Is it worth paying the £3 monthly fee for this high interest rate?

The Santander Edge Saver pays 6%, which is higher than any other easy-access account right now.

But there are drawbacks, including the requirement to open a Santander Edge current account (which has a monthly fee), a limited balance that earns interest and a bonus that ends after 12 months.

When you take all that into account, just how much will you earn? Here’s our analysis.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the Santander Edge current account?

The key requirement for the Edge Saver account is you must have a Santander Edge current account. Opening this be subject to a credit score – something you don’t need to think about with most savings accounts.

The account itself can earn you cashback on some spending and bills. Unless you’ve already got the now-defunct Santander 123 current account, this is probably the best way to earn a little on your key bills. Though at 1% don’t get too excited.

Cashback is capped at £10 a month. Even though that means the potential to earn £120 a year, I don’t think you actually will because your spend on bills is likely lower – as my analysis shows.

And another big reason you’ll get less is the £3 monthly fee. That £36 a year will wipe out much of the cashback you earn on your bills. So why bother, well if the £36 is accounted for, it means you will be getting the full 6% on your savings in the linked Edge Saver.

Can you avoid the Santander Edge £3 fee?

If you don’t want to earn cashback on the Santander Edge current account, you might be able to avoid the £3 fee altogether.

As long as you don’t set up any direct debits, you won’t get charged each month, but you’ll still be able to open up the Edge Saver and earn the full 6%.

However, Santander reserves the right to move you off the Edge current account if you don’t meet the criteria, which would lose you access to the Edge Saver too.

What is the Santander Edge Saver?

If you have the Edge current account you’ll be able to open up a Santander Edge Saver account.

The Edge Saver pays a 6% AER interest rate, but that contains a 2.5% bonus for 12 months, so it’ll drop to 3.5% after a year (though as the rate is variable, it could go up or down in this time).

Note the rate has changed a few times. Most recently, if you opened it between 1 August 2024 and 26 March 2025 the 12 month bonus was 1.5%. Between then and mid-September 2025 it was 2%.

The interest is also only on balances of up to £4,000. Anything in the account above this will earn nothing at all. That means if you have the full £4,000 saved you’ll get the gross rate of 5.84%. It make sense to withdraw interest each month in this case and put into another account paying a decent rate.

The joint account hack

Each person is allowed only one Edge Saver per Edge current account, but there is a way you might be able to get more.

Joint Edge account holders can get one saver each even though they’d have just one current account. That helps limit the impact of the fee on savings held by the couple, so you’ll earn even more.

And you could each have a personal account as well. So between the two of you, that could be four Edge savers. However, that could be three lots of the fee – unless you avoid it as detailed above.

The second year hack

Another hack will let you get the top rate again after 12 months. Rather than just keep your existing Edge Saver open at the lower rate, close it down.

Then after a few days you’ll be able to apply for a new Edge Saver, which should include the 12 month bonus.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How much interest will you earn in the first year?

If you cover or don’t pay the fee

Assuming you’re accounting for the fee against the cashback or are avoiding it being charged, you’ll get the full 6% AER back on your savings.

If you have the full £4,000 saved in the account for a year, the interest won’t compound, so you’ll earn the gross rate of 5.84%, and make £233.60 in interest in the first year. That’s pretty decent right now.

In the tables below we’ve shown the total you’ll make in the second column depending on how much you have saved and how many Edge Savers you have open.

If you need to factor in the fee

But it’s not always possible to cancel out the Edge current account fee. You might have been forced to set up direct debits for a switching deal for instance. In that case then you’ll need to deduct it from your earnings.

The tables below show how much you’d earn on different balances after the fee and the real interest rate when that happens.

I’ve also split the analysis to show how this builds if you are able to open up additional Edge Savers by having a joint Edge current account, or a mix of personal and joint accounts.

One Edge account with one Edge Saver

Without the fee, 6% is one of the highest-paying options out there. But it drops a lot if you do need to account for £3 a month.

Importantly, don’t have less than £600 in there as you’ll be losing money! I’d suggest you also want to look elsewhere if you have £3,000 or less in savings.

| Amount saved | Annual Interest | Interest after £36 fee | Effective interest rate |

| £500.00 | £30.00 | -£6.00 | -0.60% |

| £1,000.00 | £60.00 | £24.00 | 2.40% |

| £1,500.00 | £90.00 | £54.00 | 3.60% |

| £2,000.00 | £120.00 | £86.00 | 4.3% |

| £2,500.00 | £150.00 | £114.00 | 4.56% |

| £3,000.00 | £180.00 | £144.00 | 4.80% |

| £3,500.00 | £210.00 | £174.00 | 5% |

| £4,000.00 | £233.60 | £197.60 | 4.94% |

One joint Edge account with two Edge Savers

Of course if you have the joint account instead you can open two Edge saver accounts and pay just one fee. Then the rate starts to improve, as this table below shows.

The amount saved is the cumulative amount across two savers, even though you’d only be allowed up to £4,000 in each one.

| Amount saved | Annual Interest | Interest after £36 fee | Effective interest rate |

| £4,500.00 | £270.00 | £234.00 | 5.20% |

| £5,000.00 | £300.00 | £264.00 | 5.28% |

| £5,500.00 | £330.00 | £294.00 | 5.35% |

| £6,000.00 | £360.00 | £324.00 | 5.40% |

| £6,500.00 | £390.00 | £354.00 | 5.45% |

| £7,000.00 | £420.00 | £384.00 | 5.49% |

| £7,500.00 | £450.00 | £414.00 | 5.52% |

| £8,000.00 | £467.20 | £431.20 | 5.39% |

One personal Edge and one joint Edge account with three Edge Savers

You can build on this again if you have another £4,000 to save by adding a personal account alongside the joint account to open another Edge Saver – though you’ll be doubling the fee to £72 a year.

| Amount saved | Annual Interest | Interest after £72 fee | Effective interest rate |

| £8,500.00 | £510.00 | £474.00 | 5.58% |

| £9,000.00 | £540.00 | £504.00 | 5.6% |

| £9,500.00 | £570.00 | £534.00 | 5.62% |

| £10,000.00 | £600.00 | £564.00 | 5.64% |

| £10,500.00 | £630.00 | £594.00 | 5.65% |

| £11,000.00 | £660.00 | £624.00 | 5.67% |

| £11,500.00 | £690.00 | £654.00 | 5.68% |

| £12,000.00 | £700.80 | £628.80 | 5.24% |

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

Two personal and one joint account with four Edge Savers

Or if you really go to town – and pay the fee three times with a joint account and a personal account each you can open up a total of four Edge Savers. Obviously one of these account fees might be covered by cashback.

| Amount saved | Annual Interest | Interest after £108 fee | Effective interest rate |

| £12,500.00 | £750.00 | £714.00 | 5.71% |

| £13,000.00 | £780.00 | £744.00 | 5.72% |

| £13,500.00 | £810.00 | £474.00 | 5.73% |

| £14,000.00 | £840.00 | £804.00 | 5.74% |

| £14,500.00 | £870.00 | £834.00 | 5.75% |

| £15,000.00 | £900.00 | £864.00 | 5.76% |

| £15,500.00 | £930.00 | £894.00 | 5.77% |

| £16,000.00 | £934.40 | £826.40 | 5.17% |

Watch out for tax on multiple Edge Savers

If you have multiple separate Edge Savers, there’s a risk the rate will reduce again thanks to tax. Don’t forget the tax-free Personal Savings Allowance is only £1,000 or £500, depending on your tax bracket.

That means any earnings over these amounts will be taxed at 20% and 40% respectively. Plus the PSA is only on earnings before the fee.

However, since the joint account interest will be shared 50/50 it means only higher rate tax paying couples with four Edge Savers and the full £16,000 saved will need to worry too much – unless you have savings elsewhere which also contribute to your tax-free allowance.

How does it compare to other savings accounts?

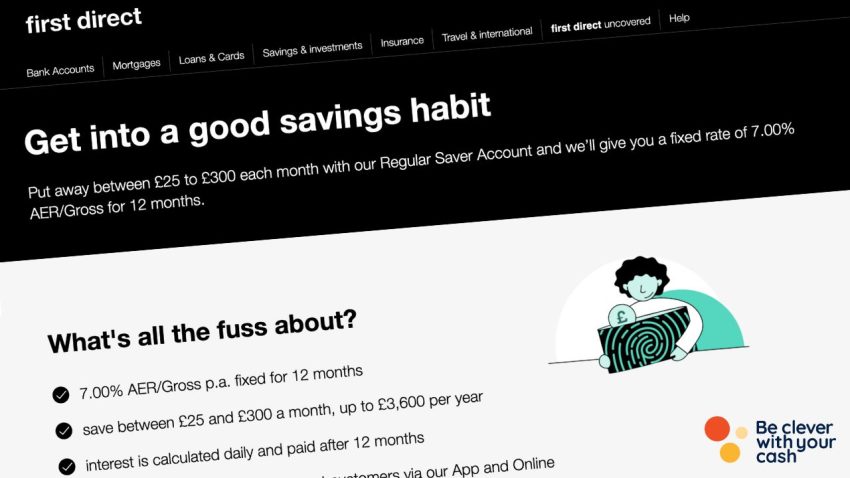

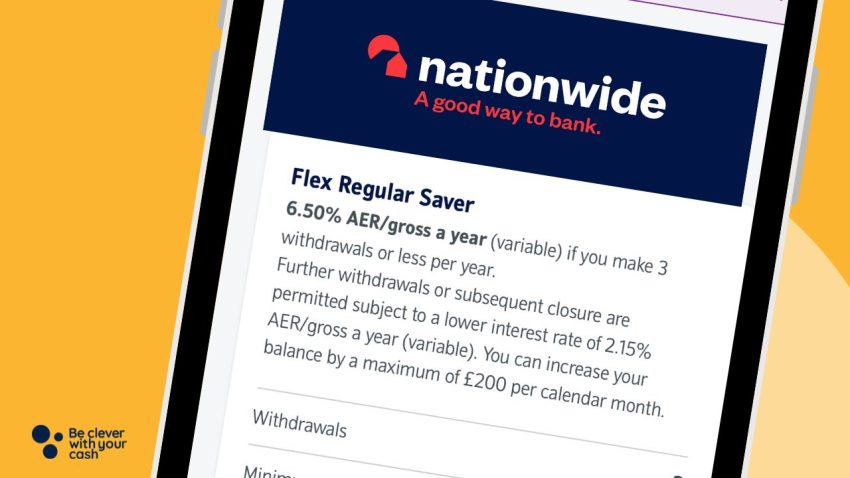

You can’t get close to 6% on a lump sum anywhere else right now, though regular savers do pay more, with accounts up to 7%.

If you are paying the fee you may be better with an account with a lower AER, but will pay you more overall.

Is Santander Edge Saver any good?

Andy’s Analysis

Despite the drop from 7% to 6% last year, when you compare the headline interest rates it’s a really decent rate, that’s currently well above the rest.

However, when you factor in the £36 fee it does mean it’s not as strong as others – though rates will fall elsewhere too.

And if you add in extra current accounts to give you access to more Edge Savers you’ll still be looking at close to 5.8% on balances up to £16,000.

Plus, remember that 6% rate is only for 12 months.

Summary

Santander Edge Saver

Santander Edge Saver

Customer rating

3.8/5

Customer rating

3.8/5

- AER (variable)6%

- Interest earnedIn separate account

- Minimum£0

- Maximum£4,000

- Requirements Requires Santander Edge current account (£3 monthly fee). You can open one Edge Saver with a personal account and two Edge Savers with a joint account.

- FSCS Protected? Yes

- Bonus Includes 2.5% bonus for 12 months

How to get a Santander Edge Saver account

You’ll need to open up the Santander Edge account – here’s my full review. Note this isn’t available to customers with the Edge Up current account.

There’s also the chance to get an extra £10 to £20 cashback when you first apply for the current account (details below).

Quidco & TopCashback: Up to £20 when you open an Edge account

If you apply for the Santander Edge account via cashback sites Quidco or TopCashback there’s often an extra you can earn on top, normally between £10 and £20 (the amount varies).

If you’re not already a customer of either site then make sure you sign up for a welcome offer first, worth up to £17 – though this can’t be used in conjunction with the Santander offer so you’ll need to make a purchase elsewhere first.

Can you explain how (or why?) the effective interest rate goes down if you put more money in? (Between £3500 and £4000) I can’t figure out why that would be the case.

The interest won’t compound if the balance is above £4,000 https://becleverwithyourcash.com/compound-interest-and-savings-what-you-need-to-know/

Hi Andy, I visited my local branch today and was told that my joint current account is only eligible for one edge savers account. Do you have a link to the website to show as evidence for this? Thanks very much!

Hey Sam, it’s one each, So you can open one, and whoever you share the joint account with can also open one

I opened a 7% account a while back. I was content to let the standing orders on my current account (Edge) wipe out the fee. After a year it dropped and is now only paying 4.2% which is disappointing. My annual interest will credit soon and I have earmarked a shortlist of others paying more. It was good while it lasted, but all good things… etc.

I’ve had the Edge saver for almost 12 months now so I’m about to lose the 1.5% bonus rate. Does anyone know if it’s possible to close the account then reopen a new one and therefore qualify for the bonus interest rate for another 12 months?

Yes, you can. I closed the 7% saver after the year had finished through online chat and opened a new one at 6% on the same day. It was very easy to do.

Good to know, I shall do that myself when the bonus rate expires.

Hi Andy, I have a joint Edge account with my wife, £4000 in each following your advice. Today i visited Sandander to open a sole account in my name, and was told as i have a joint account I could not have a second Edge saver account in my name, as per turms and conditions, only one account each. I did mention your name and advice, and was told you were wrong, Am i missing somthing?

Hi James, show them this page https://www.santander.co.uk/personal/savings-and-investments/savings/santander-edge-saver#:~:text=You%20can%20have%20a%20maximum%20of%20two%20accounts%20%E2%80%93%20one%20for%20each%20Santander%20Edge%20current%20account%20you%20have%20(in%20your%20sole%20name%20or%20that%20you%20hold%20jointly%20with%20someone%20else).

Hi, I’ve come to the party a bit late, but I think I can add something pertinent to the discussion. Since the original post Santander has introduced an Edge Up account, similar to an Edge account but on steroids. It pays 3% on balances up to £25,000, conditions being usual direct debits, pay in £1500 a month and a £5 monthly fee. I already had an Edge account and an Edge saver, so I thought this would be an easy way to maximise my savings without changing banks or opening new accounts with other providers. So I upgraded my Edge account to an Edge Up and didn’t think any more of it. Until…I got a letter from the bank stating that my Edge Saver account would be demoted to an Everyday Saver paying a paltry 1%!

Why? Because I no longer have an Edge account, but an Edge Up account, which makes me ineligible for the 6% Edge saver account! Talk about splitting hairs and the infinite ways they have of making sure you never take too much interest from them by being savvy with your savings. This fact was never explained when I applied for the Edge Up online, whilst holding the Edge Saver at the same time. There should have been a big red warning from the bank’s software to the effect that opening an Edge Up account would detrimental effect on my finances.

This is not the first time Santander has been “economical with the truth”. Like others on this forum, I was told I couldn’t have a second Edge saver account in my wife’s name on my joint Edge account, but I now know this is not the case. So, my wife and I have missed out out on a whole year’s interest of 7% on £4000. Secondly, when the interest dropped to 4.4%, nobody told me there was a second issue of Edge Saver that was paying 6%; again, another loss of interest. So I closed the old one and opened a new.

What’s my next move? Well, an official complaint to Santander that their in-house advisors suck and need to be re-trained on the basics of customer service. And maybe an appeal for compensation for the interest my wife and I have missed out on, but I’m not holding my breathe. I still have to open an Edge account to make me eligible for the 6% saver, but that will stick in my craw for a long time.

What a palaver!

You’ve heard of the trickle down economy. There’s no evidence that ever happens but here’s yet another example of the trickle up economy. Banks falling over each other to dream up new ways to give cash to people who are lucky enough to have a chunk of savings. And where do you think it comes from? Punitive overdraft and transaction charges on those who are already in debt.

And yet people will spend hours working out how to play with their balances to get an extra 50 quid interest over a year.

It’s a pretty crap way to run society.

Yes it is a Crap way to run society but it’s all we have to work with ! I am an Old Bloke of 84 years and ‘savings cash heavy’ (not much time left so do not take risks). For very many years I (and many other savers) have subsidised those who use zero interest on borrowed money to enjoy this ridiculous way to operate by Bank Of England.

Personally the 2023 years may teach people more about money. Like other old people I paid 15% for my mortgage. Quantitive Easing ruined my retirement plans and life savings ..UNTIL

these rapid increases in interest rates..then Bonanza (for us Savers) .. at last! Why should we have subsidised other peoples reckless investments (large mortgages).

Now we can all live in the real world where working and savings are rewarded.

Personally I hope interest rates increase to 10% -OK I’m a rotten ‘xugger’ (change x for b).

I enjoy your articles Andy – keep up the good work.

Regards

Well said, you old sugger

Yep, I’m with the old rugger and Del

Terry, as a society, we DO subsidise the less well off. This is why we have state pensions…the pension you enjoy was paid for by a previous generation. NHS treats all eligible, free whether they have grafted or not..eg: those too disabled to work. Those who got 0% interest on borrowing will not ALL have ‘enjoyed’ this money. Many use it to pay debts, like huge cost of living hikes! Maybe we are too benevolent in some ways, but not in others. My hubby worked from 14 till he was too ill (cancer)…hard labour mostly, then died aged 64, months off his pension. His state pension returned to the pot to fund the system. We worked 91yrs between us, always low pay despite trying to claw our way up. Life is not always kind. We had under 5 holidays in almost 47yrs, abroad only twice for 1 wk each time, the last, 17yrs ago. If you want to use blame, blame greedy banks & shareholders in big businsess, like water firms for paying shareholders big bucks. If you think you subsidised us, then I thank you & those like you or we would have been destitute. On money I now get, I keep 3 to 4 families afloat by adding a few tins of food or to top up fuel, so they are less pressure on the state & others who feel they contribute. Having worked in some very hard jobs, from 15yr old mill girl to cleaner with multiple jobs, factory work, mental health hozi & in Crown Court (fancy name, low pay), to lowest paid Civil Servant, & STILL sharing what I can. I think me and my lad did our bit. Our girl too… even after a stroke at 40, still trying to hang onto her job despite being advised not to after working from 14 at weekends, evenings & all summer. Not everything is as cut & dried as you think. Life has been so very cruel…but I wouldn’t want you or anyone else to hear our horrendous truth. Best wishes, Val.

You have had it hard. So sorry for the loss of your husband. My husband died at 26 got two jobs so my children could go to university don’t regret it.