This isn’t your typical Cash ISA — here’s what you need to know about the account

eToro’s Cash ISA is the best paying one on the market at the moment, offering 4.51% AER variable (including a bonus of 0.8% for the first 12 months). But there’s a slight catch with the FSCS protection. Here’s everything you need to know about the account.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the eToro Cash ISA?

The eToro Cash ISA is offered in a partnership with Moneyfarm, who it also partners with for its Stocks & Shares ISA. You’ll earn 4.51% if you’re a new customer.

It’s a limited-access account, which means that though you can make withdrawals from it, it’ll pay a lower rate of 3.51% if you make 3 or more withdrawals in a year.

You can use your £20,000 ISA allowance with the account, and it’s flexible, which means you can return money that’s been withdrawn to your account within the same tax year and it won’t count twice against your allowance.

You can transfer an existing ISA to the eToro Cash ISA, letting you keep your money under the ISA wrapper and therefore not impacting your ISA allowance for the current tax year.

The listed rate includes a 0.8% bonus for the first 12 months.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

What’s the catch?

It all sounds pretty good, with a market leading rate at the time of writing. So what’s the problem?

Well, it’s not a true Cash ISA as the money is actually invested. It’s held in something called Qualifying Money Market Funds, which are a kind of investment and leads to uncertainty with the FSCS protection.

What are QMMFs?

QMMFs are considered a ‘cash alternative’, but still count as investments.

Qualifying Money Market Funds are a type of investment fund that attempt to offer stable returns while remaining relatively liquid (easy to sell). In the UK, they usually invest in things like gilts (government bonds) and fixed term deposits.

These are typically very low-risk investments, and they have fairly strict regulations. However, there’s no guarantee that they won’t lose money, or that they’ll earn the headline rate.

Potential upcoming changes to QMMFs

There are rumours that cash alternatives like QMMFs will be subject to a 20% tax. It comes after the 2025 Autumn budget, when the ISA allowance was slashed to £12,000 for Cash ISAs from 2027 (with the remaining £8,000 set aside for investments only).

There’s no official news on whether this tax on cash-like investments will happen, and you’ll get plenty of notice and be able to withdraw from the account if this is announced.

Is the eToro Cash ISA safe?

Generally speaking, the eToro Cash ISA is a safe place to put your money. Your money is invested into a QMMF and your assets are segregated, so neither eToro nor Moneyfarm have access to it.

It’s covered by investment FSCS protection — this means that if MFM Investment Ltd (this is Moneyfarm), who holds your investments, were to go bust and you lose out financially, you’d be able to claim compensation. It’s unlikely that eToro going bust would make any difference, as your money is held with Moneyfarm.

However as the account is considered an investment rather than savings in terms of the Financial Services Compensation Scheme (FSCS), instead of being covered by up to £120,000, you’re covered by up to £85,000.

This isn’t cover for if the value of your investments go down, though. There’s no guarantee on the interest offered.

Summary: eToro Cash ISA

Easy access Cash ISAs

Easy access Cash ISAs

Customer rating

3.4/5

Customer rating

3.4/5

- AER (variable)4.44%

- Minimum£500

- AccessLimited access

- Maximum withdrawals3

- Bonus Rate includes a bonus of 0.8% for the first 12 months. The standard rate after 12 months or 3 withdrawals is 3.47%.

- FSCS Protected? Yes, although as the money is held in Qualifying Money Market Funds (QMMFs), it's covered by the FSCS investment protection, not deposit protection. QMMFs are a type of low-risk investment.

- Allows transfers in? Yes. The offer covers both new deposits and transfers of existing ISAs, as long as it’s your first deposit/transfer under this offer

- Flexible ISA Yes

- Withdrawals allowed If you make more than 3 withdrawals in a year, the rate drops to 3.49% AER

- Important details Variable rate correct as of 9 February 2025. eToro account required. Your capital is at risk. ISA powered by Moneyfarm. ISA rules. UK residents only. The Cash ISA interest rate is variable and linked to the secure and protected Qualifying Money Market Fund (QMMF) your money is held in.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Variable rate and correct as of 13/01/26. Your capital is at risk. ISA rules apply. UK residents only.

Are there better Cash ISAs on the market?

eToro’s Cash ISA is the best paying one at the moment, but if you’re looking for one that’s not invested in QMMFs or restricted on withdrawals, here’s the full table of Easy Access ISAs.

Easy access Cash ISAs

Easy access Cash ISAs

Customer rating

3.4/5

Customer rating

3.4/5

- AER (variable)4.44%

- Minimum£500

- AccessLimited access

- Maximum withdrawals3

- Bonus Rate includes a bonus of 0.8% for the first 12 months. The standard rate after 12 months or 3 withdrawals is 3.47%.

- FSCS Protected? Yes, although as the money is held in Qualifying Money Market Funds (QMMFs), it's covered by the FSCS investment protection, not deposit protection. QMMFs are a type of low-risk investment.

- Allows transfers in? Yes. The offer covers both new deposits and transfers of existing ISAs, as long as it’s your first deposit/transfer under this offer

- Flexible ISA Yes

- Withdrawals allowed If you make more than 3 withdrawals in a year, the rate drops to 3.49% AER

- Important details Variable rate correct as of 9 February 2025. eToro account required. Your capital is at risk. ISA powered by Moneyfarm. ISA rules. UK residents only. The Cash ISA interest rate is variable and linked to the secure and protected Qualifying Money Market Fund (QMMF) your money is held in.

Customer rating

4.9/5

Customer rating

4.9/5

- AER (variable)4.4%

- Minimum£1

- AccessFull access

- Important details Existing Trading 212 customers get a rate of 3.6%

- FSCS Protected? Yes

- Allows transfers in? Yes, but no bonus rate on transfers

- Flexible ISA Yes

- Bonus New Trading 212 customers get a bonus of 0.8% AER for 12 months for current year subscriptions

Moneybox app Cash ISA

Customer rating

5/5

Customer rating

5/5

- AER (variable)4.32%

- Minimum£500

- AccessLimited access

- Maximum withdrawals3

- FSCS Protected? Yes

- Bonus Rate includes 0.87% bonus for 12 months

- Allows transfers in? Yes

- Flexible ISA No

Customer rating

4.9/5

Customer rating

4.9/5

- AER (variable)4.3%

- Minimum£1

- AccessFull access

- Allows transfers in? Yes - but if you transfer in an existing ISA, you won't get the bonus so your rate will be 2.54%

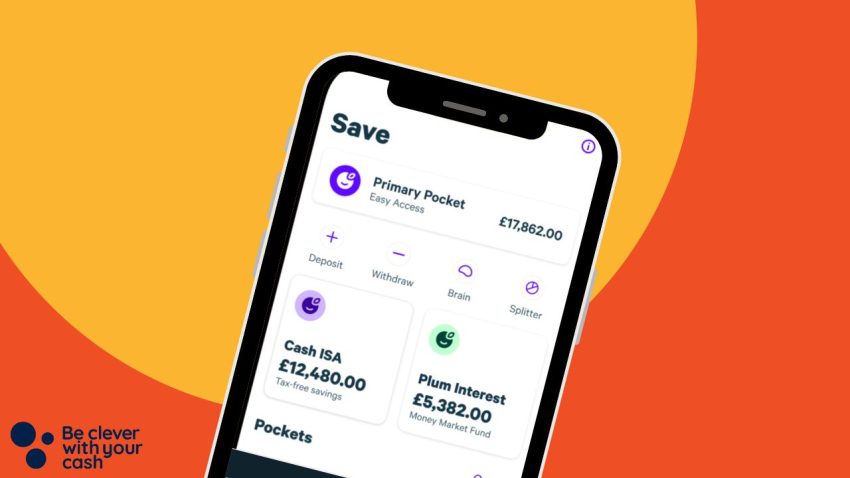

- Important details Rate shown for new customers only. Interest on Plum's Cash ISA varies - this is the rate on 04/02/2026. ISA rules apply. Includes a bonus rate (for new users) of 1.76% AER if kept for 12 consecutive months. Cash ISA T&Cs apply. Plum is not a bank. Tax treatment depends on your personal circumstances and is subject to change

- Flexible ISA No

- FSCS Protected? The FSCS protects up to £85,000 that you have saved, per bank, building society or credit union (or up to £170,000 for joint accounts), subject to eligibility. FSCS protection applies differently

- Bonus Includes a bonus rate (for new users) of 1.76% AER if kept for 12 consecutive months (no bonus paid for transfers in)

Atom Bank Cash ISA

Customer rating

4.9/5

Customer rating

4.9/5

- AER (variable)4.25%

- Minimum£0

- AccessFull access

- FSCS Protected? Yes