When you get this month’s payslip, you’ll most likely notice a different amount to normal. April is the first month of the new financial year, and a few changes came into action. Here are the basics you need to know to start understanding the difference between what you earn and what you actually get.

1. Gross vs Net Pay

Gross is the amount you are paid by your employer before any deductions. Net is what you get once everything has been taken out. This is what you’ve got to save or spend.

2. Income Tax & Personal Allowances

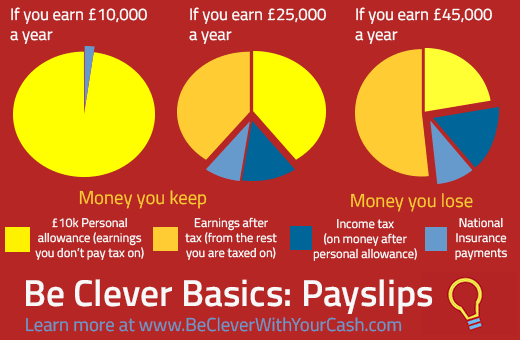

Each year, everyone earns a certain amount that doesn’t get taxed. This is called your personal allowance. For 2014/15 it’s £10,000. Anything you earn over that gets taxed.

Say you earn £25,000 a year. You only get taxed on £15,000. The current rate is 20% for anyone earning over £10,000 and less than £41, 865. So you’d have £10,000 untaxed, then £15,000 taxed at 20% (£3,000).

For any money earned over £41,866, you’d get 40% deducted. So if someone earned £45,000 a year, they’d have £10,000 untaxed, £31,865 taxed at 20% (£6,373) and £3,133 taxed at 40% (£1,253).

3. National Insurance

National Insurance (NI) payments start if you earn more than £153 a week (which is £7,956 a year). You’ll then pay 12% of what you earn over that amount up until an annual salary of £41,865. Then you pay 2% on anything over that amount.

If you earn £10,000, you pay £245 of NI, that’s 12% of £2,044, the amount you earn above £7,956.

If you earn £25,000, NI of 12% on the amount earned above £7,956 means you pay £2,045 a year.

If you earn £45,000, you pay nothing on the first £7,956, 12% (£4,069) on the next lot up until £41.865, then just 2% on £3,133 (£63).

4. PAYE

PAYE is how most people are contracted at work, and this stands for Pay As You Earn. PAYE employees don’t need to worry about their Tax and NI as it’s sorted by the employer. Freelancers have to do it themselves. A fantastic site to work out how much you’ll earn on PAYE is the Salary Calculator. You can read my Clever Site guide to this tool here.

5. Other Deductions

Additional payments such as giving to charities, student loan repayments, season ticket loans and pension contributions will all be taken out before you get it. Some of these will be taken before tax, which means you’ll only get taxed on the amount left afterwards. You’ll essentially take home more money.

6. Check Your Tax Code

You’ll see a “Tax code” on your payslip, probably some numbers followed by an L or other letter. It’s worth checking this is right as you could be paying too much or too little – and you’ll have to sort out the difference at the end of the year. A general rule of thumb is that if you multiply the number by 10 you’ll get your annual salary. If you want to know more, read this guide to tax codes on the HM Revenue & Customs site.

3 thoughts on “Payslips Explained”

Comments are closed.