Beat the queues (and closing branches) by depositing a cheque with a mobile banking app.

It’s been years since I received or wrote a cheque. But during the first lockdown I helped some elderly neighbours with their shopping. And since they were housebound and not online the easiest way for them to pay me was via cheque.

Normally that would mean a visit to the bank in order to deposit to my account, but it actually gave me a chance to try out an online banking feature I’ve been unable to use before.

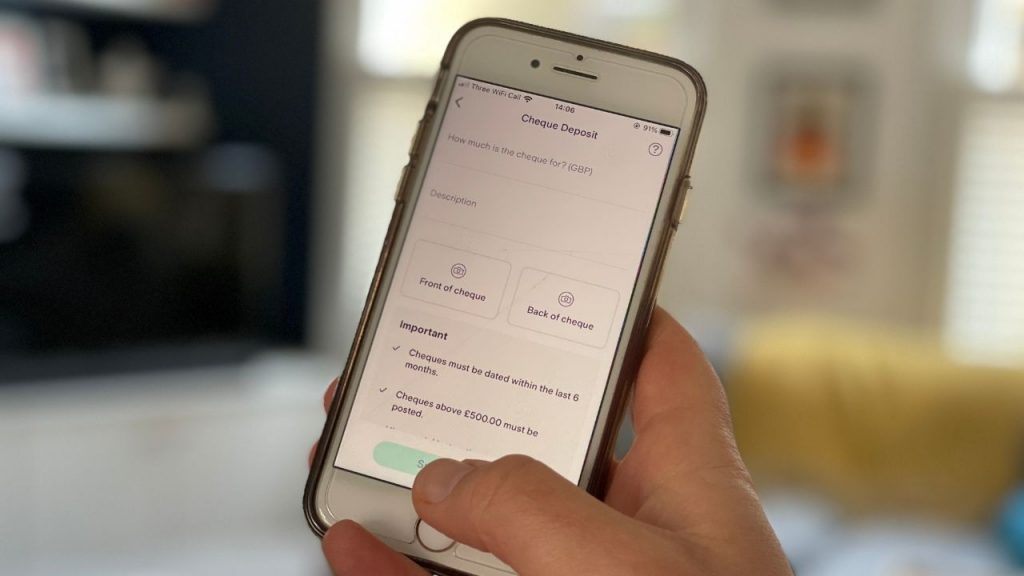

Since late 2017, some banks have used cheque imaging software to scan your cheques using the banking apps on your phone.

More and more banks now let you do this, and it’s a handy feature for those too busy or unable to head to a bank, or perhaps have seen their local branch close down.

How to pay in a cheque with your banking app

If your bank has the feature (you can see a list of the banks that do and significant banks that don’t below), then it’s a similar process with each one.

You first take a photo of the front of the picture using the app. And once that’s gone through, you take a picture of the back – even if it’s completely blank!

The phone must be completely flat above the cheque, which must also be flat. You need to get the corners lined up to markers on the phone screen. And even if you nail this, it might not be enough. When I first tried it with Halifax it took about seven attempts to get the front to scan.

But once I worked out it needed to be on a dark background it took just seconds to snap each side and hit submit. Far quicker than heading out to the bank and queuing up.

You should see the money in your account by the end of the next working day, as long as you pay it in before a cut-off time (which varies by bank). Of course, make sure you keep the cheque until it has cleared just in case it’s rejected.

Andy’s top bank apps

Banking apps aren’t just useful for paying in cheques. If you’re like me, you’re doing most of your banking on one – and some are much better than others. Here are my top apps for managing your current account:

- Starling

- Chase

- Halifax

I’ve compared the apps across all the major UK banks in detail. You can read more about the best and worst mobile bank apps here.

Banks where you can pay in cheques with your phone

These are the main banks I can find that offer this feature.

Bank of Scotland

Bank of Scotland is one where the app works in exactly the same way as Halifax’s (see below)

Barclays

You’ll find the feature on the Pay & Transfer tab of your Barclays app. You can pay in a maximum of four cheques every seven days, and a cheque can’t be for more than £500.

First Direct

Since there are no branches you’d normally need to go to an HSBC or a Post Office to pay in a cheque with First Direct. However, in June 2020 the bank added the option to do this via the app, or you can also post them to the bank.

Halifax

I found the feature in the ‘More’ tab at the bottom of the app. There’s is a maximum cheque value of £10,000 and a daily limit of £10,000.

HSBC

HSBC has a maximum daily limit of £2,000. You can find the feature in the ‘Move Money’ section of the app.

Lloyds

Lloyds’s pay-in via the app feature lets you deposit a cheque with the bank in exactly the same way as Halifax.

Monzo

After years where the only options was to send it via the post, since late 2023 you can now pay in cheques up to £500 via the app. For larger amounts you’ll need to post it.

NatWest

Added in May 2021, you can pay in a cheque using the NatWest app. You need to select the account you want to use and you’ll see the option. I found it much harder than on other apps to get the camera to find the cheque and had to put it on a dark background for it to scan.

However, once I finally got far enough to submit the cheque, the app came back saying it “couldn’t process your cheque right now”. I tried a few times before giving up! I’m sure it’s just teething problems at launch but it’s frustrating.

RBS

RBS has the same app and functionality as NatWest, so it’ll follow the same process as above.

Santander

Since late 2022 you’ve finally been able to use the Santander app to pay in a cheque. It has to be less than £500 in value. There’s a £1,000 total cap per day.

Also, for the Post Office option you’ll need to order some paying-in slips and deposit envelopes from Santander in advance.

However, you can also use cash machines or send your cheque to your local branch to process.

Starling

Simply go to menu in the top right hand corner and choose “Add money”. Then you’ll be able to take a photo of your cheque up to £500.

TSB

Since spring 2023, you can now scan cheques using the TSB app. Select the Payments tab at the bottom of the screen, then deposit cheque. There’s a £750 daily limit.

Virgin Money

The app for a Virgin Money, allows cheques up to £500 as long as they weren’t signed more than six months ago. You’ll find it via the menu in the top right-hand corner.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Banks where you can’t pay in a cheque with your phone

Here are some of the notable banks which don’t have this feature. If you can’t get to any of these banks to pay in a cheque, you can head to your Post Office and deposit it there. However, all they’ll do is post it on for you so it can take a while to clear.

Chase Bank

Chase does not have the function to pay in a cheque via the app. In fact there are no ways to deposit a cheque. Instead you’ll need to pay it into a different account and transfer the money across.

Co-operative Bank

You’ll need to visit a branch or post cheques for Co-op Bank.

Kroo

It’s not possible to add a cheque to Kroo at all, so you’ll need to deposit one elsewhere and transfer over.

Nationwide

There’s no cheque option on the app or website, but you can send it by post.

Revolut

Revolut won’t accept cheques (or cash!).

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

How to switch bank to one with this feature

It’s really simple to open up a new bank account at one of those listed above which do let you pay in a cheque with the app on your phone.

You can either open up a new account and keep your old one, or you can choose to switch using the Current Account Switch Service which moves all your standing orders, direct debits and future payments.

You can read more about how switching works here.

What about Smile bank?

FYI, With Starling, you can now pay in cheques up to £1,000 each (up from £500).

But can you pay in a Warrant (from ns&i) to the BoS, using this service! ?

I kicked off the process yesterday, so I will let you know if I remember!

As of the last update to the Santander Mobile Banking app sometime in Nov/Dec 2022, it would appear that the option of paying in cheques is now available via the triple-vertical-dot menu on any account listed in the app.

Thanks for lots of useful info. Any idea why the £500 limit ?

I’ve just tried depositing a premium bond cheque to RBS using the app. It doesn’t like it.

Is it because it’s a premium bond cheque?

Hard to say as I’ve had problems using the Natwest one, which is the same as RBS. It could be they don’t like unusual cheques!

The NatWest is still failing today and it’s a cheque from HMRC!

Thanks John. I need to wait for another cheque before I can try again!

What about metro Bank?

You can’t use Metro’s app to pay in a cheque

Can you pay a cheque online into PayPal ?

Hi Lisa, I think you can in the USA but there’s a charge to do this.

confirmed – just paid a cheque in via First Direct app – brilliant, as I’m stuck in the US with a GBP cheque and couldn’t pay it in.

Great, thanks Robby

First Direct now seem to offer this via their app (mid June 2020)

Hi, it doesn’t work with RBS. The cheque option is missing from the app. Any thoughts?

Yes, that’s right RBS doesn’t offer this feature. I expect you can post the cheque to them, but I’ve not been able to find out how you can do this with RBS, but contact them and they should be able to help.

I’d read that 10,000 cheques were digitally cashed in every day over the peak christmas period through the HSBC app. Makes you wonder how much longer physical cheques will last.

Starling introduced the feature yesterday. You can pay cheques in by photo now

Thanks, didn’t see this come through!

Hi Andy

I am not sure this is accurate as you can’t pay a cheque in to First Direct (HSBC) using your phone on the move money section, you can send in the post or go to a post office but you can’t do it over your phone and yet you can now albeit recently pay a cheque in using your phone with Starling.

Yes, First Direct aren’t one of the ones where you can do this, but you can with those listed above. Thanks for the heads up on Starling too – looks like they added it this week!

Hi Andy – just FYI, you can now deposit cheques with the Starling app, hope this helps!

That’s great. Looks like it happened yesterday. Have updated it

Starling now allow cheque deposit via their app

Cheers for this, yes looks like it was added this week

is there a way to pay in a cheque with nat west that doesn’t require going to the bank, i’m expecting a PPI check of around £1000, but I live with a transplant patient so neither of us can leave the house at present

I’ve cut and pasted this from the Natwest website:

If you are self-isolating or unable to make a journey to our branches/ post office as a result of coronavirus you can pay a cheque into your account by sending it to us via post if it meets the following criteria:

Cheques will only be accepted with a paying-in slip

Cash must not be sent, it will not be processed and there will be no way to return it to you

You’ll need a paying in slip, which you’ll find either in your paying in book, or at the back of your cheque book.

You can’t request that a cheque is paid to multiple accounts, we will only accept; 1 cheque with 1 paying-in slip or multiple cheques with 1 paying-in slip

Cheques will be processed within 5 working days of receipt

The cheque(s) is in pounds sterling.

If you are happy to do so you can send your cheque and paying in slip to:

NatWest

CPU

PO Box 21

41 The Drapery

Northampton

NN1 2EY

Please note: Customers paying any bills by post should continue to use the address advised by the company and not the above address.

This service is available for NatWest, Royal Bank, Ulster Bank, Holts, Drummonds and Child & Co customers

I have a NatWest business account and I’ve never had a chequebook or a paying in book so unfortunately I have no way of accessing a paying in slip.

I very very rarely get or see cheques now and I think people that still use them that don’t have a valid reason (and no “we always did it this way” is not a valid reason) need to be penalised in some way as they are obviously not getting the hint that its not acceptable. Maybe the banks should start charging very high fees for chequebooks or something.

You are making assumptions about everyone based on your own experiences.

I am treasuer and trustee for a small local charity, for a group where members are aged 60 – 85. We need to use NatWest (it is our only local bank). Also as a double signatory account NatWest are very unhelpful regards opening an online account. We deal with cheques because that is how many of our members still work.

the disabled get a tax refund from dvla and its paid by cheque . so it would be difficult to penalise when a government agency uses the with no good reason . they make us pay it and the we have to claim it back .

Premium Bond winnings are paid by cheque.

When you have scanned and submitted a cheque what do you do with the original cheque ?

I keep them until it’s been cleared and the money is in my account. Then I shred them and dispose of them

Thank you, I have the cheque now and will send it…..hoping it wont get lost in the post

Steve

Looks like Nationwide now do cheque imaging. 🙂

Thanks Richard, I’ll check that out

Ok, so you still can’t pay the cheque in online or via an app. The imaging they do is just to speed up the process once you’ve got it to the branch.

I need help in finding the ” more @ the bottom of the App on LLoyds Bank ”

As I wish to pay in a cheque.

Just spent ten minutes trying to pay in a small cheque on the HSBC app. Complte waste of time. The instructions lack precision, there is no help on what the instructions mean and it’s enough for me to have decidfed to use another bank.

Ah; what a nightmare. I’ve used the Halifax one and that’s ok

halifax one worked very well

Seemed pretty obvious to me. Glad I still have some accounts with them as my current account is with Natwest who don’t have this feature.

Thanks, Andy.

Hard to find the info on the Santander site and a community member needed an answer urgently.

Helpful guide 🙂

No problem Naomi!