You’ll no longer get a £5 reward from October

The current account reward add on from Barclays has been a bit pointless for the last few years – but there are big changes that could make it better or worse for you. Here’s everything you need to know.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

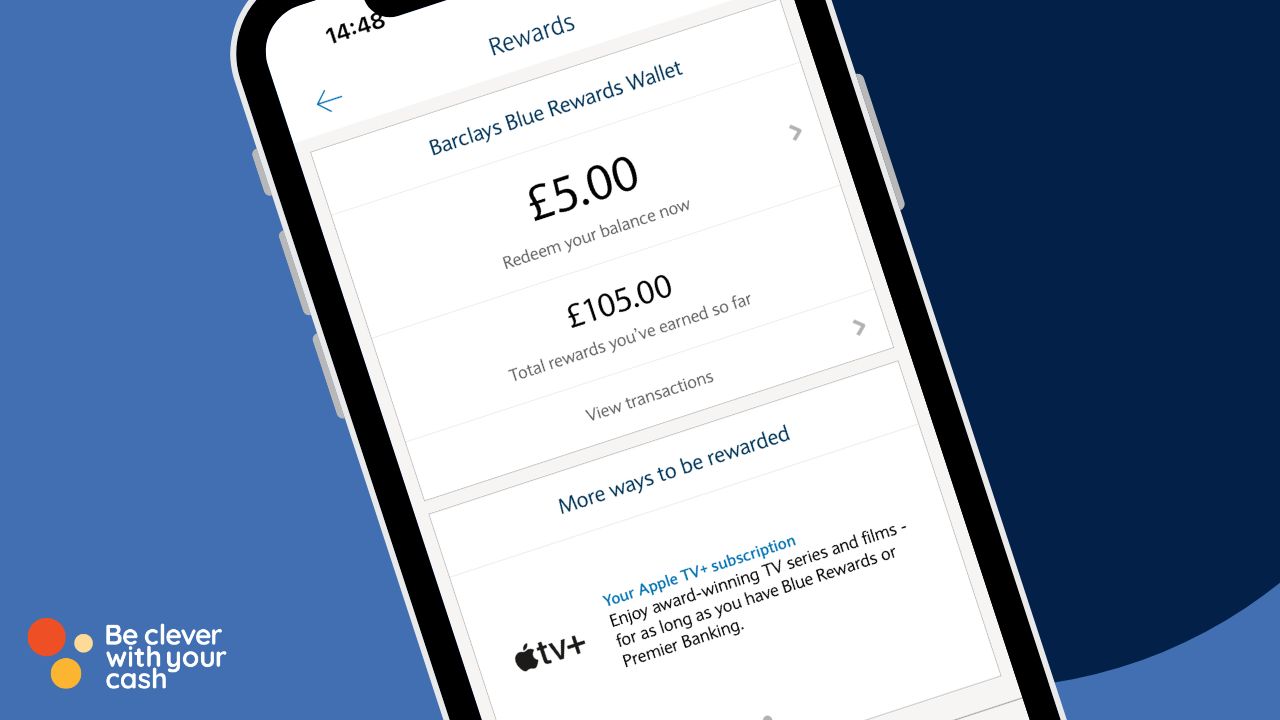

What are Barclays Blue Rewards

If you have a current account with Barclays you can choose to add on Blue Rewards. This package costs £5 a month. Until September, and as long as you meet set conditions, in return you got:

- £5 back in rewards each month

- Access to a 5.12% paying “Rainy Day Saver” account on up to £5,000

The fee used to be lower so you’d actually make a profit on the account, but for a good while now the £5 fee knocked out the £5 reward.

There were also extra monthly payments available if you have specific Barclays products

- £3 back if you have a Barclays mortgage

- £1 back if you have a Barclayloan

- £1.50 if you have life insurance (first 12 months only)

- £5 if you have life insurance with critical illness cover (first 12 months only)

Unless you have these other products, the only reason to get Blue Rewards in recent years has been the savings account – and that too has been beaten or matched by rates elsewhere.

You can also get cashback from partner retailers. It’s worth keeping an eye on it, but it’s nothing to get too excited about.

What’s changed?

There are a few big changes to talk about, the addition of free Apple TV+ and the end of the cash rewards. There’s also a temporary cashback on spending for the next few months. You’ll still get access to the Rainy Day saver account.

End of the monthly cash reward

From September 2024 you’ll no longer get £5 back for meeting the criteria. The other monthly cash payments will also end on the same date.

The last payment was on 3 September, and that reflected if you qualified in August for the reward.

In effect, it means having Blue Rewards really will be costing you £5 every month from October onwards.

Free Apple TV+

This offer went live in August in your Barclays account, and it took me less than a minute to activate.

You’ll get free Apple TV+ for as long as you have Blue Rewards added to your current account. This is worth £8.99 a month, so £107.88. You can also add on an MLS (Major League Soccer) pass, worth £14.99 during the season (February to October each year), or £99 if you buy a season pass.

So until the end of September, this really is a free add on. But from October onwards you’ll be paying £5 a month for it, so really you’re looking at a £60 sum for a year of Apple TV+. Since there are frequent offers to get free passes, I don’t think this is worth it at all.

1% cashback for three months

Between 4 September and 30 November you’ll also be able to earn 1% cashback on purchases with the debit card. It’s capped at £5 a month. Since you can match or beat this elsewhere for free, it’s not something to stick around for.

Extra offers

In September, Blue Rewards customers were able to get free tickets to an Everyman screening of Wolfs (an Apple TV+ movie with George Clooney), along with pizza, popcorn and a drink. It could be these are regular events, though it’s not been widely publicised.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

How to get Blue Rewards

The conditions have largely stayed the same. To qualify for any of the perks you must:

- Pay in £800 a month

- Pay £5 a month

However, from September onwards you’ll no longer need to pay out 2 direct debits – this was tied to the £5 reward part of Blue Rewards.

How to cancel Blue Rewards?

If you don’t want to continue receiving Blue Rewards then it’s easy to cancel it within your Barclays online account or the app.

If you do it before 5pm on the last day of the month you won’t be charged the £5 for the following month. If you cancel in the first 14 days of the month you’ll get a refund unless you’ve already benefitted from a reward.

When to cancel Blue Rewards?

We know the last bonus payment for Blue Rewards was made on 3 September, but this reflects the fee and actions taken in the previous month.

The payment for October wll be taken from your account on the second working day of the month, which this year will be 2 October.

So to avoid this you’ll need to cancel by 5pm on 30 September 2024. If you miss this then you may as well wait until 31 October and get another month of Apple TV+ and the 5.12% interest account.

What if you’re with Barclays Premier Banking?

Though Premier Banking account holders won’t be able to use Blue Rewards, the good news is you’ll also be able to get Rainy Day Saver as well as the free Apple TV+ and MLS Pass.

Should you ditch Barclays Blue Rewards?

Andy’s analysis

Any Barclays customers with Blue Rewards need to pay attention to this one. Do nothing and you’ll suddenly going to be £60 worse off. And it’s even worse for those with payments from other Barclays products.

Yes you can now get Apple TV+, but as mentioned, there are lots of ways to get Apple TV+ for free. The movie screening and snacks is a decent extra, but it’s not clear how often this will happen, and there were very limited tickets available.

And as I detailed in my September savings update, paying £5 a month just to keep the 5.12% paying savings account will actually give you 3.2% at best, and potentially far less.

So from October I can’t see the benefit of sticking with the add on. Even if we see easy access rates drop elsewhere, which is likely, that £60 annual fee will wipe out much of your interest.

That means you’ll need to cancel before 5pm on 30 September 2024 if you don’t want to keep paying £5 a month.

If you’re using the savings account, you can find alternatives in our best buy tables.

Is there any updates on when to ditch the account but still be able to get back the money I paid for AUG or JUL this month? I dont want to lose out the 5GBP paid for the account, especially i’m not using the rainy day account any more as CHASE has a better offer and i’m not benefiting from the 5GBP I paid since JUNE….

Will premier account holders have to pay the £5 fee?

hi Andy, so if you have both Barclays Premier Banking and Rewards cancel the REwards now or wait and cancel on the 2nd of September?

So if you have Premier account (and a Barclays mortgage) you lose the cash but don’t have to pay a fee either (and get free Apple TV)?

Generally your advice is pretty good. However, you don’t seem to take into account the total interest paid if yoU keep £5000 in your rainy day saver.

Total interest would be £256 on £5000 – the fee of £5 x 12 (£60) would reduce it to £196.. That’s still 4%.

The big issue here is that I can have the Barclays app & see my current a/c & Rainy day saver in one place.

Switching my savings to another provider would mean messing about accessing another bank etc to get the money to pay my bills in the current a/c…..

I use the Rainy Day a/c topped up to £5k every 1st of the month & then just transfer money to pay bills straight to my Barclays current a/c in the app. SIMPLES!

Compare Barclays to Lloyds Club current a/c which pays an absolute pittance in interest up to £5000! (Yes I do get free Disney with Lloyds but I don’t keep any spare cash in there).

While there are still other savings accounts paying 5% or more, there’s no need to use the Rainy Day Saver unless you really want to have it in once place. You’re also not capped at £5,000 with those other options.

Will we be able to keep the Rainy Day Saver if we cancel the Blue?

No, it’s just for Blue Rewards or Premier customers