How to access one of the highest paying regular saver accounts

Six months after launching, the rate has been cut for new customers. You’ll now get 6.5% rather than 8%. So is it worth it? Find out who can get it and how much you’ll make in our review.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

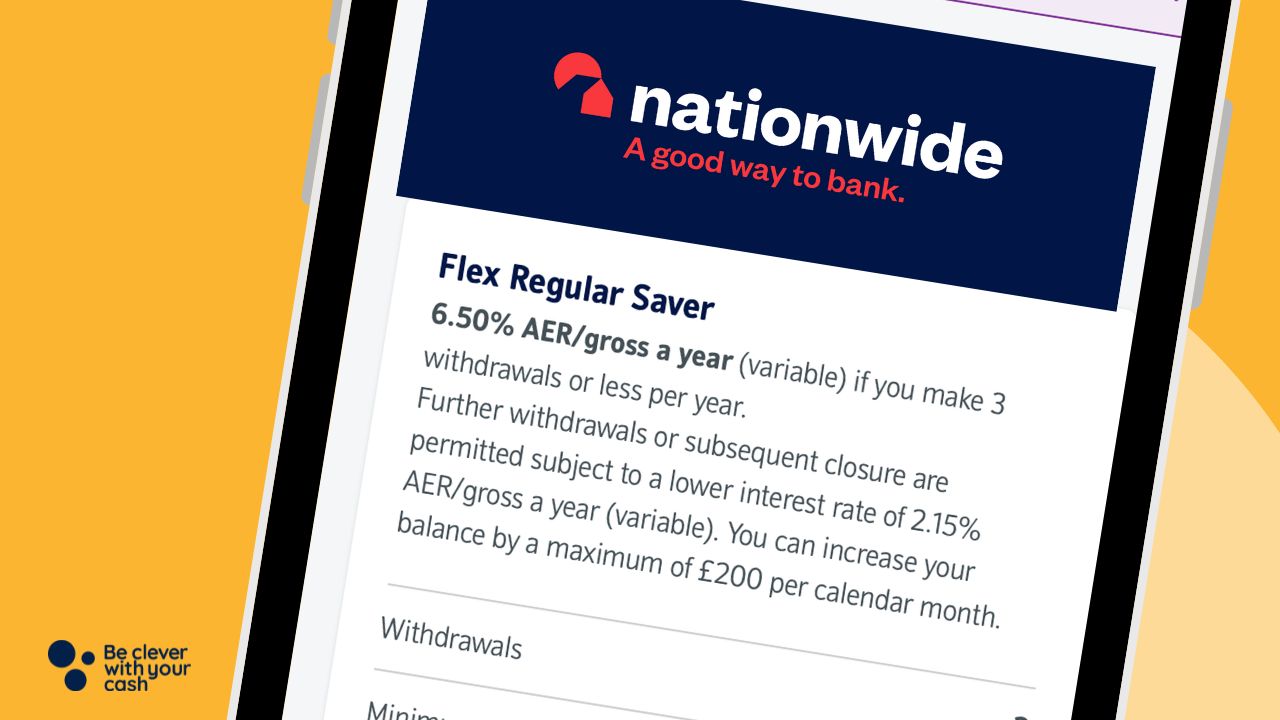

How much does the Nationwide Flex Regular Saver pay?

The interest rate on this account was a massive 8% AER, making it the highest-paying savings accounts available (for the moment at least). The rate is variable (so it could change), and the account will last for 12 months.

However a new issue of this regular saver in February 2024 cut the rate to 6.5%. Those with the previous issue (issue 2) will still get 8%, though as it’s variable that could drop at a later date.

You can only have one Flex Regular Saver per person.

How does the Nationwide Flex Regular Saver work?

Since it’s a monthly or “regular” saver, that doesn’t mean you can whack a load of cash in there to rake in the interest.

For a start, there’s a monthly limit of £200 that can be added each month for a year. So the most you can add to the account is £2,400. There’s no monthly minimum though, so you can skip months if you choose. If you do, you won’t be able to carry over any unused allowances.

The account also closes after 12 months, which is when the interest is paid. The money will then be moved into a standard Nationwide savings accounts, so you’ll want to transfer that to a better paying account at the time.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

Can you make withdrawals?

Unlike with most regular savers you can withdraw the money during the year three times without penalty. You’ll also be able to put up to £200 back in each month you do this. So say you have £600 in the account from previous months and add £200 for the current month, but then withdraw £300, you can put £200 back in during the same month.

If you do take cash out four or more times the interest rate drops to 2.15% AER, and you’ll get this rate on the total balance from the date of the fourth withdrawal.

How much could you make in a year?

Andy’s Analysis

Remember, this is a monthly saver, so the interest is calculated a little differently to normal accounts.

Let’s say you pay in the full £200 every month, that would give you a balance of £2,400 at the end of the year. 6.5% interest on this is a huge £156.

But that’s forgetting that most of the money saved won’t have been in the account for a year. In fact, only the first month’s deposit will earn the full 6.5% for a year.

The subsequent deposits will earn less as a result. So the second lot added will be there for 11 months, and earn 11/12 of the full year’s interest. And so on.

Here’s what you’ll earn based on the same size deposit every month, assuming you don’t make any withdrawals:

| Monthly amount saved | Annual interest |

| £200 | £84 |

| £100 | £42 |

| £50 | £21 |

Head to this article for more on how regular savers work.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Who can get a Nationwide Flex Regular Saver?

You’ll also only be able to open one of these savings accounts if you have a Nationwide current account. It doesn’t matter which one. Personally I’d go for the FlexAccount which is no-frills but will do the job. You must keep the current account open while you have the regular saver.

You’ll need to be over 16 years old, a UK resident and happy to open and manage the account online or via the app.

If you already have a previous issue of the Flex Regular Saver still open then you won’t be able to open up this new edition until that matures (i.e. after 12 months).

Opening a Nationwide Flex Regular Saver

Once you have the current account, you can simply open the Flex Regular Saver from your online or app banking. The first deposit, of at least £1, must be paid within 28 days.

The money needs to be added each calendar month, so if you’re opening it towards the end of a month make sure you add the cash straight away so not to miss out.

You can add cash by standing order (not a bad idea to ensure you don’t forget), or just transfer it from a different account.

You can only open one of these in your name, even if you have both a solo and joint Nationwide current account.

Nationwide Flex Regular Saver summary

Nationwide Flex Regular Saver

| Account name | Nationwide Flex Regular Saver |

| Interest rate | 6.5% AER (variable) |

| Max monthly deposit | £200 |

| Min monthly deposit | £0 |

| Carry over unused allowance? | No |

| Account closes | After 12 months |

| Withdrawals | Yes, but more than three withdrawals a year and the rate drops |

| Requirements | Must have a Nationwide current account |

How does it compare?

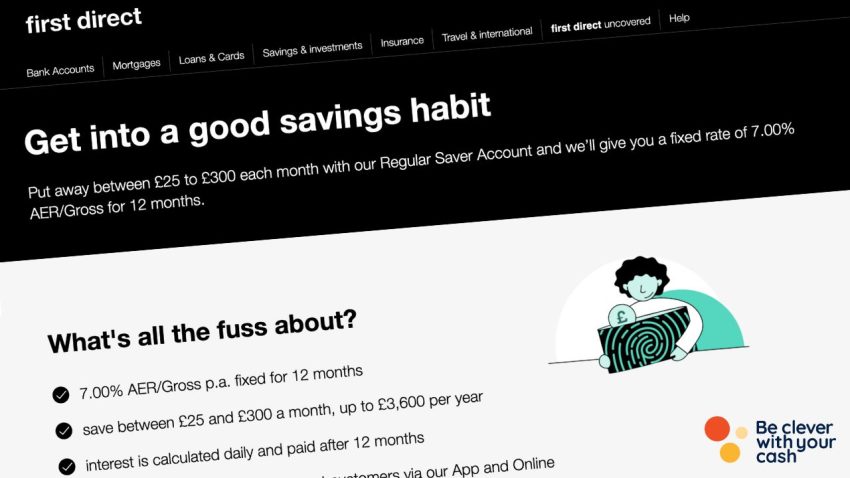

At the time of writing this is the second highest paying regular saver, just below First Direct’s 7% paying account and above the Club Lloyds monthly saver at 6.25%. However as you can pay more into those other accounts each month you’ll make more interest in a year with those. They are also fixed so the rate can’t change in the first 12 months.

You can see other regular saver rates here.

So ive a grand in an account that ill drip feed into my new flex saver account.

Am i better off putting in £200 a month (and then leaving it for 6) or paying in £100 a month 12 times? Just the “subsequent deposits will earn less as a result” situation has me confused 🫤

If was to open this Regular Saver today could i put the £200 in today and then another £200 on the 1st October then every 1st of month or do i have to wait till the 22nd October and then every 22nd of the month?

I believe it’s calculated per month and so after the 1st deposit you can add the rest on 1st of following month, you don’t have to wait until the monthly anniversary of your first deposit.

YBS now has loyalty regular saver paying 7% and £500 per month can be paid in.