We’re calling on you to have your say about your financial provider

They say talk is cheap – but it can actually make all the difference to your finances.

Our joint Your Money, Your Voice campaign with our sister site Smart Money People is all about encouraging people to speak up about their money. Not only will it result in getting the best outcomes for you but it’ll also force the industry to take notice and hopefully make changes in their customers’ interest.

So here are six ways to put your money where your mouth is.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Speak to your provider

If your bank, energy supplier, credit card company or other provider doesn’t know what’s going on, it can’t help you.

If you’re unhappy with your account or the service – tell them. Outline your issues in writing and explain how you want the firm to put it right. If you’re not happy with the response you can take the matter to the Financial Ombudsman Service, which deals with disputes between customers and financial firms.

It’s also worth speaking to your provider if you’re struggling to keep up with payments or are in financial difficulty. They may be able to help by giving you by pausing payments, for example, or signposting you to other support services.

Ask a question

There’s no stupid questions when it comes to your money, whether you’re asking a friend or an expert.

In fact, one of the best places to ask a question is the Be Clever With Your Cash Facebook group. It’s free to join and we’ve more than 12,600 members who can help you.

There’s also Andy’s monthly Q&A’s on Youtube and Instagram. We post the details of upcoming events on our social channels and our weekly newsletter – so keep an eye out.

Inquire about perks

When was the last time you asked your provider to reward you for your loyalty?

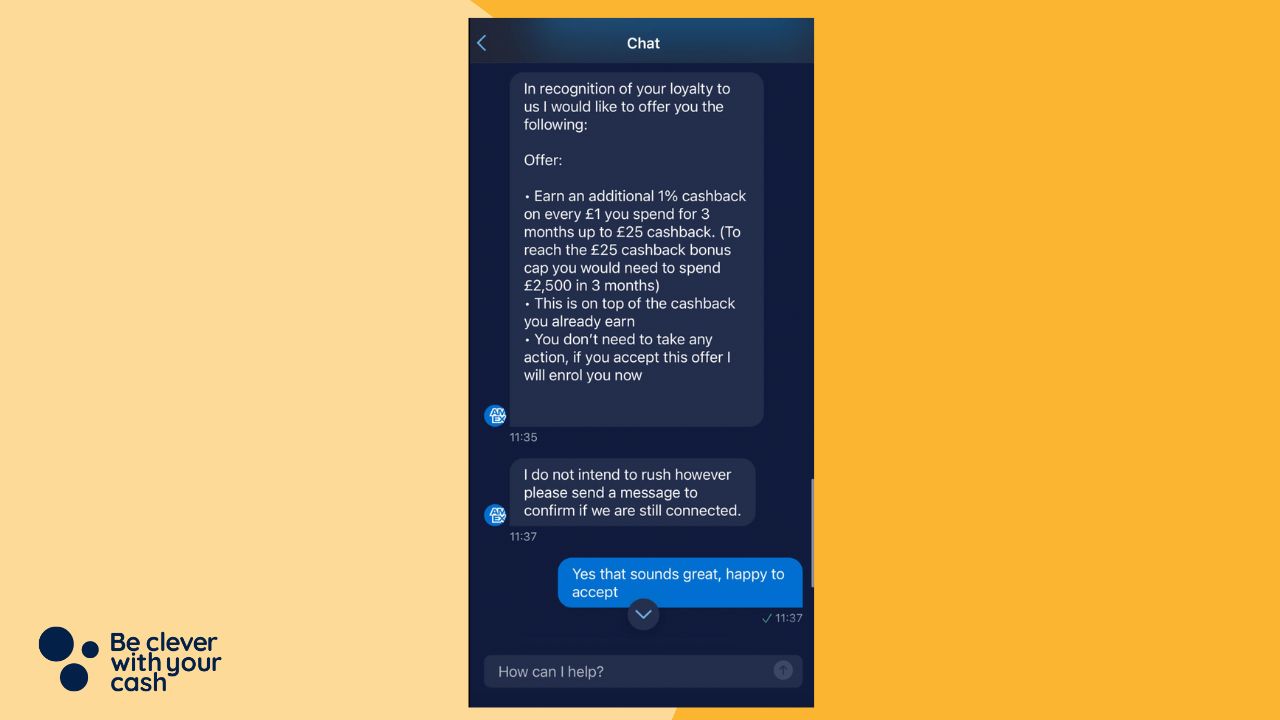

We know that sometimes companies will offer you discounts or perks if you threaten to leave (many have serious retention departments) but we’ve also heard of some members of the Be Clever With Your Cash community asking their providers for deals or loyalty discounts over the online chat feature.

A member of the Be Clever With Your Cash Facebook group shared his recent experience of asking American Express the question over chat and was offered an additional 1% cashback on his Amex card on top of what he earned already.

I’ve also had success in the past asking for discounts on retail websites before making the purchase.

Now be warned, this doesn’t always work but it’s definitely worth a try. Let us know how you get on!

Leave a review

Another way to get your provider’s attention – and the attention of members of the public – is to leave an online review, whether it’s good or bad.

If you’re struggling to get a response, you may find you get a reply from the company when you leave a review as they want to be seen to be doing the right thing. It may also prompt them to take action to ensure the issue you’re having doesn’t happen again.

You’ll also be helping other customers make better decisions when it comes to picking (or sticking) with financial providers.

There are a number of review platforms including Smart Money People, which is the leading website for financial service reviews, and the companies’ own pages.

Start a money conversation

We’re not fans of talking about money in the UK. In fact, some 81% of people avoid discussing their finances, according to research by the Money and Pensions Services (MaPs).

However, there are so many benefits to doing it. For example, MaPs suggests that people who regularly talk about money tend to make better and less risky financial decisions, feel less stressed and anxious and more in control.

The research also suggests those who chat about their finances have stronger personal relationships. And if you’ve got kids, chatting to them about money can help them form good money habits for the future.

So why not start a conversation today? Chat to a friend or other trusted loved one.

You might find they’ve got some brilliant tips to help you save money at the supermarket or on holiday.

Or if you’re worried about your finances, they may have had a similar experience and can share how they overcame their challenges. Even if they haven’t, you may just feel better and less alone by opening up.

Last month Be Clever With Your Cash reader Andrew Merritt shared his story about having his smartphone resulting in the thief stealing £20,000 of his savings.

In doing so he helped loads of our community to be more vigilant and to install protective measures on their own devices to stop it happening to them.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Have a financial date night

If you’re in a relationship, you could consider taking the money conversation one step further with a financial date night.

Money can be a particularly difficult conversation between couples and can be one of the biggest causes of arguments. There’s a lot of shame and fear of judgement about how you manage your money, especially if you have debt, and as a result lots of people try to keep it a secret. But this can cause anxiety and stress.

But by setting aside some regular time to discuss your finances with your partner (with some wine, food and romantic music, if you fancy), you can build trust and openness and feel more in control.

It can also help you plan for the future, reach your financial goals, both individually and as a couple, make cutbacks where you need to and give your savings a boost.