Everything you need to know about the Tandem Bank Instant Access Saver

Tandem Bank is an app-based savings provider and lender that aims to help customers make greener money decisions.

Its Instant Access Saver often has a top-paying savings rate. And this review takes a deep dive into how the account works and whether it’s worth getting.

Read on to find out everything you need to know about the Tandem Instant Access Saver and how to navigate the app.

**UPDATE 26/02/25 This review has been updated to reflect Tandem decreasing the rate you can get from 5% to 4.15%. **

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is Tandem Bank?

Launched in 2014, Tandem is a digital bank that offers savings accounts, loans and mortgages. It became an official bank in 2018 when it took over Harrods Bank and acquired its banking licence.

Tandem Bank recently bought some “alternative” lenders to branch into the green loans space. And aspires to “build the UK’s greener, digital bank” and “make it easier for more people to live a greener lifestyle.”

Similarly to other digital banks like Monzo, Tandem Bank is completely managed through an app. (So there aren’t any physical branches that you can pop into.) You’ll need to download this onto your smartphone for full use of all the features, but can also access it on a tablet (although the app may not run as smoothly).

Tandem also uses Open Banking to connect your current account to your savings. Which allows you to transfer money into your savings account instantly without leaving the app.

Tandem Instant Access Saver

The Tandem Instant Access Saver currently pays 4.15% and offers the following features:

| Interest rate | 4.15% AER variable |

| Min deposit | £0 |

| Max deposit | £250,000 |

| Withdrawals | Easy access (you can make unlimited withdrawals, although money must be moved to a UK-based current account.) |

| Multiple accounts | No |

| Joint accounts | No |

| Requirements | You must be at least 18 years old and a UK resident |

How much interest rate does Tandem pay?

Currently, the Tandem Bank Instant Access Saver offers 4.15% – which is among the higher-paying savings accounts on the market at the moment.

This includes an underlying rate of 3.90% plus a 0.25% “Top Up” which takes the overall interest rate to 4.15%.

If you managed to open a Tandem Instant Access Saver when the bonus rate was still active, remember that it only lasts for 12 months. After that, the account interest goes back to the lower rate.

Be sure to set a reminder for when the bonus runs out so you can move your money into an account that pays more interest. Of course, you also have the option to shift your money before the bonus ends if a better-paying account launches too.

Tandem tends to offer Top Up bonuses throughout the year so it pays to keep an eye out for when it launches a boosted rate.

How to activate the bonus

To activate the bonus rate on your Tandem Instant Access account, you’ll need to select the “top up your rate” button which should sit at the bottom of your account balance on the home screen.

Once you click the top up button the app will show you a page confirming your top up rate, and a few more details about how it applies to your account. You’ll just need to select “top up” at the bottom of that page to activate it and start saving with the added bonus.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

When is interest paid?

Interest in the Tandem Instant Access Saver is calculated daily and paid into your account each month from the day of your first deposit into the account. They’ll send you a text message when your interest has been added and you can view your statement in the app for more details about how much you earned.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How much interest can I earn?

The amount of interest you can earn with a Tandem Instant Access Saver varies depending on your account balance, whether you have the bonus activated, and if the interest rate changes.

The table below shows some estimates of how much interest you could earn on different account balances in 12 months. Bear in mind that these examples assume that you don’t make any withdrawals (or more deposits) into your account.

| Balance | Interest (4.15%) |

| £100 | £104.15 |

| £1,000 | £1,041.50 |

| £10,000 | £10,415 |

| £100,000 | £104,150 |

| £250,000 | £260,375 |

How much can I deposit?

There is no minimum deposit or account balance with the Tandem Instant Access Saver. The only limit is that the account can hold a maximum of £250,000. Bear in mind that only up to £85,000 is protected by FSCS.

Can I apply for a joint savings account?

Currently, Tandem doesn’t offer a joint savings account, which means that you can only open a savings account for yourself.

Using Tandem

Since it’s an app-only bank that doesn’t offer a current account, using it might be different to what you’re used to.

How do I manage my account?

Tandem Bank runs digitally and you manage everything – from opening your account to moving your savings around – within the app.

Once downloaded you can log into the app on your smartphone. It’s also possible to get into the app on a tablet, however, it may not run as well since it’s designed primarily for mobile use.

How do I log into Tandem?

Logging into your Tandem account is quite different from other providers. You use the mobile number you register the account with as your username and will get sent a six-digit code to log in with. The code expires after three minutes and you have the option to resend a different one if you don’t make it into your account within that time.

Aside from being quite unique – most of us are used to having a username and password along with another level of security (like a secure number or code) to get into an account – this feature could be problematic if you can’t access your phone or have a poor mobile signal.

How do I add money to my savings account?

Tandem is pretty strict about how money can be deposited into your account. You can only transfer money into your savings accounts from a current account that’s been verified as belonging to you.

You’ll have the option to use the current account you registered with when applying for the saver since that’s already verified. However, you’ll need to connect any other accounts you want to transfer cash from using Open Banking as well.

You can then add money to your savings within the Tandem app. Or you can do a bank transfer using the sort code and account number if you prefer. You could also set up a standing order so the money transfers over automatically (Instant Access only). Beware that any money that you attempt to transfer into your savings from an unverified account will be sent back.

Tandem says this feature aims to prevent fraud. And although it can take some time to set up, having accounts connected within the app could save you a lot of hassle in the long run by allowing you to top up your savings quickly rather than doing bank transfers.

If your bank isn’t one that can be connected you’ll need to transfer your money via an account that can be verified. And since these must be current accounts you can’t connect separate savings accounts.

You’ll get a text message when your transfer has gone through – which is reassuring because it takes up to two hours for the money to show up in the app. (My first transfer took about that long so don’t worry if your transfers don’t appear right away!)

How do I withdraw money from my savings account?

You can withdraw money from your Tandem savings account through the app. You’ll only be able to transfer it into any current account you connected to the app through Open Banking.

How do I connect another bank account to Tandem?

To connect a current account to your Tandem Instant Access Saver, you’ll need to select ‘Pay in’ on your account screen. Then choose ‘Pay in using Open Banking.’ You’ll need to press the dropdown arrow under ‘From’ and select “Connect a new current account.”

Once your account is verified you’ll be able to make transfers from it into your savings. If you run into any trouble connecting another account, you can get in touch with Tandem’s customer service using the chat feature in the App or by calling 0203 370 0970.

Which banks can I connect to Tandem?

Tandem allows you to connect over 75 banks and building societies including:

- Barclays

- First Direct

- Halifax

- HSBC

- Lloyds Bank

- Monzo

- Nationwide

- NatWest

- RBS

- Revolut

- Santander

- Starling Bank

- TSB

There’s a full list of banks you can check to see if your provider is supported. If you don’t see your bank in the initial list of providers in the app, contact customer service to help you link the account. According to Tandem’s website, as long as the account you’re trying to link is a UK current account they should be able to add it for you.

Other Tandem Bank savings accounts

Tandem Bank also currently offers fixed-rate savings accounts with terms from 1 to 5 years which we’ve summarised in the tables below. You can see if higher paying options are available in our best buy tables.

Tandem 1 Year Fixed Saver – 4.40%

| Interest rate | 4.40% |

| Min deposit | £1 |

| Max deposit | £2.5m |

| Withdrawals | Not until the term ends (the only exception is financial hardship which will be assessed by Tandem) |

| Multiple accounts | No joint accounts |

| Estimated interest for £1,000 balance after 1 year | £1,044 |

| Requirements | You can only add money to your account within the first 14 days of opening it. |

Tandem 2 Year Fixed Saver – 4.25%

| Interest rate | 4.25% |

| Min deposit | £1 |

| Max deposit | £2.5m |

| Withdrawals | Not until the term ends (the only exception is financial hardship which will be assessed by Tandem) |

| Multiple accounts | No joint accounts |

| Estimated interest for £1,000 balance after 2 years | £1,089 |

| Requirements | You can only add money to your account within the first 14 days of opening it. |

Tandem 3 Year Fixed Saver – 4.20%

| Interest rate | 4.20% |

| Min deposit | £1 |

| Max deposit | £2.5m |

| Withdrawals | Not until the term ends (the only exception is financial hardship which will be assessed by Tandem) |

| Multiple accounts | No |

| Estimated interest for £1,000 balance after 3 years | £1,134 |

| Requirements | You can only add money to your account within the first 14 days of opening it. |

How do customers rate savings accounts with Tandem Bank?

Users of Smart Money People rate Tandem’s savings accounts 4.78 out of 5 stars at the time of writing (updated in February 2025) and that’s based on 42 reviews.

Tandem savings account holders positively reviewed the levels of interest rates offered and consistent communication from the bank.

Customers with a negative experience of Tandem Bank highlighted issues using the app and contacting customer service.

Is Tandem Bank safe?

Tandem is a fully-fledged bank that’s regulated by the Financial Conduct Authority (FCA). So, legally they’re required to make sure that you’re treated fairly and your money is protected.

Up to £85,000 of your savings with Tandem is protected under the Financal Services Compensation Scheme (FSCS). This means that if anything goes wrong with the bank, you can get up to £85,000 of your money back.

What is the FSCS scheme?

FSCS protects up to £85,000 of your money held in banks that are regulated by the FCA. An important thing to remember is that the protection applies to a banking licence rather than each bank individually. More than one bank can be held under the same licence. So let’s say you have four savings accounts with providers under the same banking licence, your £85,000 coverage would be split across all four, rather than applying to each one.

Is Tandem Bank ethical?

Tandem markets itself as the “UK’s greener digital bank” with a mission to “make it easier for people to live a greener lifestyle.” It has partnered up with alternative lenders Allium and Opolo to offer lending opportunities to help people reduce their carbon footprint.

For example, Tandem currently offers a “greener car finance” loan for people looking to buy an energy-efficient car using Hire Purchase finance. It also offers loans for home improvements designed for people looking to boost the energy efficiency of their homes.

If you save with Tandem it means your money won’t be used directly or indirectly in fossil fuel extraction – an important factor for environmentalists.

It’s unlikely too that your money will be used for other unethical practices as the bulk of funding received is used for direct to consumer lending, including green lending initiatives.

To date, the bank reports that it has helped 97,000 customers make greener choices and given over £288m green home improvement loans. According to the Tandem, it has also removed 49,000 tonnes of CO2 during 2022 through its initiatives.

Pros and cons of Tandem Bank

If you’re thinking about opening a Tandem Instant Access Saver it’s always worth weighing up the pros and cons of the account.

Pros

- Top-paying easy-account interest rate (at the time of writing)

- Simple to set up and use

- Allows you to connect bank accounts for in-app transfers

- FCA-regulated and FSCS protection

- No credit checks

Cons

- Instant Access rate falls after 12 months

- You can only deposit from and withdraw to selected accounts

- You need reliable signal to log into the app

- No online banking option (it’s app only)

- No physical branches or face to face support

- Deposits can take up to two hours to appear in your account

- Limited customer service hours

Is Tandem Instant Access Saver any good?

Overall, the Tandem Instant Access Saver, offers decent interest but it can be beaten by a few other accounts now that it’s dropped the Top Up bonus for new customers.

Remember to watch out for when that 12 month bonus ends if you already have an account with the Top Up! (And of course, other providers could offer rates that beat the overall rate as the year goes on too.)

Although generally speaking the app itself is simple enough to set up and use there are a couple of pain points to keep in mind.

Firstly, you’ll need to have a reliable mobile signal to log into your account. Unlike with most other providers, you don’t set up a username and password with Tandem.

Instead, you’ll have to enter your mobile number and you’ll receive a six-digit passcode each time you want to login. This can be a bit laborious, I don’t always get the code when trying to log in on the first try (or two) and have to resend a new code each time.

But having said that this account is primarily for saving rather than everyday banking so in theory it shouldn’t slow you down too much. (Just something to be aware of!)

Another thing to keep in mind is that you can only top up your savings from verified accounts (that belong to you) which are connected to Tandem through Open Banking.

This can take a while to set up, depending on how many accounts you want to use to top up your savings. It also means that you can’t top up your savings from accounts that don’t belong to you or aren’t verified through the app.

Although this process is intended to help protect you (and Tandem) from fraud, it may make topping up your account tricky if you need to transfer funds from outside of the account the app has verified.

The customer service hours are important to point out too. You’ll only be able to get in touch with them from 9am to 5pm, Monday to Friday, which isn’t ideal if you have an issue over the weekend or later in the evening.

How to open a Tandem account

To open a Tandem savings account, you’ll need to download the Tandem App from the App Store or Play Store. Once downloaded you’ll need to register for an account.

To be eligible for a Tandem Bank Instant Access Savings account you’ll need to meet the following criteria:

- Be at least 18 years old

- Be a UK resident (including for tax purposes)

- Have a current address in the UK

- Hold a UK bank account in your name

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

Alternative savings accounts to Tandem Instant Access Saver

The Tandem rate can be beaten by other accounts. It’s important to keep an eye on the best savings accounts to stay updated on the providers offering the biggest returns.

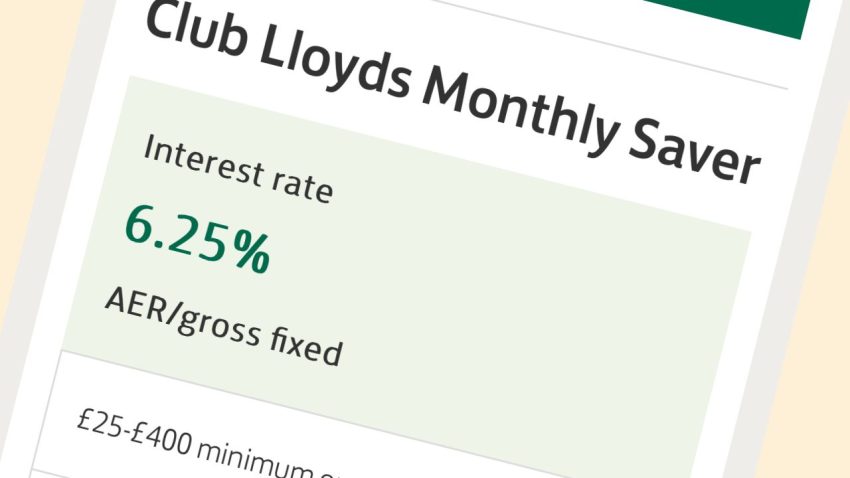

If you open a Santander Edge current account you can open an Edge Saver paying 6% AER on balances of up to £4,000. This does come with a £3 monthly fee but you’ll also earn cashback on your bills which should cover that charge.

If you’re looking for a little more in terms of interest, you could boost your returns by opting for a notice account. Fixed-rate savings accounts tend to offer the most by way of interest though.

It’s worth noting that fixed-rate accounts have a lot less flexibility than easy-access savers. This means that you won’t be able to access your money until the account term ends. (There may be some exceptions but that’s decided on a case-by-case basis.)

So while getting the highest return on your savings is definitely something to look for, it’s also important to weigh up your financial circumstances with that. For instance, if you think you’ll need access to your savings to cover any expenses in the short term then an easy-access account may be more suitable for the time being.

Tandem Bank FAQs

Can Tandem Bank change my savings rate?

As with most banks, Tandem can change the interest rate on their variable savings accounts. That includes the underlying rate (which is the main interest rate you get on the account) and any top rates or bonuses. Existing fixes are locked for the duration of the term.

During 2023 they were quite competitive on easy access and fixed rate accounts, and were near the top of the tables for most of their accounts – though it doesn’t mean they’ll always do this if competitors offer better rates.

Tandem says that any increase to the savings interest will take place immediately. However, they’ll give you 30 days’ notice if they decide to reduce the amount of interest they pay.

Does Tandem offer a credit card?

Tandem no longer offers credit cards. It used two credit cards – a cashback one paying 0.5% on purchases worldwide and Tandem Journey which aimed to help people build their credit score. However, both cards were discontinued in November 2020.

How to contact Tandem Bank

Tandem offers support through the app, via phone and email. When you click on the “contact us” button you can choose between three options:

- Live chat support: chatting with a member of the support team through the app.

- Call: calling the customer service team on 0203 370 0970.

- Email: you can email the team using [email protected] .

Both the call and email option will take you out of the app so you can speak with someone via phone or send across your message. However, Tandem’s customer service is only available 9am-5pm Monday to Friday, excluding Bank Holidays.

What happens if I withdraw all of my savings?

Tandem will calculate interest on your savings up until the day you removed the funds. This will be paid into your account 12 months from whenever you first added money to your saver.

Can I open more than one Instant Access Saver Account?

You can only open one Instant Access Saver so it’s not possible to have multiple accounts.

Can I transfer money from an overseas current account?

Tandem doesn’t allow transfers into your savings from non-UK current accounts. This is to help prevent fraud and ensure money coming into your account is from an approved provider.

Are there limits on the amount of money you can transfer using Open Banking?

Transferring money into your saver through Open Banking uses the UK’s Faster Payments system. Each bank sets its own limits on how much you can transfer using Faster Payments. For personal accounts this can be anything from £1,000 to £100,000. You can check the transfer limit for your bank or contact their customer service team.

I have had a Tandem account since Aug 23 and to date have not had any problems whatsoever – passcode always received within a few seconds of wanting to log onto my account and have received no e mails from them – no issues found connecting my bank to the Tandem account and all deposits made with no problems

I opened an account with Tandem quite recently, 9/8 after seeing it on this site, it was OK but as I use a tablet, not great. I had my Nationwide account linked to it, but in the last few days it keeps saying my bank isn’t connected. I have gone back & forth, reconnected it & being a weekend, no customer service. I have sent an e-mail which they should get tomorrow. This is not right for me, maybe I was unlucky, but don’t need the extra hassle.

I am considering unsubscribing because I am getting too many emails