Find out if you’re eligible

When Chase boosted the savings rates for customers in April, existing savers missed out. Well, this latest offer is open to more people. Here’s what you need to know.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the offer?

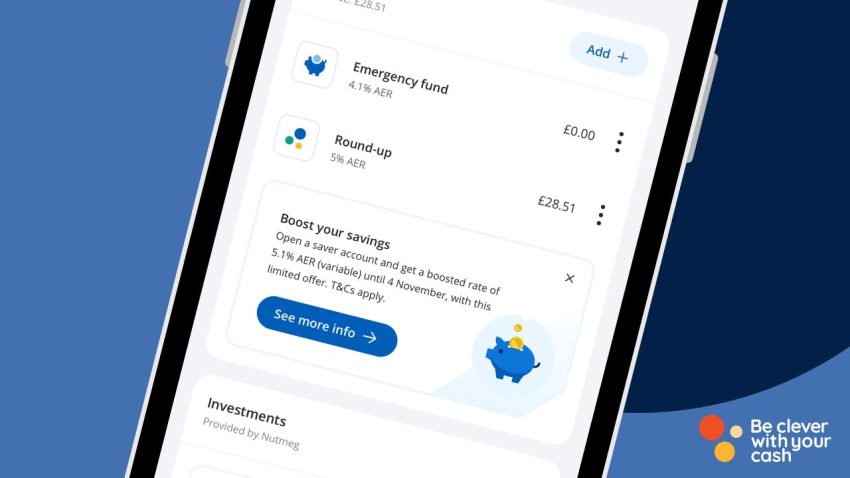

Chase’s savings accounts currently pay a variable rate of 4.1% AER. It’s linked to the base rate, which means if there is a cut by the Bank of England this year, it’ll fall by the same amount.

This deal gives you a temporary bonus rate on top of this, which is fixed at 1% AER, meaning right now you’ll get 5.1% on your balances. That makes it right near the top of the best buy tables for easy access savings.

If the base rate drops from 5.25% to 5%, then the underlying Chase rate will fall to 3.85%, and the rate with the bonus will add up to 4.85%.

However, the bonus is only for a fixed time – until 15 January 2025. That means you’ll get up to seven and a half months with the bonus, before it drops back to the underlying rate.

*UPDATE 15 JULY – you’ve only got until 23:59 on Wednesday 17 July 2024 to trigger the extra 1%*

Who can get it?

To open a Chase saver you need to have a Chase current account, which you can open via smartphone apps only.

There are then two ways to be eligible for this offer. Either, as of 2 May 2024,

- You didn’t have a Chase saver account at all, or

- You had one or more saver account but the combined balance was less than £50,000

The terms and conditions say this is not available to all customers, though everyone who meets the above criteria should be offered the bonus rate. You’ll see in the app if you are eligible, and probably get an email too.

What if I already have a bonus rate?

You can only hold one Chase saver with a boosted rate at any time, which suggests those who took advantage of the offer in April will miss out on this one, though it’s worth looking in the app to see if it appears for you.

You can probably get around this by closing the existing saver with a bonus rate and applying for the new one, which will last a few months longer.

What if I don’t have a Chase current account?

The offer is available to new customers as well as existing ones. You’ll need to open a current account first, then open the separate savings account.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How to add the bonus

You’ll see in the “Save & Invest” tab of the Chase app if you’re eligible for the offer this time, and if so you click through to open up the new savings account in the app.

There’s no set end date for this, so it could go at any time.

You will only get the boosted rate on this new account you open and you can only get it once. Any existing savings accounts will pay the standard rate without the bonus.

You should be able to see the rate clearly in the app, though you can also give this account a bespoke name to help you identify which one it is, but failing that you can see the rate for each saver when you click for more details on each one.

How is it different to the last offer?

A similar offer ran in April 2024, but this was only for people with less than £500 in a Chase Saver account. That annoyed a lot of loyal customers. The good news is most of those people will be eligible for the latest iteration.

Can you get a better rate?

This is one of the highest paying easy access accounts right now, with only a handful of other options paying more.

But it’s worth remembering not only is the boost temporary, but the underlying rate can, and probably will, fall this year. Of course, other accounts could also cut their rates when / if the Bank of England does the same to the base rate.

You could get 7% with the Santander Edge Saver, but only for one year and on balances of up to £4,000. There’s also a fee with the connected current account, but you might be able to avoid that.

After this, ISAs from Chip and Plum are worth a look. You’ll get 5.1% and 5.17% respectively, though the latter only allows three withdrawals. And of course both limit you to £20,000 of new money in a financial year.

For accounts without a balance limit, the best paying is 5.02% from Oxbury, though you’ll need a minimum of £20,000. New Chip customers can also get 5.01%, though they might be better off with a lower rate but up to £50 bonus. Here’s more on all the best rates.

But… the 1% current account interest is going

At the same time as launching this offer, Chase also revealed that the 1% rate on in-account interest for the main current accounts is to end on 5 August 2024.

Though this wasn’t a stand out rate, and it’s better to move your savings to a higher paying option whether within or outside of Chase, it was good that you’d earn something on this cash in the account. Especially if you were using it to earn cashback on spending.

If you really want to earn on higher current account balances then Kroo currently pays 4.35%, while Starling pays 3.25% on up to £5,000.

You’ll still get 5% on round ups

What isn’t changing is the interest rate on the round up account. You need to turn this on, and then when you spend you’ll see money sent to this account. So if you spend £23.76, a total of 24p would move over. That’ll earn 5%, though this account resets after 12 months.

Is Chase any good?

If you’re after this savings account then you’ll have the current account too, and that’s one of the best ways to spend money thanks to the 1% cashback via the debit card. It’s also fee free to use overseas, and you’ll get the cashback there too. The app is decent as well. Here’s our full Chase Bank current account review.

When it comes to savings, it’s easy and fast to access your money when you need it, but you are relying on the app to do this.

What do customers think?

Over at our sister site Smart Money People, Chase users have scored the savings account 4.96 out of 5. You can read what they think in more detail, and leave your own review, here.

It was only available for customers with £500 or less in their Savings Account May 2nd 2024.

They have put it up to customers with £50,000 now.

The 1% cashback on the current account was capped at £15 a month, so worth £180 a year tops. And even then you had to deposit £500 a month from an external source.

This new package is worth an extra 1% of £50,000, £500 a year, £41.66 a month.

So a win win all round

Penalises me who’s fortunate enough to have over £85000 with Chase. I’m moving it out.

I opened chase last week, on website it says 4.1%, my saving says this but the rounding up option says 5.1% I think you must mean this, you can’t add anything into it, as it will round up what you spent in the main account automatically.

Wow. 1%. Jesus wept.