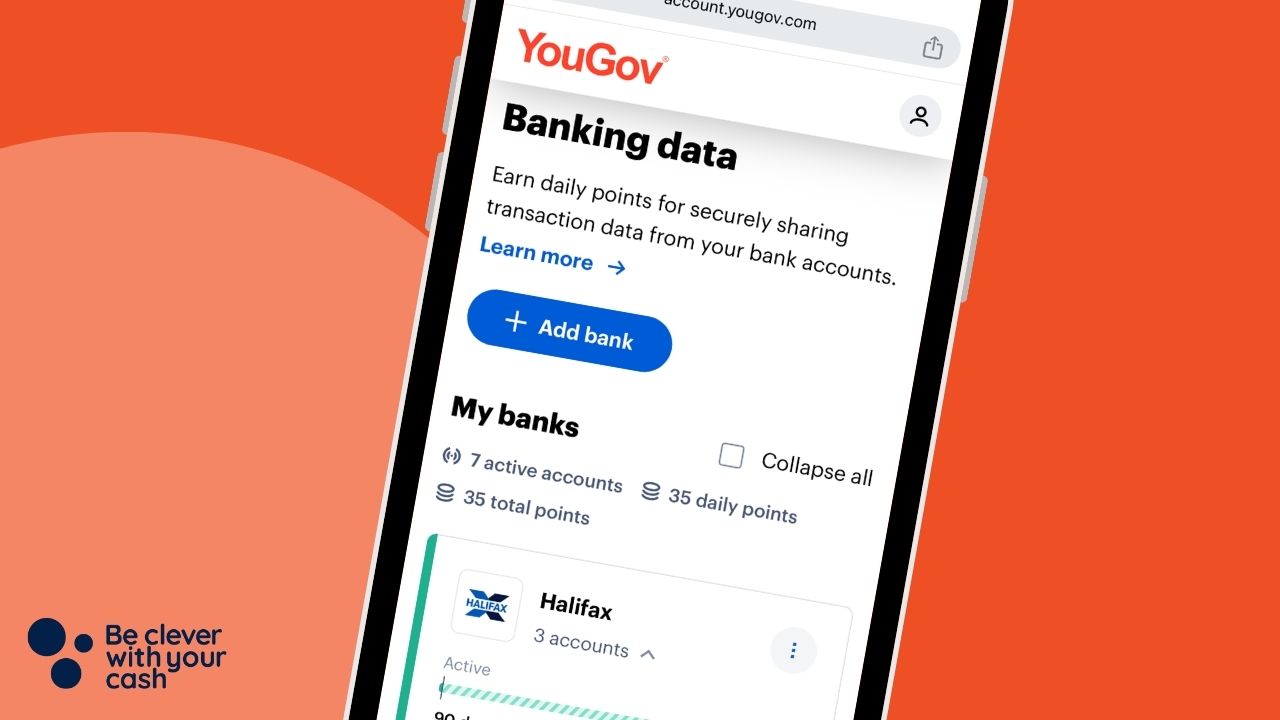

Earn money for sharing your banking data.

YouGov Finance has finally been replaced, and this new way to connect accounts could be worth £55 a year. Here’s how it works.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is YouGov Connections

YouGov Connections is part of survey company YouGov. You’ll have heard of them as their polls are often quoted in the press on any number of topics from politics to popular culture.

Most of these polls are held via a YouGov account, and anyone can sign up to be part of it (though you won’t be able to answer every one – sometimes you’ll be screened out). The people who respond to their surveys earn points, which can be swapped for cash.

YouGov Connections is a little different. You can still earn points, but rather than tell YouGov your opinions, you’ll be letting them see your data. This could be things like your Netflix or Amazon account, but the latest – and most profitable – iteration will connect to your current accounts and credit cards.

This replaces YouGov Finance which worked in a similar way but was closed down in April 2024. I’d been using that for a few years and managed to make hundreds of pounds with very little effort.

Who can use YouGov Connections?

YouGov launched the service in late summer of 2024. Initially it was invite only, but it looks like it’s now available to all customers via the YouGov app.

If not, it’s worth checking your YouGov account anyway. Some members of our Facebook group said the feature was unlocked for them after completing three surveys on YouGov.

Otherwise hopefully it’ll be opened up to everyone soon. If you don’t already have a YouGov account, it’s worth signing up ahead of time.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

How much can you make?

Points are earned daily, and how many you get depends on the type of account you connect.

| Points per day | Points per year | Value | |

| Current account: | 5 | 1,825 | £18.25 |

| Credit cards | 5 | 1,825 | £18.25 |

If you connect a current account or credit card for a full year, it’ll be possible to earn 1,825 points, which adds up to £18.25. Savings accounts pay less.

Initially you could also add savings accounts (worth a lower two points per day), and have a total of 10 different accounts connected. That mean there was £182.50 up for grabs.

But new rules introduced on 30 October 2024 reduced that limit to a total of three accounts, and removed the option to add savings. So your total earnings over a year could be as follows – if you keep the connections active all year.

| Current account or credit card | Yearly value |

| 1 | £18.25 |

| 2 | £36.50 |

| 3 | £54.75 |

If you’d signed up prior to the change and already have 10 accounts connected you can keep earning points on those, though if you remove any, you won’t be able to add new ones as replacements.

How does YouGov Connections work?

Once you’ve been invited to join, you’ll need to start adding banks. It’s easiest via your phone if you have all the banking apps set up and can be done with a few clicks. However it’ll work via your desktop and online banking too (it’ll just take longer with each log in).

Accounts must be ‘active’, which YouGov defines as being open for more than one month, and having at least one transaction per 30 days. Be careful here with credit cards you don’t regularly use.

If you have more than one account at a bank, particularly a mix of current accounts and savings accounts, you can choose which ones to connect. That’s useful if you don’t want a lower paying savings account taking up one of your 10 slots.

Once connected you’ll start to earn the points, and you can see your running total in your account.

Every 90 days you’ll need to go back in and reconnect your accounts. It’ll be pretty quick to do this as it’s just renewing your consent to access the data. If you don’t do this you’ll be losing points, so it’s worth putting a reminder in your diary to do this.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

What banks can connect to YouGov?

When you first click through you’ll be presented with a handful of big name banks, but don’t worry if your provider isn’t there. Just type into the search box and hopefully you’ll get the result you want, especially for credit cards and current accounts. The notable exceptions I found that isn’t listed is Kroo.

Chase three accounts hack

If you’re short of accounts to connect – which is less likely now you can only add three accounts, then Chase Banks allows you to set up 10 current accounts within the app.

Then it’s very easy to transfer a £1 from one to the next as a standing order every month. Once you’ve set this up, it’ll mean those accounts remain active, and you’ll keep earning your points!

Make sure it’s new Chase current accounts you’re setting up and not savings accounts.

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

Is YouGov Connections safe?

So it sounds good, but obviously you’re sharing a lot of data with YouGov here.

First, let’s look at your bank accounts themselves. The connections will be via open banking, which is regulated by the FCA. This is the same process you might have already used to connect apps like Chip, Snoop and Plum to your current account.

Your money will be safe though, as YouGov won’t have access to your card number or be able to actually touch your money in your accounts.

Next your data. When you connect, YouGov will be able to see your account number and sort code, as well as things like where and when you spend your money and how much.

Obviously, YouGov are doing this so they can sell the data on to companies. However it’ll all be anonymised so they won’t be able to identify you.

Of course, YouGov can see this and though that might mainly be things like how much you spend at Tesco or the size of your mortgage payments, it could also contain things like paying for political memberships or other things you consider private. So it’s worth having that at the back of your mind and reading the privacy policies before signing up.

Both permissions last only 90 days, and you’ll need to re-consent every three months. You can also opt out and disconnect at any time, which will remove any historical data you’ve previously shared.

How to get YouGov payouts

To turn your points into money you need to earn 5,000 points, which is worth £50. With three accounts earning 5 points a day, it’ll mean you can cash out after 334 days, so roughly every 11 months.

Other YouGov Connections

You can also earn points via other connections. Each earn 75 points, worth 75p per connection. These include:

- Amazon shopping history

- Netflix viewing history

- Apple TV+ viewing history

- Disney+ viewing history

- Paramount+ viewing history

- Prime Video viewing history

- YouTube viewing history

Last time I had a withdrawal to my bank from YouGov it arrived very quickly. I have been waiting a few days now and wondering if anyone else is having the same issue?

I’m not receiving any reply from the customer service form.

For “hack” read “dishonestly obtaining money by false pretences”.

This is a nice straightforward way for normal people to earn a bit of extra cash by sharing their genuine data.

Here we have someone whose entire life seems to be dedicated to gaming the system. In this case as soon as yougov realise the data they’re getting is fake and therefore utterly useless the scheme will end for everyone, just as I suspect the previous one did.

Although hopefully they spot these opportunists and close the loophole, after banning the user from taking any part in future.

Within hours of the hack being published You Gov addressed the loophole and reduced it to 3 maximum. It does ruin it like you say for people willing to share genuine data. Andy BCWYC reckoned it was coincidence but I’m not so sure.