Set budgets, track spending and manage money with these apps

Budgeting apps can help you manage your money by analysing your finances to help you save.

From current accounts and credit cards to energy bills and mortgages, budgeting apps consolidate your accounts and expenses into one dashboard and offer insights to help you save.

Here, we explain what budgeting apps are, how they work and whether they’re worth using.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What are budgeting apps?

Budgeting apps are essentially software programs that help you monitor and manage your money.

Most budgeting apps allow you to view your banking information as well as credit card accounts, loans, mortgages and bills all in one place.

This helps to get a clearer picture of your financial health including what’s going well and areas that could be improved to boost your money.

How do budgeting apps work?

Budgeting apps typically work something called open banking.

This is a system that allows your bank or lender to share details about your account with third parties – in this case budgeting apps.

Using data from your different financial accounts, budgeting apps can help you get better insight into how you manage your money.

What does a good budgeting app offer?

Although the features offered by budgeting apps vary, there are some key ones which are necessary to help you manage your money effectively. These include:

See all of your accounts in one place

Most budgeting apps use open banking to connect with your bank accounts or credit account provider to analyse your spending.

All of this data is usually pulled together neatly into one dashboard which makes it easier for you to monitor your finances in one place.

It helps you get a clear picture of your overall balance too. This is quite handy if you’re using a cashback credit card and need to ensure you’ve got enough in your current account to clear the bill each time you get a statement.

Some budgeting apps let you add other financial products like mortgages, investments and pensions as well.

Spending insights and categories

Budgeting apps offer pretty powerful spending insights and let you track your expenses in more detail than most banking apps.

All of your transactions are sorted into categories for example transport, food or bills. Sometimes these categories are preset in the app.

However, you may be able to customise your categories so that they suit your finances better depending on the platform.

Categories are really helpful because you can see how much of your money goes towards a certain group of expenses. (Which can be hard to track manually.)

For example, you can compare how much you’re spending on essentials like rent or mortgage payments and bills versus non-essential expenses like takeaways, entertainment or holidays.

Most budgeting apps also let you group expenses by retailer. So you can see how much of your money goes to say Amazon or Uber Eats.

Again it helps to leave no stone unturned when it comes to your finances and makes sure you’re aware of where your money is going.

Budget setting

A core feature most budgeting apps offer is, of course, helping you set a budget and stick to it.

To get the most out of your budgeting app it helps to work out what you want to spend for each expense category beforehand so you can adjust your spending limits accordingly.

You can adjust how long you want your budgeting period to last as well. For instance, you may want it to track your expenses from the first of the month or perhaps when you get paid instead.

Once everything is set up you’ll see how well you’re managing to stick to your budget. So, let’s say you allocated £200 for groceries – you can track how close you get to this target (or if you go over it.)

If you continually go over your budget in certain areas it might suggest you need to readjust how much you think you should spend versus the reality of what it costs.

Upcoming spending reviews

Another feature that makes budgeting apps useful is that they bring together regular and committed spending.

This will largely include things like bills and subscriptions. However, it can also include any standing orders you have set up – for example, you might have one for your savings account.

Having a clear idea of how much of your money is already committed to essentials helps you work out what’s left to spend elsewhere. (Or even save if you can!)

Some of the apps might also show you upcoming direct debits and how they impact your bank balance to give a true reflection of what you can spend right now.

Prompts and nudges

Most budgeting apps will send you a nudge or notification to highlight the latest updates on your budget.

These can vary from letting you know that your spending is on the right track to warnings that you are close to overspending (or are already spending more than the sums you allocated.)

Certain apps will also let you know when subscriptions are up for renewal – which can help you get ahead with cancelling if you no longer want to use them.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

Issues with budgeting apps

While budgeting apps are generally pretty useful, they aren’t a silver bullet solution to solving your financial circumstances. Here are some of the pitfalls to be aware of:

Not all providers can be added

While open banking is pretty powerful – beware that not all bank account or credit card providers are covered by each budgeting app.

This could render them a bit useless if your providers can’t be connected via open banking.

In the past, Editor-in-chief, Andy, has experienced issues with connecting some accounts with all the budgeting apps.

You might also struggle to connect things like Premium Bonds, or savings and investments held with online savings accounts (e.g. Tandem or Zopa) or rival fintech apps (e.g. Chip or Plum).

PayPal is also a notable absence, though that’s only really an issue if you keep money there rather than use it as a way to pay via your debit or credit card.

Some apps allow you to add a manual account, though that does then require you to add individual transactions and / or balances. Which again defeats the purpose.

You might still need to log into individual apps

You’ll usually have to check if a bank switching or monthly reward offer from your current account requires you to log in to your banking app or online banking on a monthly basis.

Which can take up a fair bit of time.

Though you’ll see adverts saying “sign up in two minutes”, there are usually a few steps that could potentially take hours to complete.

That includes things like adding accounts, categorising transactions, building budgets and so on.

Category limitations

Although categories are beneficial, they aren’t always that intuitive when you get started.

You’ll likely have to adjust your categories to get the most accurate snapshots of your spending then you want each transaction to be in the right place.

So a spend at the pub might go under “Going Out”, while your Spotify subscription under “Bills”.

In theory, the apps should learn about transactions and how to sort payments the more you use them. But in practice, you’ll often have to go into the categories and change some.

It can also be tricky if you regularly shuffle money around different accounts in order to meet the eligibility. For example, if your current account requires a certain amount of money to be deposited in it every month to get a freebie – like the Club Lloyds current account.

Some apps will treat it as income or spending, so you’ll need to change or potentially exclude those transactions.

Pushing offers

One of the main ways budgeting apps make money is by getting you to switch your credit card or utility provider via them. They’ll usually get paid a commission for this – in the same way comparison sites do.

However, some of the apps will really push this feature, often under the guise of it being for your benefit. But other than a reminder that you should be shopping around for the best deal, these deals aren’t always the best.

That’s because the apps can’t access your actual bill usage, only the amount you pay. So it’s not possible for them to know whether switching to another provider will help you long term.

Fees

Charging for full use of the budgeting features is another way budgeting apps make money.

Although most apps are free to download and use some of the features, you’ll often now need to pay to get full functionality to manage your money.

So it’s really important to find out what fees are charged and whether they’ll benefit your efforts to budget effectively.

If you find you don’t use many of the app features on the paid for tiers, then it’s best to switch to the free version to help you save.

Not many to choose from

Over recent years we’ve seen a fair few budgeting apps go out of business including Money Dashboard, Claro Money and Yolt.

While others, such as Cleo, have shifted their focus away from the UK market.

This means that there aren’t a lot of budgeting apps left to choose from. And, you may need to consider alternative ways to budget such as using features in your banking app to get the best value.

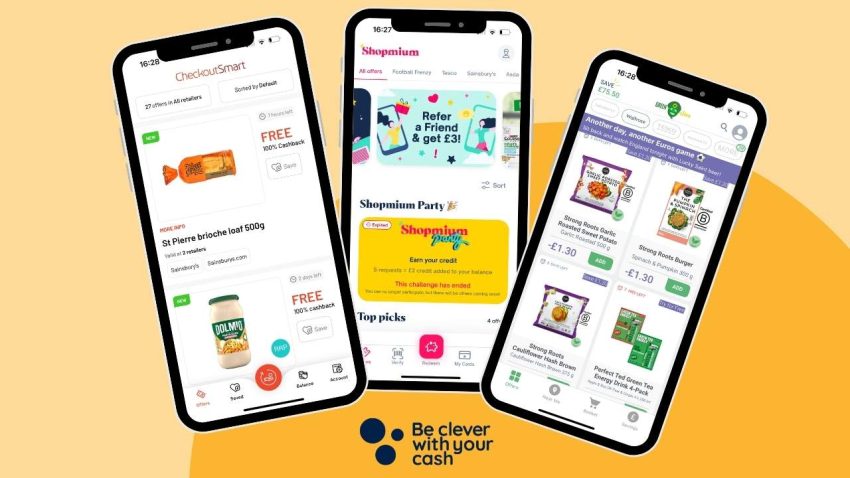

The main budgeting apps

If you want to try a budgeting app we’ve included a summary of some of the main providers below:

Emma

Pros

- Really easy and fast to get started

- The total current balance is on the home screen

- You can see the spend vs budget on each category for the current month

- There are reminders of regular payments due

- You can add offline accounts

Cons

- Very limited free version

- You have to pay to add or customise categories

- Pushes switching deals and (usually) average cashback deals

- No desktop option

MoneyHub

Pros

- Offers the largest selection of banks and other accounts, including NS&I

- The total balance is on the home screen

- You can create custom categories

- There are reminders of regular payments due

- Desktop version

- You can really get into detail

- It’s not that expensive over a year and there’s a six month free trial

Cons

- You have to pay to use it after a 180 day trial though it’s not much compared to others.

- It’s possibly too complicated

- No multi edit feature on the app or desktop

Snoop

Pros

- Not overly complicated

- The total balance is on the home screen

- You can create custom categories

- There are reminders of regular payments due

- Desktop option (can’t add accounts or change categories)

- £5 Amazon voucher joining bonus

Cons

- Existing categories aren’t great

- You can’t search transactions

- You get a lot of nudges and prompts to switch bills

Are budgeting apps safe?

Budgeting apps that use open banking are generally safe to use.

That’s because only apps and websites by firms regulated by the Financial Conduct Authority (FCA) – or European equivalent – can use the open banking system.

This means that they’ll have to abide by certain rules to ensure that you are treated fairly when using the app.

Since budgeting apps don’t hold your money, the protections you get are centred around data privacy and protection.

And as with any financial provider, it’s important to do your research to check if they are a legitimate company.

It’s always worth checking whether a company is on the FCA register to make sure that it’s safe to use.

Are budgeting apps worth it?

Budgeting apps offer a helpful way of managing your money, which can be especially useful if you’re just getting started or need help recommitting to your financial goals.

The biggest selling point is that they aim to take a lot of the stress and admin out of monitoring your finances. And ultimately, making it easier to manage your money.

This may be especially helpful if you have lots of different bank accounts and credit cards to keep on top of. Through open banking, budgeting apps let you see all of your balances on a dashboard.

However, to get the most out of budgeting apps these days, you often have to pay for a subscription account. This cost can really add up over time, which may hurt your efforts, particularly if you’re trying to save.

So, you’d be much better off using the free version of these apps to get to grips with budgeting basics and get on top of your spending.

Check your bank for free budgeting tools

It’s worth checking to see if your bank offers free budgeting tools through your banking app or online banking account.

Now, these features tend to be quite limited and only offer general spending insights or basic budgeting tools. Rather than the detailed analysis you can tailor using a designated budgeting app.

However, understanding where your money is going is an important first step in getting on top of your. And, it could help you gauge whether app-based money management is for you before committing to a third-party budgeting app.

I’m also astonished that you don’t mention YNAB. It has revolutionised my spending and saving habits over the three and a half years that I’ve been using it. Worth every penny of the subscription.

YNAB (you need a budget) is an excellent budgeting app, but not featured? Is there a particular reason this wasn’t included?