Monzo Flex is a Buy Now, Pay Later credit card, here’s how it works and our take

Monzo Flex is a Buy Now, Pay Later card that lets you split purchases into monthly payments. We’ve given Monzo Flex a go to find out how it works, some of the drawbacks and the costs of Monzo Flex to find out if it’s worth it.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is Monzo Flex?

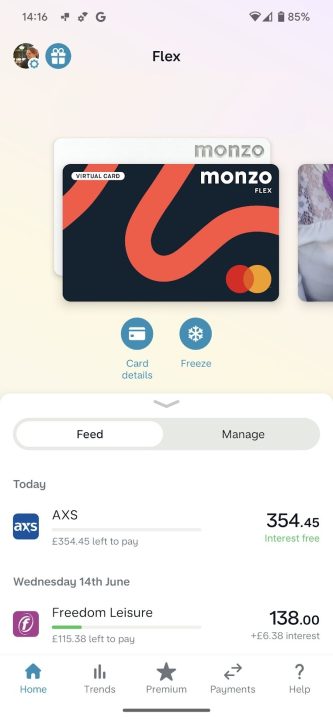

Monzo Flex is Monzo’s take on Buy Now, Pay Later. It lets you split a purchase into either three, six or 12 monthly instalments. Splitting into three won’t incur any interest, while the others will. You can make a purchase with Monzo and afterwards “flex” the payment through the app. You can also use it with a card, either a physical one or using Google or Apple Pay.

There are some things that you’re not allowed to flex, including gambling transactions, cash withdrawals, purchases of cryptocurrencies, top-ups to investment platforms and credit card payments.

Is Monzo Flex a credit card or Buy Now, Pay Later?

Monzo Flex is essentially a credit card, but it’s a different take on one, as it’s also a Buy Now, Pay Later service. Unlike other BNPL services such as Klarna and Clearpay, Monzo Flex doesn’t restrict you to certain retailers.

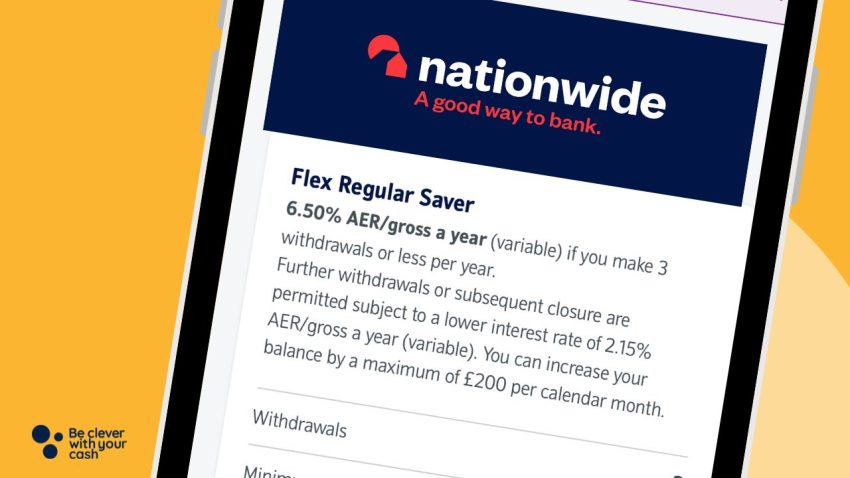

It’s possible to get a short 0% rate on spending as long as split those purchases by three months. Unlike 0% purchase credit cards that tend to have a set period, e.g. 18 months, you can keep adding new transactions with no interest.

It’s key to check the app within 24 hours of making a transaction to choose a timeframe. If you don’t, Monzo will default to six payments, which would charge you interest. If you choose to pay over more than three months then interest will be added. Monzo tells you exactly how much you’ll pay in interest at this point.

For any purchases split over six or 12 months, you’ll have an APR of 29%. As with ordinary credit cards, you can avoid interest by clearing your balance by the first payment date. Unlike normal credit cards, this is broken down by each transaction, rather than the full balance. You can think of it like an individual credit agreement for each transaction.

Check out our essential credit card rules to find out how to make a credit card help your finances, rather than harm them.

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

Why would you need Monzo Flex?

You might opt to use Monzo Flex if you’re making a large purchase that might be more manageable if it’s split into monthly payments.

For example, I initially opted to use Flex to turn my ice skating coaching payments into monthly payments, as I had to pay for six months in one chunk, which was an expensive “one off” payment.

It doesn’t apply for me, but you could also use it when the option to pay a larger sum makes the overall cost cheaper – such as a season ticket. Although for very expensive purchases, you may be better off with a traditional 0% credit card that gives you longer to spread the cost.

Is Buy Now, Pay Later a good idea?

Buy Now, Pay Later (BNPL) can be a good idea in specific circumstances and when used wisely, but it’s also a fairly dangerous tool.

This is because it’s difficult to tell that you’re taking on credit at all. You can fall into serious money problems really quickly by choosing to pay later for a lot of transactions. These providers, including Monzo, make it really easy — almost too easy — to buy things on credit.

I managed to rack up nearly £200 on the card by accidentally “flexing” payments when it was made my default card on Google Pay – more on this below. You can find out more about our stance on BNPL in our guide.

How Monzo Flex works

Monzo Flex is built into the Monzo banking app, so it can be managed alongside your other finances.

There are two ways to flex a payment with Monzo Flex. You can either make the transaction with your main Monzo debit card and flex it in the app up to two weeks later — you’ll see a little blue symbol next to eligible transactions if you can flex it.

Alternatively, you can get a virtual or physical card just for Flex. This means you can enter your details online or use the card in store to use it like you would a credit card. This automatically splits the payments.

By default it will split the payment over six months. I think this is a small downside of the card, as it adds interest to the purchase. Monzo would do well to default the payments to three months to keep them interest free. You can jump in and change the payments anytime, as well as pay early. You’ll be prompted to choose a timeframe within 24 hours of the transaction.

Inside the app, you can see how much interest you’ll pay and what your next payment will be. This lets you handle your upcoming payments and helps keep track of how much you owe, but it can be a little confusing if you have a number of transactions to manage at once.

When spending with the card abroad, won’t be charged additional fees. Monzo also won’t charge a premium on the Mastercard exchange rate. Don’t use it at an ATM abroad or in the UK, as you may be charged extra fees and you won’t do your credit report any favours.

Issues we faced with Monzo Flex

One of the major issues I faced with Monzo Flex was that you can flex really small payments. Of course, you wouldn’t typically stick a £2 transaction on a credit card, but somehow I managed to do so accidentally. Let me explain.

I was recently a victim of card cloning on my main account, having noticed a few odd transactions that I didn’t carry out. Monzo dealt with the issue brilliantly, but it resulted in new cards being sent out, confusing my Google Pay app.

As a result, I spent several weeks with my flex card as my default card in Google Pay, accidentally flexing everything from a £1.70 parking fee to a £2 transaction at the IKEA cafe. The good thing is, I was able to go into the app and pay these off right away, but I had a very disorganised set of finances for a little while!

Will I get Section 75 protection with Monzo Flex?

Unlike most other BNPL providers, you can get Section 75 protection if you use your Monzo Flex card (or virtual card). You won’t for transactions that you make on your debit card and flex later through the app.

You’ll only be covered if you bought goods or services valued between £100 and £30,000 and you don’t pay through a third party or agent, such as a travel agent or a marketplace platform.

You only have to pay part of the total purchase on your credit card, so even just paying £1 on your credit card and the rest on your debit card gets you covered for the whole purchase.

What is Section 75?

Section 75 is a part of the Consumer Credit Act that means that if something goes wrong with your purchase, such as a fault or it not being delivered, both the credit provider (in this case, Monzo) and the retailer are responsible.

You’d therefore be able to contact your credit provider and make a claim for a refund if you’re struggling to get one with the retailer.

There are some drawbacks, so read our whole guide on Section 75 to make sure you’ll be covered if you have something specific in mind.

Does Monzo Flex impact your credit score?

Monzo Flex will impact your credit score. Where Monzo is different to most other BNPL providers in this instance, it carries out a hard credit check when you apply, although you’ll be able to check your eligibility before you apply. Your credit usage will be reported to Equifax, Experian and TransUnion, just like other credit cards.

Make sure you don’t miss any payments, as Monzo will report them to credit reference agencies if it can’t take payment after seven days, see more below on this.

If you use Monzo Flex responsibly, it can be a good tool and may even help you build your credit score. As with all credit, you should ensure you can afford to make payments before taking on any debt, and if you’re struggling, you can contact Monzo directly through the app or a debt advice charity.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

What happens if you miss a Monzo Flex payment?

If you miss a Monzo Flex payment, Monzo won’t charge you any late fees and will give you seven days to catch up on your payments. If you don’t catch up quickly, your credit score may be affected.

Monzo will switch your plan to one with more payments and try to take a smaller amount if you don’t catch up within seven days. This might impact the amount of interest you’ll pay.

After this, if it’s still not able to take payment, it will be reported to credit reference agencies.

How do I get Monzo Flex?

You can get Monzo Flex through the Monzo app, as long as you’re already a Monzo customer.

You’ll just need to apply through the app. Once accepted, you’ll be given a credit limit and a virtual card pretty much instantly, with the option to order a physical card.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

Customer reviews of Monzo Flex

Smart Money People rates Monzo Flex at 4.95 stars, based on 552 reviews at the time of writing (July 2023). Positive reviewers like that you can set a limit, found it easy to set up and liked that you can order a card.

Negative reviewers found that they were stuck on a low credit limit, with difficulty raising it. One reviewer found it frustrating that you can’t set a default number of payments to flex it.

Is Monzo Flex any good?

Monzo Flex is essentially a credit card with a Buy Now, Pay Later element implemented into it, which is quite a good feature for the card. When used wisely, this can get you a 0% rate for three months on any future purchases you make, rather than a set period, as you see with other credit cards. This can be helpful for unexpected transactions or ones you’d prefer to split over a few months.

However, you should ensure you use it carefully, else you’ll find yourself owing money endlessly. It’s probably one only to use for the occasional big purchase you know you can afford but want to spread over a few months.

If you can afford to clear the balance every month and don’t need to split payments then consider a cashback credit card instead.

If you’re looking for Section 75 protection, you need to use the card to make the transaction rather than flex it later.

What’s good about Monzo Flex?

- You’ll get Section 75 protection on your purchases

- Can spread the cost of expensive and essential short term purchases

- Can be managed within your Monzo app

- No late payments

- No fees to use the card abroad

Downsides of Monzo Flex

- Makes it too easy to take credit

- You can flex some really small payments, which could rack up a lot of debt quite quickly

- It defaults to six-month splits that charge interest

Monzo Flex

| APR | 29% |

| Credit limit | Depends on your eligibility – up to £3,000 |

| Details | Requires a Monzo current account |

| Pay for purchases within three months to pay no interest | |

| Pay in six or 12 months with added interest |

This is a good idea just i wich it was not Monzo its hard to keep track it can be very confussing.

ie

I paid amazon £80 odd pounds but cancelled the order so Monzo did not make the payment to Amazon as they did not ( claim the payment ) so after a couple of weeks i contacted Amazon about the refund and they told me they never had a payment as it had not been ( claimed ) due to the order being cancelled so i had to contact Monzo who after 4/5 days put the balance back on the card all well and good Yes but in the meantime i had made a payment of £26.03 off the amazon balance thinking i would also get this payment back But no they say that i have to contact amazon.

Think it’s worth updating the content to make clear to anyone interested in this that Monzo now allows Flex customers to pay the full purchase in 1 payment rather than forcing to split it in at least 3 months – i.e. it can be used as a regular credit card rather than only a BNPL product. They also now allow to change the payment date and assign a day of the month that would be more convenient to the customers to pay their respective monthly balance due, compared to how they had it before that the day of the month would be always fixed and could not be changed at all. Fully agree on the fact that it would be ideal that the default option would be 3 months rather than 6 when forgetting to choose the payment spread, but obviously Monzo wants to make money out of it so understandable.

Also, worth mentioning that the maximum credit limit for Flex is £3,000 and the rep APR is 24% rather than 29%.

I have a £5000 limit, so the £3000 limit is not true. I find it very useful and think Monzo in general is a great bank.