If a pickpocket makes off with your phone, follow these steps

Phone theft is rife – especially in cities – and it’s on the rise.

Claims data from American insurance company SquareTrade revealed that phone theft claims in the UK has increased by 425% since June 2021, with 42% of phone thefts happening in London.

If you’re unlucky enough to have your phone stolen, it’s not just inconvenient. Canny crooks can also reset your passwords, get into your banking apps and steal your money within hours.

Here are some immediate actions to take if it happens to you.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Find my phone

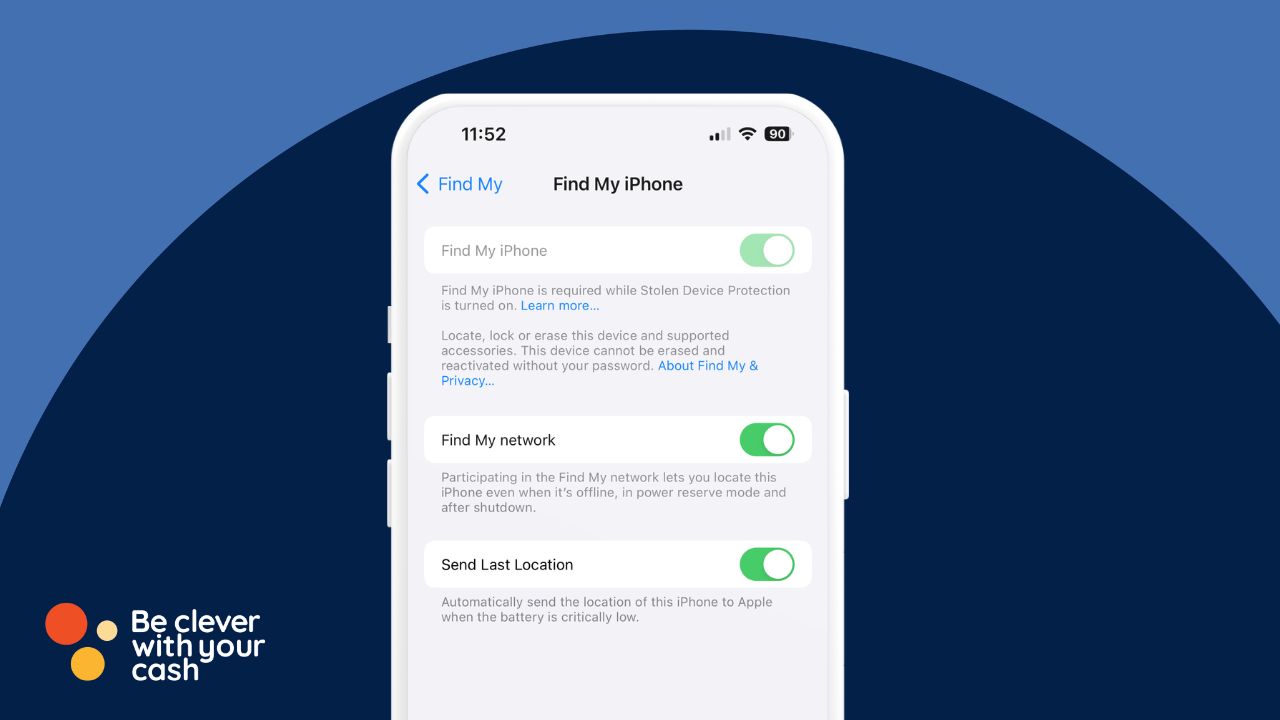

If you’ve got Find My Phone set up on your iPhone, or a similar feature with Android, you can login via a web browser, mark your phone as lost and lock it. You may also be able to find out where it’s been taken, which you can share with the police.

Note, you’ll need to have Find My Phone enabled beforehand and it’ll track your phone until it’s switched off.

Tell your provider

Now, this can be tricky if you don’t have a phone. But, it’s important to report the theft to your bank, credit card and other providers, who can suspend your app and put a freeze on your account. So, if you can, try and borrow someone’s phone to make the call.

If money has been moved to other accounts already, you could also try and contact the recipient bank to make them aware.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Report to the police

You should report the theft to the police by calling 101 (if you’re able to use another phone) or filling in an online form. If you know your phone’s IMEI number, give it to the police too. This number is unique to your phone and can be used to help track it down.

You should also be given a crime reference number which your insurance company will ask for if you decide to make a claim.

Change your passwords

This next step isn’t quick or easy as James O’Sullivan, founder and CEO of smartphone security company Nuke From Orbit, discovered when he had his phone stolen.

He says: “The more bank cards you have in your digital wallet, the more social media and email accounts you have apps for, and the more you use your phone for mobile banking, the worse it gets. My phone was stolen and shutting it all down took so long that I lost not only my phone but thousands of pounds as well.”

At the very least, change the password for your emails and your Apple, Google or Samsung account.

James suggests using different passwords across the various accounts, changing stored passwords and manually calling up your providers to go through all the identity verifications, to prove who you are. He adds: “No doubt the criminals will have already tried to change your passwords.”

Don’t forget other accounts where you may have cash stored – from cashback sites through to loyalty schemes like Nectar.

Thieves swiped my phone and stole £20,000

When Be Clever With Your Cash reader Andrew Merritt was pickpocketed in London in April last year, he had no idea what the crooks would be able to do with his iPhone.

But over the next few hours, the criminals were able to change his passwords, access his apps and accounts, steal £20,000 from his savings and take out a £15,000 loan in his name.

Andrew told us the full story and we’ve also come up with some handy tips to protect your savings from smartphone thieves.

Speak to your network

Another thing to think about is the criminal using your mobile phone. Not only can they run up your phone bill but they’ll also be in receipt of password reset codes sent by SMS. There’s also nothing to stop them contacting your friends and family, posing as you and asking for money.

You want to report the phone theft to your network provider within 24 hours. That way you’ll only be responsible for the first £100 of usage, if the crook goes beyond your allowance (which still seems unfair to me!) Once reported, the network will block your SIM and the two-factor authentication.

James says: “Preventing access to your SIM immediately helps to safeguard your mobile services and protect your Personally Identifiable Information (PII) which if left can put users at risk of hidden debts and potential financial ruin.”

Contact your insurance company

If you’ve got specialist insurance or home insurance that offers cover for stolen mobile phones, you’ll want to report it to your insurer as soon as possible and make a claim for a new one.

You’ll usually have to contact them within 24 or 48 hours but it should state it in your policy.