Top tips to protect your data and banking apps in case your phone’s ever stolen

These days we use our phones for so much more than just calling and texting. And with mobile phone thefts tripling in the past four years with over 70,000 phones being stolen in London alone in 2024, we need to be on our guard.

If your phone falls into the wrong hands, sophisticated crooks could access your banking apps, reset your passwords, and go on a spending spree. So what can you do to protect yourself?

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Keep your phone security updated

Make the most of the security features your phone provider is offering.

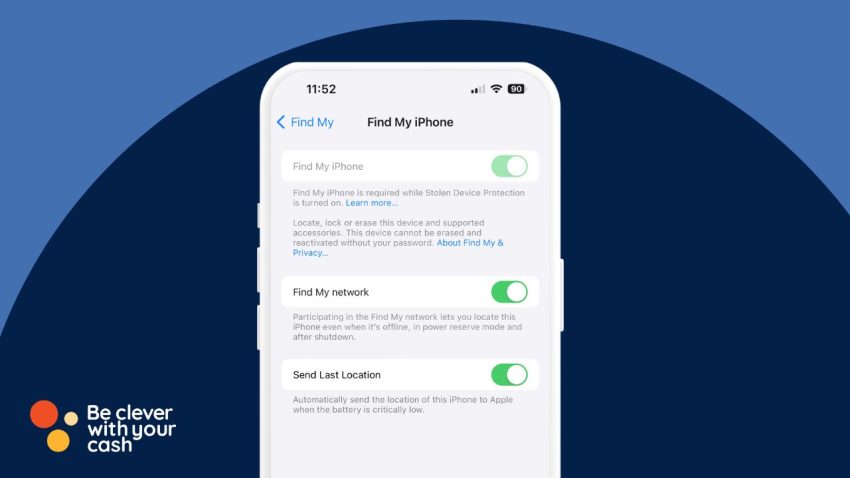

For example, if you’ve got an iPhone, you can switch on Find My Phone to protect your information if it gets stolen. It’ll help you locate the phone, mark it as lost (which freezes your Apple Pay cards) or wipe all the data from your phone.

You can also install Apple’s ‘stolen device protection’ which captures the device’s usual location.

It means if your phone is stolen and the thief attempts to change your passwords, use payments saved in Safari, view or set up a new Apple card somewhere unfamiliar, they will be unable to without further checks such as your fingerprint or Face ID.

To turn it on:

- Go to Settings, then tap Face ID & Passcode

- Enter your device passcode

- Tap Stolen Device Protection, then turn Stolen Device Protection on or off.

It also places a delay on actions, like changing the phone’s password or removing Face ID, to give you more time to report as stolen.

You’ll need to have an iPhone with at least iOS 17.3.

On Android phones, Find My Device, allows you to locate and secure your lost device and erase data, if need be. It’s available on Android 5+ devices.

Google has also recently introduced new security measures to protect your phone if it’s lost or stolen.

This includes an automatic feature called Theft Detection Lock. This locks your screen if it senses the motion of your phone being snatched and someone running, cycling or driving away with it. It’ll also introduce a ‘private space’ feature which allows you to set up a dedicated area on your phone that’s hidden and protected by a separate PIN.

Another feature, Remote Lock, will let you lock your screen using your phone number from any device, once you’ve passed a security check.

You’ll need to make sure you’ve got at least Android 10+ for these measures to work on your phone.

For Samsung phones you can set up SmartThingsFind.

Use biometrics

Using your fingerprint or facial recognition instead or, or in addition to, passwords and your PIN adds an extra layer of security to your phone and your apps.

If you’ve not set it up already, it’s a good idea to use Apple’s Face ID or Touch ID on your iPhone, Face Unlock of Fingerprint Unlock on your Google phone or if you’ve got a Samsung, Face recognition or fingerprint sensor. Be aware, biometrics may not be available on all phone models but they should be on most newer handsets.

Protect your email account

Your email holds the key to many of your accounts. So if someone manages to get access to it they may be able to reset many of your other passwords. Ideally, you want unique passwords to your email and other personal accounts that are at least 14 characters long and include a mix of special characters, capital letters and numbers.

Martin Lauer from cybersecurity firm, The One Point, suggests jumbling up song lyrics or unique slogans, to make them both strong and memorable.

He recommends avoiding bad passwords such as ‘Admin1’ or ‘Password1’ and says names and birthdays should also not be used.

Double up and use biometrics, such as your fingerprint, in addition to a password, for stronger security.

Don’t store passwords on your phone

This tip is from Be Clever With Your Cash reader, Andrew Merrit, who recently shared his horrifying story of being pickpocketed. A crook stole his phone, moved £30,000 between his accounts, took out a £15,000 loan in his name and stole £20,000 from his savings.

Andrew no longer stores his account names and passwords in Apple’s keychain because if a thief manages to get your passcode to access your phone (say by looking over your shoulder when you open your phone in a public place) they can then access all of password-protected accounts.

Instead, Andrew now uses the free Microsoft Authenticator app.

Protect your SIM card

You can lock your SIM card with a PIN to stop someone putting it in another device to receive messages, including two-factor authentication codes, to allow them access to your accounts.

For iPhones:

- Go to Settings – Mobile – SIM PIN

- Turn on your SIM PIN

If you’re asked to enter your SIM PIN, do. If you’ve never used one, enter the default one from your network provider. If you don’t know it, give them a call.

For Android:

- Go to Settings – Connection – SIM Manager

Turn off message previews

If you’ve got message previews on your phone, it means anyone can see the first few lines of a text or WhatsApp message, without needing to unlock it.

So if your phone is stolen and you are trying to reset passwords remotely, the thief will be able to see any authentication codes that are sent to your phone without needing the passcode. It’s a good idea to switch these off for an extra layer of protection.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Block thieves from changing settings

If your iPhone is locked someone could still put it in Airplane Mode, which would stop you being able to trace it using Find My Phone. If you turn off your Control Centre (via Settings, Face ID & Passcode) thieves won’t be able to do it.

You can also set up a Screen Time Passcode (usually used by parents wanting to limit what their kids can do on their phone) which would prevent access to your settings, like Find My Phone, iCloud ,Apple ID and Face ID, to stop a crook from changing or disabling them. This would mean they could get access to your digital wallet and they could stop you from locking or erasing the data on your device.

Don’t keep your ID with your phone

While phone cases that include space for your bank cards and driving licence seem really handy, it can be a nightmare if the whole thing is stolen. When Andrew’s phone was stolen the thief also took his driving licence, which may have helped him apply for the loans.

Check out this article for more of the changes Andrew has made to protect his phone.

Consider whether you need all your banking apps

Yes, having banking apps on your smartphone is convenient, but do you need access to them all the time? Or could you keep your main account on your phone and have the rest on another device that’s kept safe at home?

The ones you do decide to keep could be kept in a hidden folder on your phone to prevent thieves from finding them. You could set up a hidden folder and protect them with your fingerprint, facial recognition or a unique PIN for extra protection.

Know your IMEI/MEID number

Martin says it’s crucial to make a note of this number as if your phone is stolen, it’ll help your network track it down. He says: “This number is unique to your device and can be found in your settings under About Phone.”

If you’ve got an Android phone, dial *#06# for the IMEI number.

Martin also suggests enabling a tracking system with GPS locating turned on to maximise the chance of retrieval. For example, Apple has Find My iPhone as I mentioned earlier, or Mr Lauer suggests a location tracker app, such as Life360.

Backup your data

Within your settings, enable your cloud automatic backup; your device will then back up regularly to a safe storage unit in the cloud. If your phone is stolen, you can still access your data and photos remotely.

I was puzzled how thieves gained access to Andrew Merrit’s bank account. Now I knew. The passwords and numbers were readily available in Apple’s keychain.

There’s an online registration service called Immobilise (https://www.immobilise.com/) where you can register your devices to help law enforcement agencies find them in the event they get stolen.

Sim PIN on iPhone

You write:

“Go to Settings – Mobile – SIM PIN

Turn on your SIM PIN”

But it’s not there – it’s in in “Cellular -SIM PIN”

*** WARNING! ***

Be very careful if you enable SIM PIN as you can end up totally locked out of your phone! I did this after reading this article as once you start the enable process you can not back out of it. The phone asks for PUK codes and PIN codes and the whole thing is not very clear. So I tried to cancel and it would not let me, hence the phone became locked and totally unusable. I had to call my mobile network from another phone and get an unlock code.