It’s a surprise rate increase for customers with smaller savings pots.

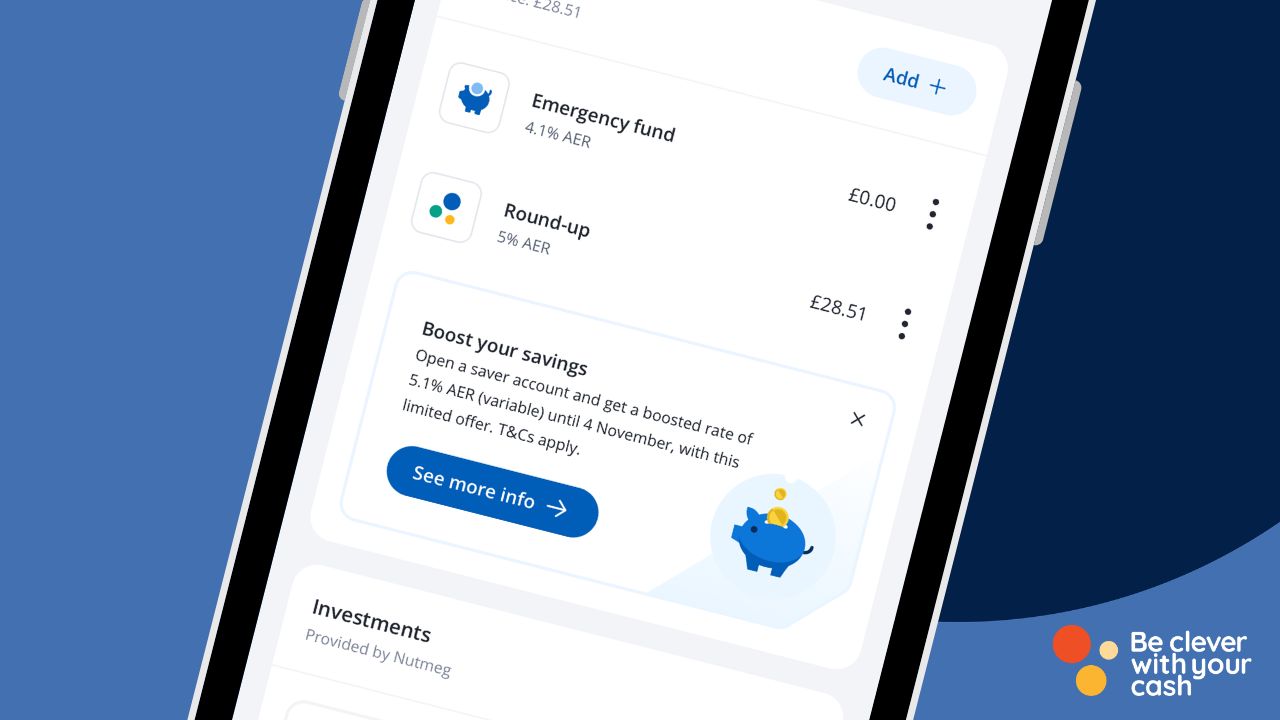

From today, digital bank Chase is offering eligible customers 5.1% on their savings. Here’s everything you need to know.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Who gets the new rate?

Chase says it’s trying to help customers reach their savings goals, and appears to be targeting those who are new to saving or have not yet started.

It’s increased its standard saver interest rate to 5.1% – up from 4.1% – until November 4.

You’ll get this new rate if you’ve less than £500 in your Chase savings, as of 8 March 2024. However, you’ll earn 5.1% on your whole balance if you’re able to save more.

The new rate is only for existing customers who have been with Chase since 29 February 2024 or before. If you’re eligible, you’ll get an email over the next few days and you may see a message on your Chase banking app.

The standard saver rate is variable – so can change at any time – but the one percentage point boost is fixed. So if the main rate changes between now and 4 November, you’ll still get the bonus rate on top. After the deal ends, you’ll get whatever the standard rate is at the time.

How much more will I earn?

The new rate is being offered to customers with smaller balances and on these sums the increase is not going to be life-changing.

If you have £450 saved now – and your balance remains the same for the next six months – you’d earn a little more than £11 before the deal ends. At the old 4.1% rate, you’d get around £9.

What is Chase?

Chase is a digital bank, owned by JP Morgan, that launched in the UK in September 2021. It has over two million customers and has a real focus on rewards including 1% cashback on debit card spend for the first year, in the UK and beyond.

Chase is one of Be Clever with your Cash’s favourite – you can find out why in our review. It was also three times winner in last year’s British Bank Awards, run by our sister company Smart Money People.

Is it worth it?

With easy-access rates falling over the last few months, Chase’s higher new rate is bucking the trend. It’s very competitive – albeit only to certain customers – and a decent deal if you qualify.

The only other easy-access account that beats it is Cahoot’s Sunny Day Saver, which pays 5.2% for 12 months but only on balances up to £3,000.

Meanwhile Chase will pay 5.1% on balances up to £500,000 (although only £85,000 is covered by the Financial Services Compensation Scheme) and while this is unrealistic for most of us, the point is you’re not restricted by balance.

Say you move £10,000 today. You could earn around £255, if the rate doesn’t change, compared to £205 if you were still earning 4.1%.

If you’re eligible for the new rate and have cash savings dwindling in a lower-paying account elsewhere, it makes sense to stash them in your Chase savings account to maximise your returns. However, remember, the rate is variable and can change at any time.

Chase is also changing the easy-access saver to a base-rate tracker on 13 May. This means the interest rate will be set at 1.15 percentage points below the Bank of England’s base rate. If the base rate drops, which it could well do before November, so will your saving rate. Be sure to keep an eye on it.

What are my other options?

If you don’t need easy-access, you could put your money in a notice account for a higher rate. For bigger savers, Market Harborough Building Society pays 5.45% on a minimum balance of £10,000 if you can give 195 days notice to access your money. And United Trust Bank offers 5.25% if you’ve got a deposit of at least £5,000 and are happy to give 180 days notice.

Smartphone app Plum has a limited access Cash Isa, which offers 5.17%, including a 0.86% bonus for the first year.

For those who prefer saving small amounts each month, you can get up to 7% with a regular savings account. First Direct and Cooperative Bank both offer 7% on minimum monthly deposits of £1 and £25, respectively.

For more on the best places for your cash, see our top savings accounts.

This is the explanation I got:-

I know that you want to have this offer, John. For further explanation, the eligibility in having this offer is that the customer has never had a Chase saver, No active savings account and the total savings balance is under £500 on 8 March 2024.

I think I qualify because I moved out of Chase to Santander for the higher rate, but I too think it’s unfair to penalise other savers, they should offer it to everyone.

It’s sneaky really of them to just try and get cash in but not have to fork out to more loyal customers, a great example of why loyalty to banks/insurance etc. should never be considered.

I switch my broadband as soon as my term comes up to the cheapest reliable one, they rarely offer a comparable price.

Always been happy with Chase, had a current account and a saver to drip feed into it as and when needed for the last couple of years I’ve now opened the bonus saver too and the only downside to me is that I can’t move money between the bonus saver and the main account, have to use an external account to do this. With Santander dropping their rate very shortly it’s a useful short term home for my easy access savings.

I’m not eligible as I’ve got more than £500 in my savers account. I’ve just withdrawn it and put it into my zoos account. At least zopa treats customers fairly

Chase 5.1% only for customers who don’t have a saver account with them already. I’ve been with them since last September and opened a saver then too so don’t qualify. Another instance of unfair treatment of loyal customers by a bank. I thought chase was better.

HI Christine

I am in the same boat so much for being a loyal customer

I had also hoped Chase were better

I’ve just opened up the new saver at 5.1% and have already got a saver at 4.1% (which I’ve had for over a year). Is it worth trying again in case there was a fault when you tried?

Chase have told me this offer is only open to selected customers with small amounts in the saving accounts (about £500)

NOt the best markiting by the chase team

Same here. Chase is not my main current account but I use the debit card for much of my everyday spending for the 1% cashback. As my spending varies from month to month I keep a modest cushion in a dedicated savings account in case I need to top up the current account. Despite the lower interest rate than I could get elsewhere, I use the Chase Saver for that for the speed and convenience of topping up the current account in a hurry. And I set the balance to keep in the Chase Saver at £500 so I won’t qualify for the boosted rate. Most annoying!

This isnt true, I have been with chase about 2 years and have a number of little savings accounts with them, I have a holiday fund, home improvement fund and general savings accounts. I got the email and opened a 5.1% account today

Loyal customers get it. I’ve got it and I’ve been with them 1.5 years. You need to open the 5.1% one as a separate account to any existing saver accounts you have