Disclosing vulnerability to your provider could help you get the support you need

It’s never pleasant to think about but at some point in our lives, or at several, we may become vulnerable. Not only could this impact our overall wellbeing but it could also affect our finances.

But what exactly is vulnerability and what should you do to protect your money if you experience it?

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is vulnerability?

Generally speaking, vulnerability is where someone might be more at risk or in need of special care because of their circumstances.

And if we look at the definition of vulnerability for financial services, as laid out by the regulator, the Financial Conduct Authority (FCA), it’s someone who “due to their personal circumstances, is especially susceptible to harm, particularly when a firm is not acting with appropriate levels of care.”

So, as you can see vulnerability is a broad term. You might be considered vulnerable if you’ve got a long-term illness, mental health condition, a physical or cognitive disability or have issues with your sight or hearing, addiction, have difficulty communicating, or are elderly, for example.

And you might also be seen as vulnerable if you’ve experienced certain life events that might mean you need more care, such as if you lose your job, if you’re bereaved, going through a divorce, you’ve just had a baby or if you struggle to understand your money.

Debt charity, StepChange, says it considers everyone seeking debt advice to be financially vulnerable – another type of vulnerability.

Vulnerability is common – current FCA data suggests that 26 million people in the UK show one or more characteristics of vulnerability. That’s more than one in three of us.

And new research from our sister site, Smart Money People, found that as many as 11 million of these people don’t realise they are officially considered vulnerable according to the regulator’s definition.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How can vulnerability impact your finances?

Whether your vulnerability is caused by a physical or mental condition or by a life event, it could lead to significant challenges with your money.

Smart Money People’s research suggests you’re 47% more likely to fall victim to a scam when you’re vulnerable, for example.

Meanwhile, one in six people (16%) said their situation made it more difficult to make financial decisions, and a further one in seven (14%) said it distracted them from managing their finances.

And the consequences could be really serious.

If you’re not on top of your finances it could lead to missing payments. This could result in a damage to your credit history and fines, or if you end up in arrears you could lose your home.

For example, if you fall behind on your mortgage payments your house could be repossessed and if you can’t keep up with your rent, you could be evicted.

And if you can’t pay your council tax, the council could eventually send bailiffs to your home to seize your possessions to repay your debt.

Falling into these kinds of problem debts will not only be detrimental to your finances, but it’s very likely to have a negative impact on your health, mental health and wellbeing. And if you’re vulnerable already, it could well make it worse.

Last year 52% of StepChange clients disclosed an additional vulnerability on top of their debt problems.

Should you tell your provider that you’re vulnerable?

It can be a daunting conversation to have with your provider and most vulnerable customers (68%) don’t disclose it to any of their financial providers, according to the research by Smart Money People.

However, by not telling your provider, it prevents you from accessing additional support.

Most organisations would encourage you to speak to your bank, credit card provider and other financial firms you have products with about your vulnerabilities, especially if you owe them money. The idea is that if they know you’re vulnerable, they should help you.

In fact, the regulator has rules to ensure vulnerable customers are treated fairly.

The FCA says companies must take extra care of their customers if they are experiencing one of these four types of vulnerability:

- Health – if you have a condition or illness that affects your ability to carry out day-to-day tasks.

- Life events – for example if you’ve suffered a bereavement, lost your job, or had a relationship breakdown.

- Resilience – if you find it hard to withstand financial or emotional shocks.

- Capability – if you don’t understand, and have trouble managing, your money. This might be because you find it hard to do things like read letters or write emails.

Tim Sheppard, policy and propositions manager from the Money and Pensions Service, says: “If you are vulnerable, all companies – especially those you owe money to – have a responsibility to help you with an appropriate level of care. These companies might have specialist teams to give the support you need to manage your debt and day-to-day money.

“If you know you’re not going to be able to make your next payment, giving your credit enough warning means that they might be able to put a plan in place to help you before

things get worse. Continuing to ignore the problem might mean you’ll face interest and late payment charges and eventually a loss of service, goods or put your home at risk.”

If you’re tricked into sending money to a fraudster, in what’s known as an ‘authorised push payment scam’, it’s really important to outline any vulnerabilities or vulnerable circumstances. These scams are often high pressure and involve criminals posing as legitimate organisations, such as your bank, the police and HMRC, to get you to transfer money, often to protect it.

New rules were introduced on 7 October 2024 which state your bank must refund money lost, as long as you meet certain criteria. And if you’re vulnerable, or considered unable to protect yourself from scams because of your circumstances, you should be refunded regardless.

A £100 excess could apply to eligible claims with some providers, but if you’re considered vulnerable when you’re scammed, you may not have to pay it.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

How should I tell my bank I’m vulnerable?

Simon Trevethick, from StepChange Debt Charity, says you might want to ask a friend, family member or support worker to help you have the conversation with your provider.

He says: “Once you do disclose your vulnerability, your creditors may ask for further information, and it’s up to you to choose how much you tell them.

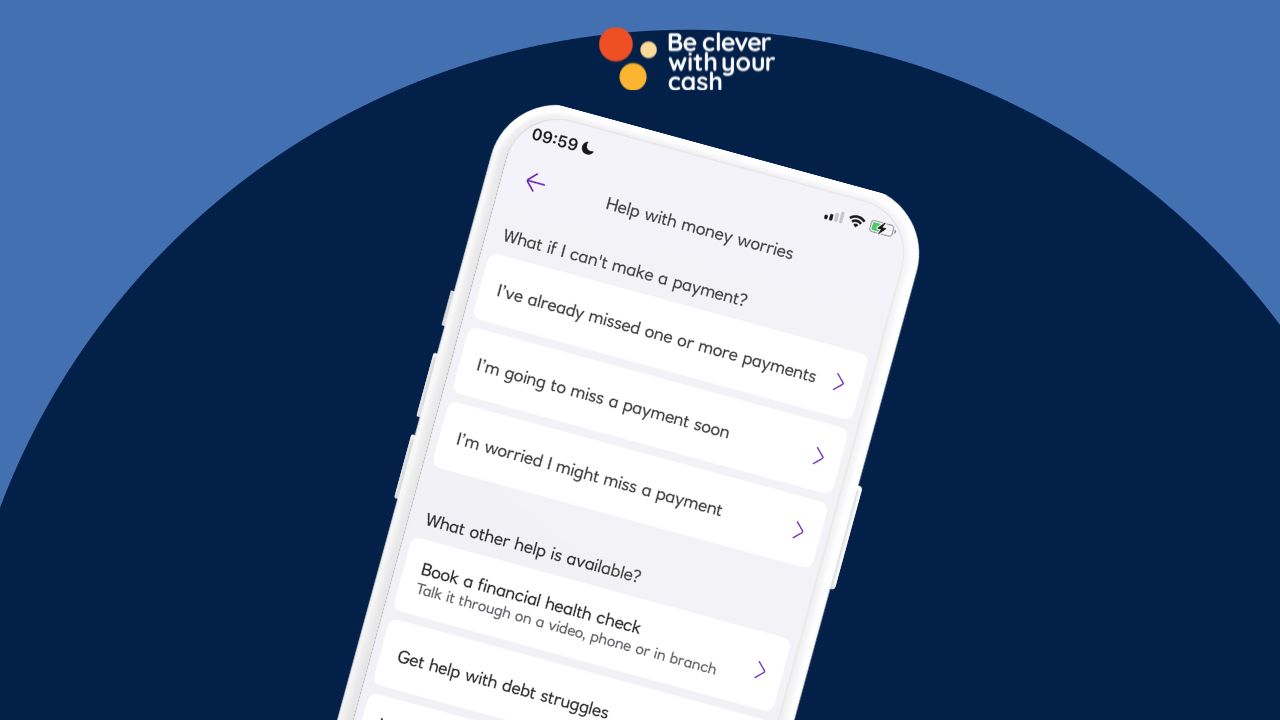

“Many companies have multiple ways to contact them nowadays, so you can choose a method that you feel the most comfortable with – be it online through webchat, email, or over the phone. Some financial providers may have specialist teams in place who are trained to offer tailored support to vulnerable customers.”

Kathryn Townsend, Nationwide’s head of customer vulnerability, said that you may also want to consider in what circumstances you disclose your vulnerability.

Firstly, you might want to think about how your provider could make your everyday experiences easier and more accessible.

So say you have trouble hearing or seeing and you need extra support, such as speaking to branch staff face-to-face so you can lip read, or large print communications – Kathryn says you should share this proactively with your provider.

That way, your needs can be recorded on the system for future interactions and avoid you having to go over it every time you need something.

And secondly, you might want to mention your vulnerability when things go wrong unexpectedly.

This could include something that happens in the moment or if you can see that something could occur in the near future, such as if you’re struggling to make payments and you think you might miss the next one. In doing so, staff should be able to help support you with the financial side of the matter.

Kathryn says this could include supporting a customer when registering a fraud or support to change details if fleeing an abusive relationship, for example.

She adds: “In short, it’s always good to talk to your banking provider to see how they can help you with everyday banking – or if you’re worried about a specific issue or product.”

Are there any risks to disclosing my vulnerabilities?

The organisations I’ve spoken to have all encouraged customers to talk to their providers about their vulnerability to ensure they get the best support.

However, if you do feel you have been treated unfairly, you can make a formal complaint to your provider via their complaints procedure. And if you’re not satisfied with the outcome you can take your complaint to the Financial Ombudsman Service, which handles disputes between financial firms and customers, for free.