Multiple readers have had issues with with the British Airways Amex card

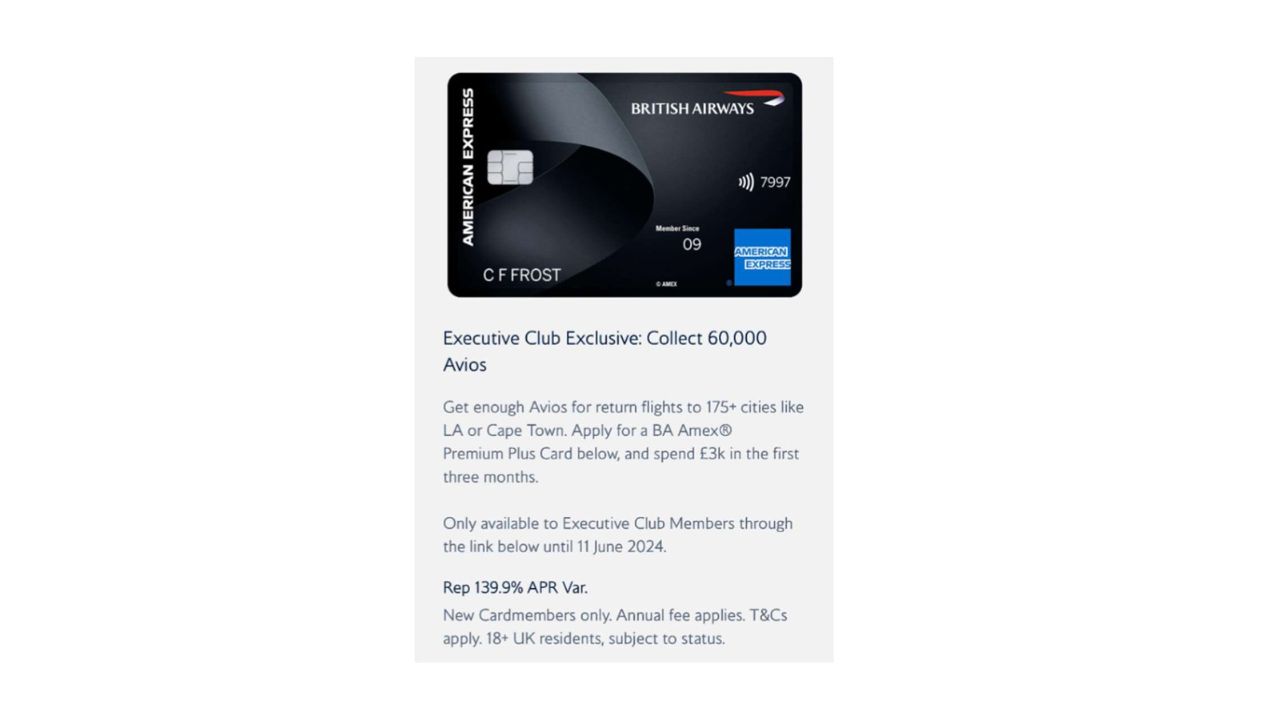

Earlier this year American Express was running a really good boosted welcome offer, a massive 60,000 bonus Avios to new customers.

The rules were simple. You needed to apply via a specific link and spend £3,000 on the card within the first three months.

However, we heard from readers who met the criteria but were denied the bonus points, even after they complained to Amex.

But one reader, Mark, took his complaint to the Financial Ombudsman Service (FOS) which forced American Express to honour the points and pay him compensation.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Refused 60,000 Avios

In May, Mark, 53, applied for the British Airways American Express Premium Plus card online, via the British Airways Executive Club, after seeing one of our editor-in-chief Andy’s Youtube videos. He’d never had an Amex card before but was planning some big holidays next year where the Avios would come in useful.

The telecoms manager, who lives in Nottinghamshire, met the spending threshold in the first three months but the 60,000 bonus points never appeared. Instead, he received the standard offer of 25,000 Avios.

He contacted American Express over the online chat feature on its website and it told him that the 25,000 points was the offer he qualified for. Mark then emailed British Airways to see if he could get further and it referred him back to Amex, because of data protection.

He made a formal complaint to American Express which insisted it had done nothing wrong. It told him that the 60,000 points were only applicable to customers who applied for the card through a link in a direct email sent by the British Airways Executive Club to members.

But Mark says: “Everyone kept going on about an ‘email offer’. But the 60,000 points had nothing to do with an email offer. Nowhere on the website did it mention that I needed to apply via an email link. It said to get the offer I had to apply through the ‘link below’ – which I did. And I never received an email including a link either.”

The image below is a screenshot of what Mark saw on the BA Executive Club website – as you can see it says the 60,000 bonus points are “Only available to Executive Club members through the link below until 11 June 2024.”

Credit card complaints

When your complaint isn’t upheld with a financial services firm, you have the right to take it to the FOS – which is what Mark did in September.

Credit cards were the most complained about product to the Ombudsman between April and June this year. The FOS received some 18,175 complaints about credit cards – more than four times the number it received during the same time period the year before. The uphold rate in favour of the customer was 31%.

Mark said the initial complaints form took him 15 minutes to fill out and was really straight forward. You need to have already complained to the business and received a final letter or waited eight weeks since your complaint.

You’ll also need to tell the Ombudsman the name of the financial business you’re complaining about, the dates of correspondence with the business (including the date of its final response) and your account or policy details. There’s also room on the form to upload evidence, such as the messages that have gone between you and the business, so make sure you take screenshots.

Mark complained that he didn’t get the bonus points, despite meeting the criteria. He also told the Ombudsman that he was unhappy with American Express’ customer communication.

By early November, the FOS contacted Mark to tell him American Express would be honouring the additional 35,000 Avios and would also pay him £100 compensation.

Mark says: “The points and compensation I got are worth about £600 or £700 so it was well worth taking the matter to the Ombudsman. I’m really pleased I did and I would recommend others do the same.”

Poor communication

Mark says American Express should be clearer with its customer communication when it comes to its offers.

He says: “The firm is quick enough to accept my application but you don’t have any idea if you’re going to qualify for the offer (subject to spending thresholds) until it’s too late.

“What it should do is notify customers once their application has gone through that they will qualify for the bonus points, if they meet the minimum spend.”

American Express refused to comment on why Mark wasn’t eligible for the bonus points nor whether it had made an error. However, it has acknowledged the FOS’ decision and has now resolved the issue.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Has American Express denied you bonus points?

Several readers got in touch with Be Clever With Your Cash in the summer to say, like Mark, they hadn’t received the 60,000 bonus points after applying for the British Airways American Express Premium Plus card via the BA Executive Club and meeting the spending threshold.

When we asked Amex about it, it said it couldn’t identify any issues.

But given it has now agreed to honour Mark’s points, following the Ombudsman’s intervention, we want to have another look at this issue. If you’ve had a similar experience with Amex and not getting your bonus points, do get in touch via Facebook or email [email protected].

Amelia’s view

I’m absolutely on the customer’s side here and I’m glad the Ombudsman agreed.

From where I’m standing, it looks like American Express’s right hand doesn’t know what the left one is doing. And it’s a real shame that even when information is brought to its attention, it’s refused to acknowledge there is clearly an issue or take any responsibility.

From what I can see, Mark (and other customers) met the criteria to get the bonus 60,000 Avios. And yet American Express refused to honour them on the basis he had not applied through an email link (which he never received) – despite the BA website saying he could apply via a link in the Executive Club page. At the very least this is poor communication from American Express and then to deny customers these points, which they’re entitled to, feels truly unfair.

American Express had the option of putting this issue right with the customer – but it failed to. I’m really pleased that Mark didn’t accept the unsatisfactory response to his complaint and took it to the Ombudsman. Sometimes firms need a bit more persuasion to do the right thing and it’s definitely worth making full use of the free resolution service the Ombudsman provides.

What is the BA Amex Premium Plus card?

The British Airways American Express Premium Plus card is a bit of a mouthful, but essentially it’s an Amex credit card that allows you to earn Avios points. It’s a decent way of doing so, especially when it boosts the welcome offer.

Avios can be used on BA flights and holidays, hotels and experiences, and they can also be converted into Nectar points.

In the Spring, it was offering 60,000 Avios bonus points (the equivalent to about £600) for new applicants as long as they spent £3,000 in the first three months and in October it increased the spending threshold to £6,000. These deals pop up a few times a year and we’ve seen the bonus points reach 80,000.

The card costs £300 a year and offers 1.5 Avios for every £1 spend on purchases, plus three Avios for every £1 spent with British Airways and BA holidays. New customers can earn 30,000 bonus Avios at the moment when they spend £6,000 in the first three months of getting the card.

You can also get up to 90,000 bonus Avios when you invite friends to join Amex plus 3,000 Avios when you add the first supplementary card, for someone else to use, to your account.

The British Airways American Express credit card is a similar Avios-earning card and it’s free. However, it usually offers a smaller welcome bonus – you’ll get 5,000 points when you spend £2,000 in the first three months – and you’ll earn one Avios for every £1 spend. The supplementary card bonus is 1,000 Avios.

As I’ve said before there’s a lot of rigmarole and you need to be rich for Amex. Also need a thick skin because you’re going to be turned down a lot. I’ve seen it happen. Going to the Ombudsman? Be easier to work for a living.

I’m not rich but I’ve been happily using Amex for quite a few years now, best customer service of any credit card provider as far as I’m concerned. Also worth adding that I never had any problem getting my huge Nectar points welcome bonus when I got my card however long ago it was now.