You could be sitting on hundreds of pounds of unused energy credit

Now the weather is warming up, chances are you’re using less energy than in the winter.

And because of the way most of us pay for our energy bills – by a fixed monthly direct debit – now is the time of year when you might have built up a big old credit balance in your account – which you can, and should, claim back.

In fact, according to comparison site Uswitch, energy suppliers are sitting on £3 billion worth of energy credit from 15 million households – averaging £200 each. But some homes are in credit as much as £500 with their provider.

Here’s everything you need to know.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

How have I built up energy credit in my account?

Most of us pay for our energy bill by direct debit. The amount you pay is based on estimated usage and split over 12 monthly instalments.

Though your usage will differ, depending on the season, the amount you pay stays the same. It means rather than face massive bills in the winter, the direct debit method spreads the cost evenly and helps you budget.

So in winter, you’ll be using more energy, maybe more than you’ve paid for in those months, and in summer, you’ll be using less – and are probably overpaying. Think of it as a direct debit cycle.

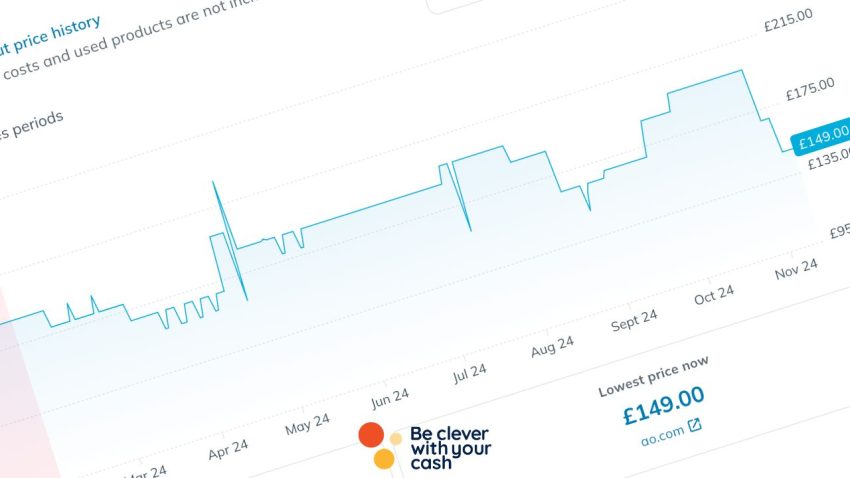

But the direct debit is still estimated based on previous usage and the current unit and standing rate charges, both of which can change, meaning it’s possible to have too much – or too little credit.

At the end of April or in early May, you want your credit balance to be at its lowest. This is because while the end of January is the midpoint of winter (in terms of the weather), it takes a few months for your energy debt to stop increasing.

In early November is when you want maximum credit in your account, to prepare for the colder weather and give you a couple of months buffer when your energy usage goes up.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How much energy credit is too much?

As a rule of thumb, if you’ve got more than a month or month-and-a-half’s credit in your account at this time of year, that’s too much.

So say your energy bill is £160 a month. If you’ve got £240 or more in your account, that’s too much by the end of April or early May.

Another time to check is in November. If you’ve got more than a couple of months of credit in your account at that point, then that’s too much, too.

You can claim a credit refund at any time of year, but you want to make sure you have enough in your account to cover your bills (that could be increasing with more usage) or you can still afford your bills without the credit in your account.

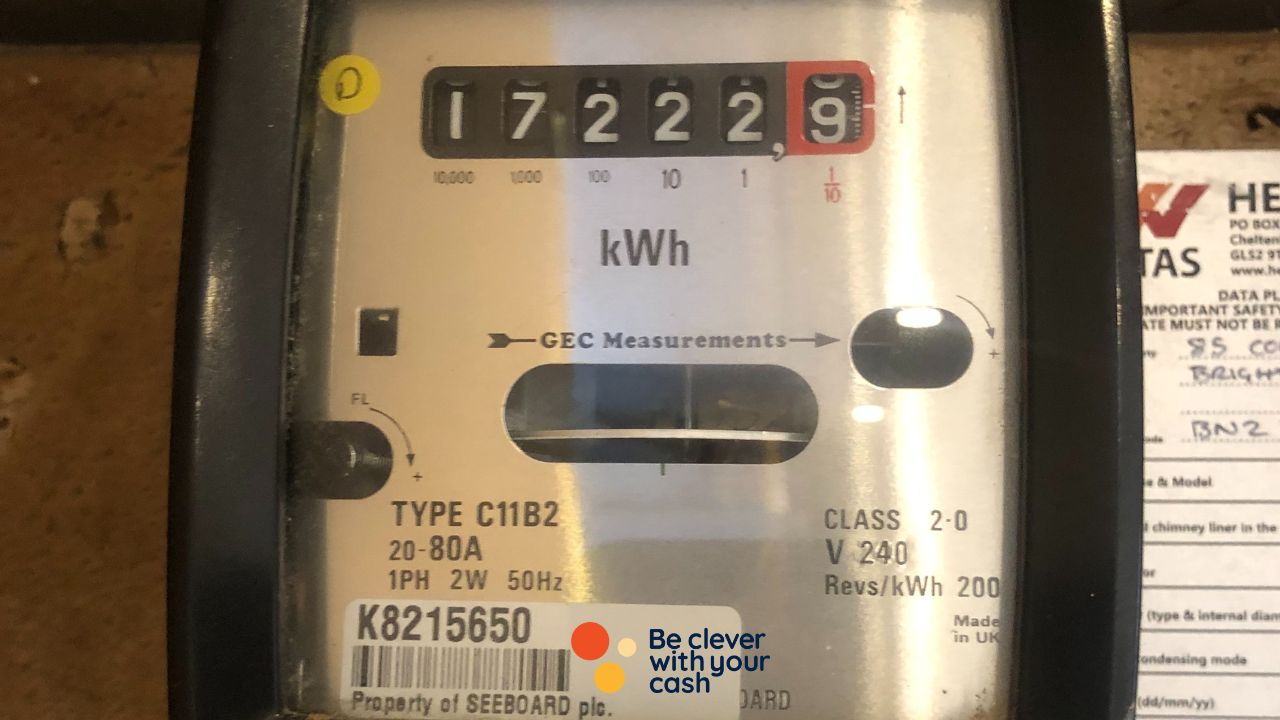

Now, a word of warning here. You want to make sure the account balance is accurate – which it should be if you’ve got a smart meter or you’ve taken a recent meter reading.

What should I do if I’ve got too much credit in my energy account?

You can – and should – ask your energy supplier to refund you the money.

Contact them directly with an up-to-date meter reading and state how much you want refunded.

Now, it’s worth knowing that your supplier could say no. However, if they refuse to give you a refund, they have to give you a good reason and explain their decision.

For example, they might not refund you a small credit balance during the summer because you’ll likely need it for higher bills when the weather changes.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

Get cash back from old energy suppliers

As a rule, you should also get your unused credit balance repaid by an energy company you used to use.

According to the energy regulator Ofcom, suppliers should always proactively refund any credit remaining on your balance, if you switch.

They have six weeks from the switch to automatically send a final bill and 10 working days from the final bill to automatically refund a credit balance.

If they don’t, contact your previous supplier with your old account information. If you can’t find it, an address can help them find your closed account. The company must refund any credit they hold no matter how long ago the account was closed.