You can also get complete access to your credit report at the same time.

Credit reports and scores are essential tools you need to be aware of – and continue to monitor. A few years ago you’d have needed to pay to access your full report on a regular basis, and even see your score.

But now there are third party websites and apps you can use which won’t charge you a penny.

Here’s why they are important, and how to sign up.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

The three credit scores and reports

You’d think there’s just one credit score but actually three core ones (let’s ignore for now the fact that lenders might have their own scores too!). Each one is different, and they are based on the date in the credit reports managed by the UK’s three credit reference agencies – Experian, Equifax and TransUnion.

Frustratingly they all have different methods of compiling and presenting their scores. There are totally different ranges, so it’s impossible to compare them.

Now you might think, that doesn’t really matter as you’ll only focus on one report. Well sadly no. You need to check all three reports.

That’s because they potentially hold different details about your financial history. Not every company reports to all three. So you might find your bank or credit card appears on one or two, but not all three.

And that matters because when a lender checks a report to consider your application, they’ll probably just go to one.

And if that one is one with missing accounts or errors it could end up with a rejection.

Credit report vs credit score

A credit report is a collection of information about your finances. From all the bank accounts, loans and other credit you have, through to a record of missed payments, financial connections and address history.

It’s frequently used to confirm your identity, but more commonly it’s a way for lenders to work out if they will give you that mortgage or credit card.

So it’s really, really important – though it isn’t the only thing that’ll be taken into account when you apply.

The score is far less important. It’s simply a representation of the health of your credit report. In itself it won’t make any difference to any applications.

Still, it’s handy for us as punters to get a quick idea of things. And it’s easier to track a score than regularly go through the report.

If there’s a sudden drop in the figure it’s a good idea to try to find out if it’s anything significant that you need to deal with.

But if it carries on relatively steady then you know you’ll only need to take action if you want to bring it up – a sign you’re getting rid of errors and adding depth to your underlying credit report.

Here’s more about how credit reports work, and why they’re important.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

How to check your credit score & report

You can sign up to each credit agency’s own service to access your score for free. Some banks even bundle this in with your current account. So that’s pretty easy.

But if you want to see your full report (which is the important thing to check), then with both Equifax and Experian you’ll have to pay a monthly fee of around £11 to £15.

Though you can also request a Statutory Credit Report to view online, it’s generally not as detailed, and won’t have your score. So you’re better off using a third party service that’ll give you full online access in a few clicks for free.

They don’t all update in real time (often it’s a monthly refresh), and might not go back more than a year, but you’ll get everything you need right now to check for errors and find areas you might be able to improve. You can also use these sites for additional services, such card and loan eligibility and tracking.

These services will all also email you monthly or when things change. It’s worth clicking through to check when you receive them. This can be an early warning sign of any fraud or applications not in your name. If you ignore these (it’s easy to do when your inbox is full) at least check them before any you make any applications.

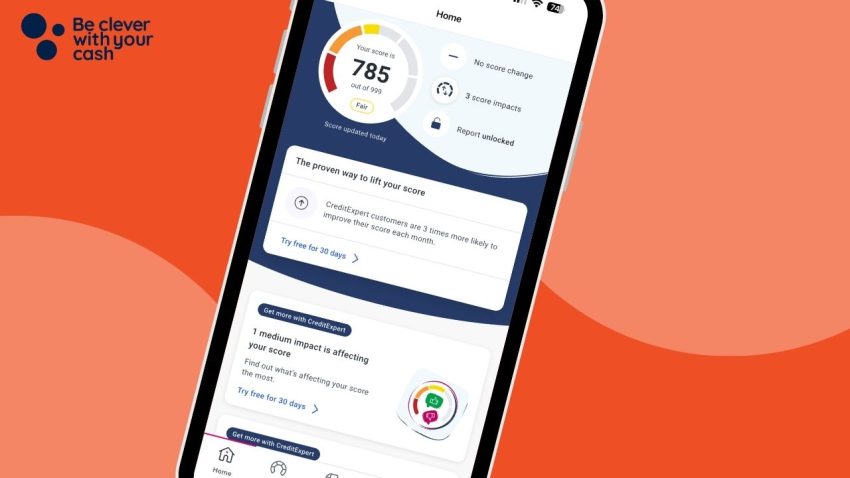

Free Experian credit score and report

Experian app

Since July 2025 you’ve been able to get digital access to your Experian report via the Experian app.

There’s also an eligibility checker. This is vital when you are looking to apply for a new credit card or loan. Here’s more on how they work.

You get an update to your report once a month which should be fine for most people. Since Experian is the biggest credit reference agency it’s probably the most important one to keep an eye on.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Free Equifax report and score

ClearScore

ClearScore is a free way to monitor your Equifax score for life. It’s simple to find your way around it and it explains what you’re seeing.

You can access on desktop or via an app. I like the timeline feature which lets you see how your score, as well as things like mortgage debt change month by month.

Again it updates monthly, but for most that’ll be fine.

A warning – ClearsScore will email you regularly trying to get you to open a new credit card or loan. Just ignore the products they try to sell you!

Free TransUnion report and score

Credit Karma

It’s completely free to check your full report direct with TransUnion. You can do this via their own Credit Karma website. Your score is updated weekly.

Check all three credit reports

If you’ve been a victim of fraud and you’re worried about applications going out in your name then you can also sign up to CheckMyFile.

This is free for 30-days, but it will give you full access to all three reports including those instant notifications of changes. If you don’t want to keep the service you’ll need to cancel to you don’t pay the full £14.99 a month.

Earn cashback to check your score

Cashback sites TopCashback and Quidco will pay you to sign up to Experian’s free site.

Rates can change so it’s worth checking both, but at the time of writing the amounts are listed below.

Dont’ forget that if you’ve never used either cashback site you should nab a new member bonus of up to £20.

| Quidco | TopCashback | |

| Experian free account | £2 | £9 |

| Experian Boost | £5 |

Can you do an up to date comparison for TransUnion now that MSE are using them. Particularly the difference between credit karma totally money and MSE credit club as I believe credit karma only updates every 7 days whereas the other two are daily?