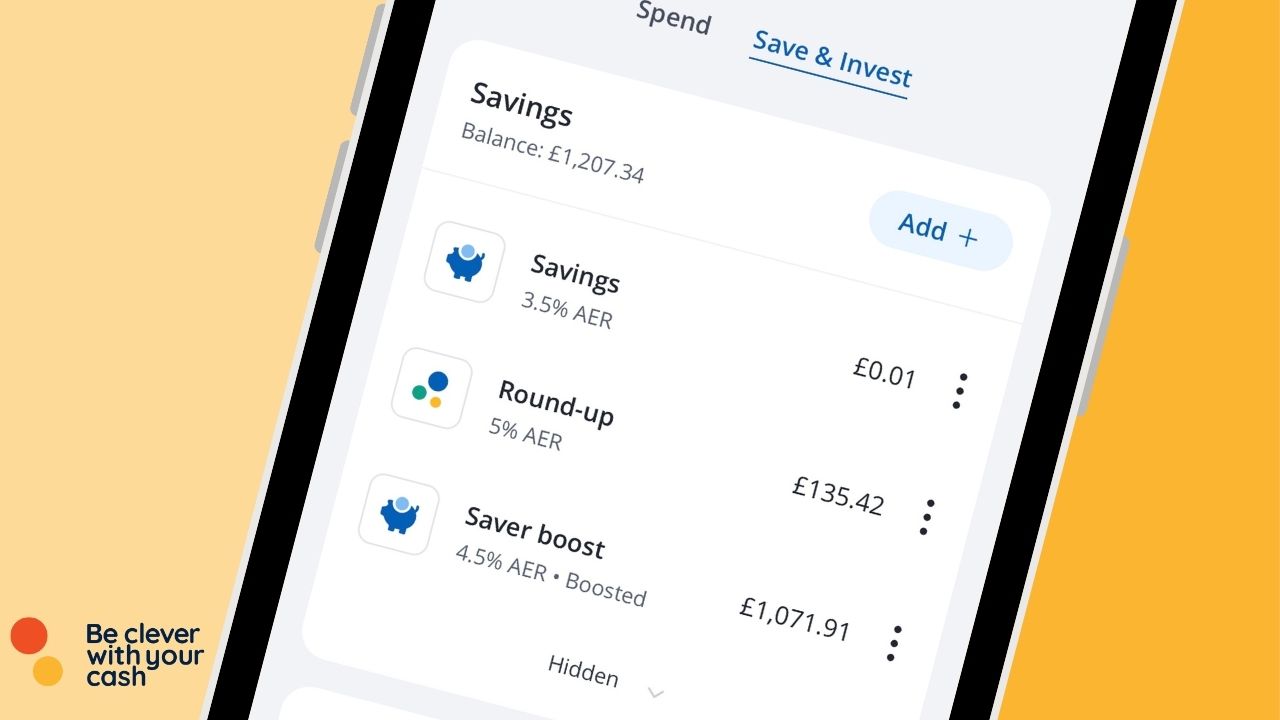

Since then, the base rate has been cut twice (once in August and again in November) and is now 4.75%. And Chase’s savings rate has fallen too, as it changed the rate it tracks at. It’s now 3.5% (1.25% below the base rate) – or 4.5% including the 1% boost.

However, the bonus is ending on 16 January. So all the customers who qualified for the bonus back in July will see their rate drop to 3.5%. If you had £10,000 in savings, it’ll mean you’ll earn £100 less in interest over a year.

And next month it’ll be even worse as Chase is changing their tracker rate again. From 19 February it’ll be 1.5% below the base rate, so you’ll receive 3.25%. And with another base rate cut expected two weeks before that, you could be getting as low as 3% very soon.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Can I get a better savings rate?

Yes – there are loads of easy access accounts that pay more than 3.5%, let alone a possible 3%

Right now, the top account pays 4.85% from Atom (though the rate drops if you make a restriction). So if you had £10,000 in savings, you’d earn £135 more in interest a year with GB Bank compared to Chase, once the rate drops.

Alternatively, you might want to consider a Cash ISA, if you’ve not yet used all of your £20,000 annual allowance yet. You can earn up to 5.05% with Trading 212.

For other options, see our top savings accounts and top Cash ISAs.

Be warned though, limited and easy access rates are variable so they can change at any time. And with rates falling over recent months (and with further cuts to the base rate expected later on this year), there’s a good chance these top rates could disappear too. However, they’re still likely to beat the Chase rate without a boost applied.

If you can lock your money away, you might want to consider a fixed rate bond instead which will guarantee your rate. You’ll find these in our best buy tables too.

What about if I’ve just signed up to Chase?

There’s a separate offer that launched in December 2024 for brand new Chase customers who open a current account and then a savings account.

The 1% boost via this offer is separate and runs for six months from when you join. So right now you’ll get 5%, though that’ll drop to 4.75% in February, if not 4.5%.

Should I ditch Chase?

It depends. If getting the best return on your money is important to you, then by all means, consider moving your money to an easy-access savings account offering a higher rate. It’s not a huge effort opening up another account and the extra interest you earn might be worth it.

As I said above though, variable rates on these other accounts can change at any time and there’s no guarantee you’ll get the headline rate for as long as you have the account.

And moving your money to get an extra 1% – 1.5% isn’t for everyone. There are other things to consider when choosing a savings provider, aside from rate, such as customer service and how easy it is to manage your account. You might be happy with Chase from that aspect and would prefer not to take a risk with an unknown provider.

Let’s face it, the 1% cashback feature on the current account is pretty gold plated compared to any other bank so you can see why Chase can’t then offer market leading rates on savings. That said, the constant reduction in the rate offered beyond base rate cuts has been disappointing. I would have rather they offered a slightly lower rate up front and then just tracked the base rate. Given the launch of the Chase credit card and interest free offer and ability to make minimum payments via your savings account Chase is probably targeting the stooging market on the basis that customers will make a trade off between the benefit of the interest free offer and a slightly lower rate on stooged savings.

Just opened an easy access with Gatehouse to move majority of my Chase Savings to. The way I use my account is to use Chase for everyday use as it gives the 1% cashback, have a small buffer in the savings pot to top up the current account when needed, and a big chunk in the Boosted Savings pot as it gave me a good rate, which I use to top up my savings pot.

I’ve moved the Boosted Savings Pot to Gatehouse as it has an app which I can then top up the Chase savings pot when needed, and Gatehouse gives me 4.65%. It’s not as high as Atom, but Gatehouse has unlimited access via the app which is better than Atom.

Chase were market leaders when they first launched in the UK , now they are no better than the High Street banks

There are many other instant access accounts out there that offer better rates to switch to, however, Chase still offer near perfect rate conversion when spending abroad and cashback. Their app is very user friendly to switch funds to and from savings/current accounts to enable you to take advantage of spending on the card abroad which is the cheapest way to spend abroad. You need to weigh these aspects up too when considering a move away.. It is possible to switch your savings elsewhere and move back what you need to the current account at Chase when you are abroad, however remember that to benefit from their cashback offer you must transfer £1500 a month into your current account from a source other than Chase

Chase used to offer good incentives but now you’ve opened accounts with them, they’ve done what all the big 6 have done, so cut their rates in the hope that you are too lazy to switch.

1% is worth switching for!!! Come on, people!

I like Chase, particularly for use abroad and the cashback. But as they’re no longer competitive on savings, the more people that move their savings out, the more likely that they’ll bring boosted rates back (hopefully).