We’ve tested the new cashback feature on the HyperJar app

Budgeting app, HyperJar has recently launched a new feature which pays you cashback when you buy gift cards through the app. This is similar to what JamDoughnut, Cheddar and TopGiftCards all offer.

We’ve given the new HyperJar cashback feature a go to see how it’s different from other cashback apps.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is HyperJar?

HyperJar is a budgeting app with a prepaid Mastercard. It’s supposed to help you manage your money by splitting your budget into categorised jars. It’s similar to “cash stuffing”, a recent budgeting trend where people set aside cash for specific categories.

In brief, you can set up individual categorised “jars” and assign some of your budget to them. When you use your prepaid HyperJar Mastercard, the money is taken from the corresponding jar.

However, what we’re really here to talk about is its new cashback feature. This was launched at the end of October 2023 and it piqued our interest, as we’ve recently been looking into other cashback apps with similar offerings, like JamDoughnut and Cheddar.

What is cashback

Cashback falls into two types: the kind you get from some debit or credit cards, and cashback earned as a reward for purchasing from specific retailers through a cashback site.

There’s a lot going on in the background – with the cashback sites and retailers agreeing on deals that allow them both to make money from the transaction.

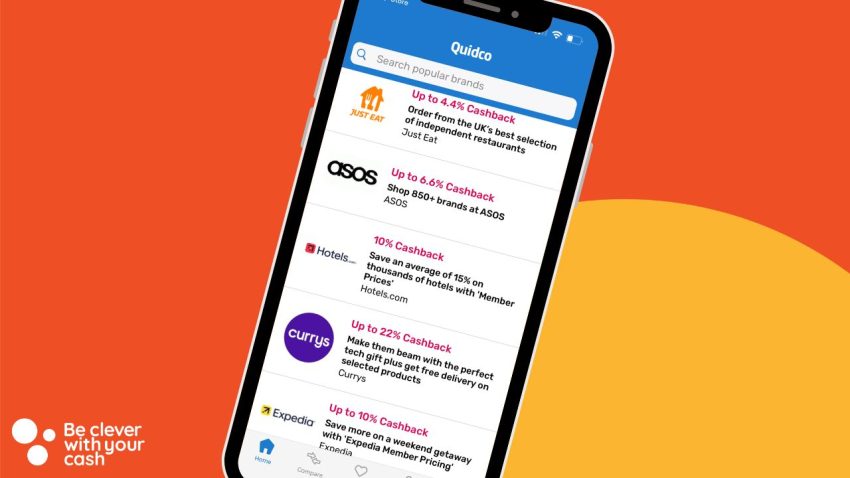

Other cashback sites include TopCashback, Quidco and Cheddar. In some cases, you can get cashback from transactions made on your debit or credit card if you link them up, this works with Cheddar and Airtime Rewards (where the cashback is paid as a balance off your phone bill).

How does HyperJar cashback work?

To use the cashback feature, you’ve got to have a HyperJar account with a prepaid MasterCard. You’ve got to load money onto your prepaid card in order to buy gift cards.

At launch there are 66 brands within the app to choose from and we’ve listed some further down the article.

You don’t have to buy them as presents — you can use the gift cards for your everyday purchases. There are supermarkets, fashion retailers and restaurants available to choose between. When I tried it, I bought a Morrisons gift card and an IKEA gift card – not your typical gifts.

Cashback is earned on the total value of the card and it is put straight into your wallet and available to spend right away. There’s no need to wait until you reach a certain threshold before you can withdraw your cashback (unlike some of the similar apps).

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How much cashback can you earn with HyperJar?

Depending on the retailer, you could earn as much as 11% back, if not more – though for everyday retailers expect it to be closer to 2% or 3%.

If you were to spend £200 at Asda every month, earning 3% back, you’d get £6 back a month, or £72 a year – not bad for money that you’d have spent anyway.

So don’t expect this to be any kind of epic money making scheme, but it can be a nice earner over time.

The cashback rates at launch seem to be higher than the rates you can get with JamDoughnut or Cheddar, although sometimes JamDoughnut has “pumped up” rates that can be better, so it’s probably worth having an account with both to compare cashback amounts.

HyperJar brands: where can you earn cashback?

HyperJar has 66 cashback brands on its app at the time of writing, including a range of supermarkets, restaurants and fashion brands. Here are some of our favourites, with the cashback amounts at the moment.

| Groceries | Eating in and out | Shopping and travel |

| Asda – 3.5% Hello Fresh – 7.5% Marks & Spencer – 5% Morrisons – 3% | Caffé Nero – 8% Costa Coffee – 7.5% Deliveroo – 3.5% Harvester – 9% Uber Eats – 3% | Adidas – 10% Currys – 5.5% National Express – 11% Uber – 3% |

This list isn’t extensive, and we recommend checking the website and app to see the current cashback rates as they change all the time.

How to buy gift cards on HyperJar

The app is fairly easy to use, but as you have to have a normal HyperJar account first, it can be a little confusing to start with.

Unlike similar apps you can’t just buy your gift cards. Instead you need to load some money into your account each time. You can do this via a bank transfer to your HyperJar sort code and account number or via open banking which connects to your banking app.

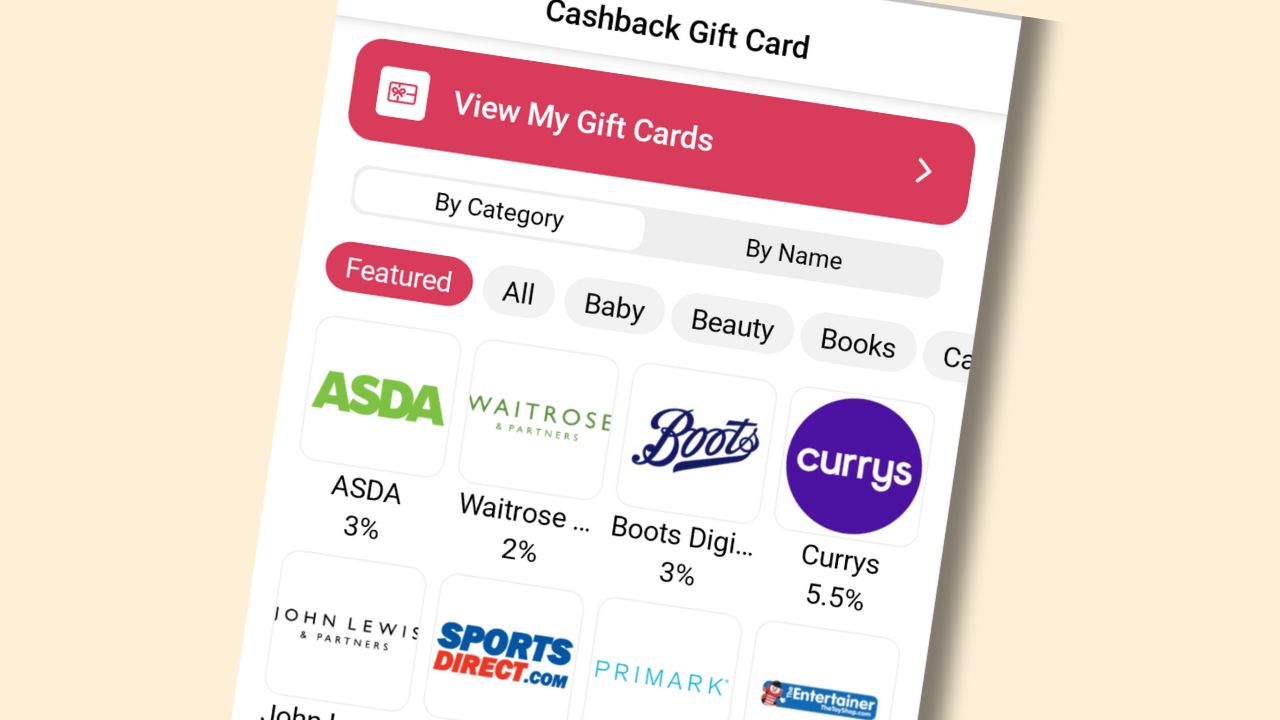

The cashback feature is in the “Cashback” tab on the app, and you can browse through the different gift cards available, with a clear view of how much is available. You can browse through different categories to find what you’re after. Frustratingly, you can’t search for a specific retailer.

When you buy a gift card you can choose where your cashback will be paid, such as whether you’d like it in a particular jar.

How do you use your gift cards?

Your gift cards are stored in the “Cashback” section of the app, under “View my gift cards”.

To use your gift card, all you’ve got to do is click on the gift card and it’ll give you a barcode with a number for if you want to use it for an online purchase. Sometimes there’s a PIN too – I had to use this for an in-store IKEA purchase.

If there’s money left on the gift voucher after using it, it’ll be saved for next time — just like with an ordinary gift card. You can type in how much you’ve used or mark them as used to keep track of what’s left.

There’s no “share” option or option to print the voucher – you could screenshot it for this purpose, but the only way HyperJar offers is to use it within the app.

You can use your gift card online by entering the barcode number where there’s a “pay with a gift card” option.

As with other similar sites, there are sometimes restrictions with some gift cards – for example, some can’t be used online, some can’t be used in-store and some have to be printed. In the case of some supermarkets, you can’t use the voucher to buy fuel. These are outlined in the app when you’re purchasing the gift card but you will need to read those conditions.

Are gift cards safe?

It’s worth noting that gift cards aren’t a very secure means of holding cash – if you have £50 on a retailer’s gift card that then goes bust, you’ll likely lose the money. In addition, gift cards tend to have expiry dates, whereas cash doesn’t.

You can counteract this by making sure you only buy gift cards you’ll use in full and don’t keep a lot of cashback racked up in the account. We’ve written more about the risks of gift cards and how to avoid them in our guide.

Can you stack savings with HyperJar?

You can try stacking the gift cards you buy with other promotions – for example, if you have a voucher code or if there’s a sale on.

Make sure to check that the gift card itself can be used with a voucher code, which isn’t the case with some sites, such as BuyAGift.

It’s hard with HyperJar to add extra cashback on top. You might be able to use your gift cards when paying via other cashback sites such as TopCashback or Quidco.

However, these sites sometimes don’t pay out if you use a gift card. It’s often listed on the specific merchant pages but not always, but it could be worth a try.

Sadly you won’t be able to earn extra cashback on your gift card purchase via a cashback card as you’ll pay for the gift cards by topping up your HyperJar account.

How do you access your cashback?

HyperJar pays your cashback straight into your HyperJar account, so it’s available to spend right away. If you want to, you can withdraw it to your bank account through the app. You can do this 4 times per month for free, after this it costs 50p per withdrawal.

Other cashback apps, such as JamDoughnut and Cheddar have a withdrawal minimum, so you can’t withdraw your cashback until you’ve earned a certain amount.

If you want to use HyperJar’s budgeting features, you can also choose to pay your cashback into a specific “jar”. This means that you could have a cashback jar set aside for treating yourself, or you could decide that you always want your earned cashback to go towards fuel.

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

Is HyperJar safe?

There isn’t FSCS protection on your deposits as HyperJar isn’t a bank, but money is held in a ring fenced account, as with other cashback apps.

It makes sense to cash out when you can rather than leave it sitting in a jar – just to be safe.

Summary: is HyperJar cashback any good?

HyperJar’s new cashback feature is pretty good – the rates seem to be higher than with other cashback apps in our experience, although it’s still worth having a quick peek to make sure other ones can’t do better, such as if JamDoughnut has something “pumped up”. We love that there’s no minimum withdrawal for cashback that you’ve earned.

There is the frustrating extra step required to buy gift cards, as money has to be loaded onto your account before you can make the purchase, but the higher rates make up for it.

Overall, this is a great new feature if you already use HyperJar for budgeting, and one to try if you just want discounted gift cards.

Pros and cons of HyperJar cashback

Pros

- Cashback is instantly paid

- No minimum for cashback withdrawals

- Rates seem to be higher with HyperJar compared with other cashback apps

- You can combine payments and cashback with HyperJar’s budgeting features

Cons

- You need to top up your HyperJar account before buying the gift cards

- Gift cards have their own risks – read more about them here

- Not all gift vouchers are instant

- Not all gift vouchers can be used in-store or online

There is a HUGE issue that this article has not mentioned. Some cashback can only be used with the same retailer, and some can be used elsewhere but you will get a lower rate. So for example, you can currently earn 4% at Sainsburys but can only spend it there – no it not like “cash” at all. Same with the 5% at Argos.

BE WARNED THAT IT IS NOT ALL IT SEEMS!