Our exclusive research has revealed your biggest pet peeves

As a nation, we tend to be somewhat loyal to our banks and other providers.

But our latest research with our sister site Smart Money People has shown us what it would take to make you ditch them.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Customer service fails

Financial services, like other industries, don’t always get things right. We’ve all experienced long waits trying to get through to someone on the phone, being passed around from department to department and not feeling supported.

Your biggest frustrations – the ones that would make you consider leaving your provider – appear to be communications based.

Almost half of respondents (48%) said they’d ditch their firm if they didn’t offer access to a human customer service agent, whereas over a third (34%) said they’d leave as a result of untrained or unknowledgeable staff.

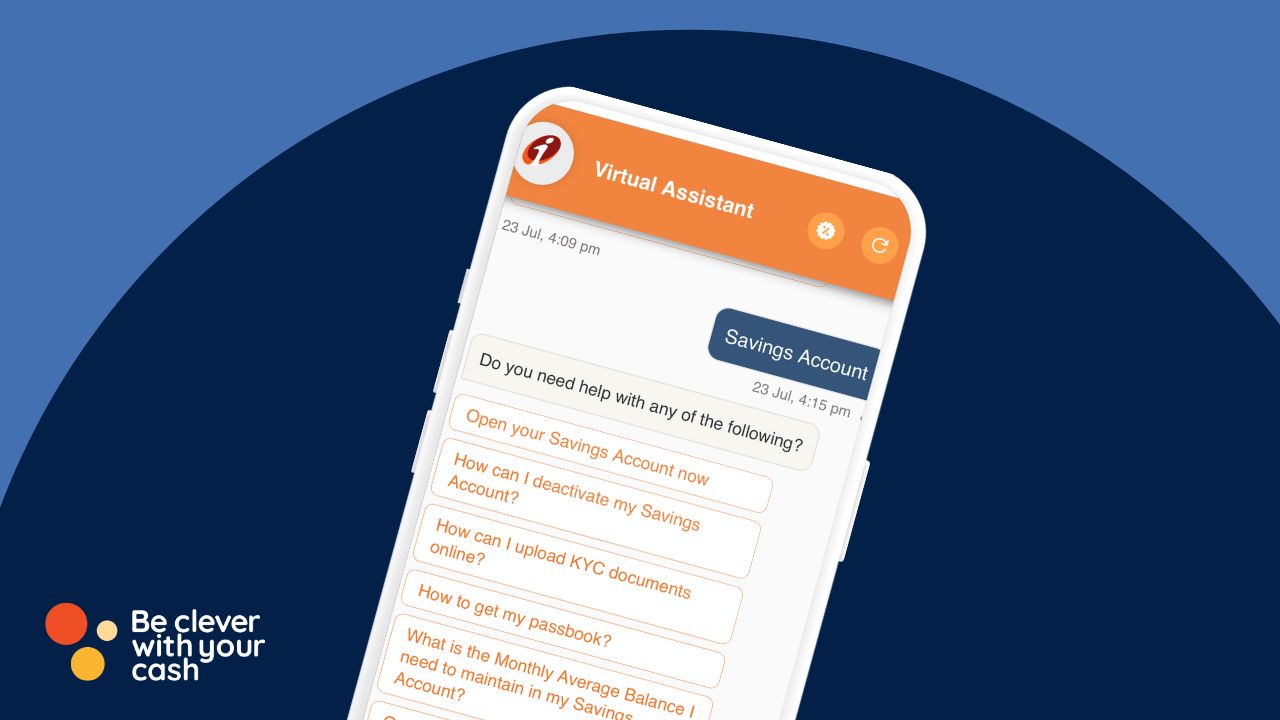

Having no available phone number (32%) and an over-reliance on chatbots (24%), were also top reasons given for dumping providers.

We asked people to give their top five reasons and the full list is below:

| Reason for leaving your provider | % who agreed |

| No access to a human customer service agent | 48% |

| Untrained or unknowledgeable staff | 34% |

| No phone number | 32% |

| Long call waiting times | 27% |

| Over reliance on chatbots’ live chat | 24% |

| Lack of empathy from staff | 22% |

| Slow response times | 22% |

| Poor customer communications | 21% |

| Call centres that say they are “receiving a high volume of calls right now” | 19% |

| Sending me the wrong information | 19% |

| Asking customers to repeat themselves to multiple staff members | 14% |

| Corporate scandals / bad stories about the provider in the press | 14% |

| Annoying call hold music | 11% |

| Websites that experience tech issues / slow to load | 11% |

| reCAPTCHA forms | 8% |

| Getting my title or name wrong | 5% |

| Too many emails or letters | 5% |

| Brand identity | 4% |

On the flip side, the research found that efficient service (49%) and knowledgeable staff (33%) lead to the most satisfied customers.

The ‘worst’ industries

Personal loan customers and those with Buy Now, Pay Later services were the least satisfied, according to our research.

Over-reliance on ‘live chats’ (30%) coupled with poor customer communications (28%) were the top reasons why people with these products were dissatisfied. An additional fifth (22%) of people had experienced unempathetic staff members too.

However, analysis of the two million independent reviews on Smart Money People, suggests health insurance firms get the poorest reviews, followed by pension providers.

For example, a customer of a big health insurance company gave a one star review that said: ‘Shocking company. I’ve been trying for a week to get through and simply change direct debit details. You have no chance of speaking to anyone. Cancelling my policy now because if I ever needed them I couldn’t go through this ordeal.’

Those with prepaid and current accounts are the most satisfied with their providers, according to our survey and reviews on Smart Money People.

Who reviews?

Despite many people experiencing issues with their financial providers, under a quarter (23%) of them have left a review in the past 12 months. And just 35% said they have given feedback directly to the firm in the past five years.

Maybe we’re a little bias, but we love reviews – hence why at Be Clever with Your Cash we do our own honest and independent analysis of different banks, savings accounts, current account switching offers, ISAs, packaged bank accounts, credit cards – and much more.

We dig through the small print, try out apps and compare to other products on the market, to give our view on whether it’s worth it.

But your views are just as important. No one wants to be a constant complainer, but I always tell my friends and family to speak up when they’re not happy to give the company a chance to put it right and to put processes in place to stop it happening again.

If you leave public reviews, you’ll also help people make more informed decisions when picking a provider. Here’s how to share your own thoughts over on our sister site Smart Money People.

What to do if you’re not happy

Say something. Put your complaint in writing and outline what you’re not happy with.

I did this recently when my ISA transfer went awry. I complained to both banks and the issue was eventually resolved (although it took about nine months to complete the transfer in the end!) I was also compensated for the inconvenience and the interest I lost as a result of the delay.

If you don’t get a satisfactory response from your provider, you can refer your complaint to the Financial Ombudsman Service within six months of receiving a final response letter. The Ombudsman is free and its job is to deal with disputes between customers and financial firms.

You don’t need to stick with a provider that’s giving you bad service. There’s loads of choice out there so there’s no need to settle.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How to find the best account or provider for you

There are a number of considerations to make.

Have a think about what’s most important to you. Yes, you may want to get the best interest rate or price, but what about customer service? Do you prefer to speak to a firm on the phone or are you happy with a chatbot? Do you need the face-to-face service of a high-street brand or will an online-only firm do?

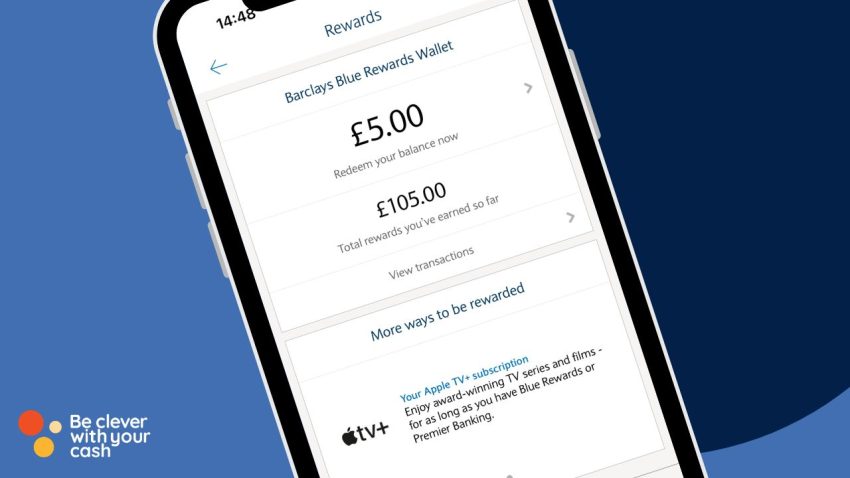

Have a think about features, too. If you love technology, you may want a provider with a brilliant app and helpful digital tools as well as decent customer service.

Once you’ve got a list of what you think you want, start comparing providers, accounts and prices. For example, you’ll find the top savings accounts and best cash ISAs on Be Clever With Your Cash, which we regularly update.

Comparison sites, such as Comparethemarket, Moneysupermarket and GoCompare, will also help you compare other products, such as insurance, although it’s usually only based on price.

Make sure you’re eligible for the accounts you’re looking for as some may have restrictions.

Check the company is based in the UK. Some firms that appear to be have contact addresses based further afield which means it may be harder to get a response if things go wrong. The Financial Ombudsman Service will also only deal with complaints about UK businesses.

Finally, check out reviews online for insight into the firm’s customer service, how easy it is to contact and how it deals with problems. It may also be worth speaking to your friends and family, to see what they think and if they have any valuable experiences to share.