Is now the right time to borrow money?

Monzo, among many other digital banks, is starting to promote loans to customers.

But should we be considering them?

Read on to find out more.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

Monzo promotes £25,000 loan

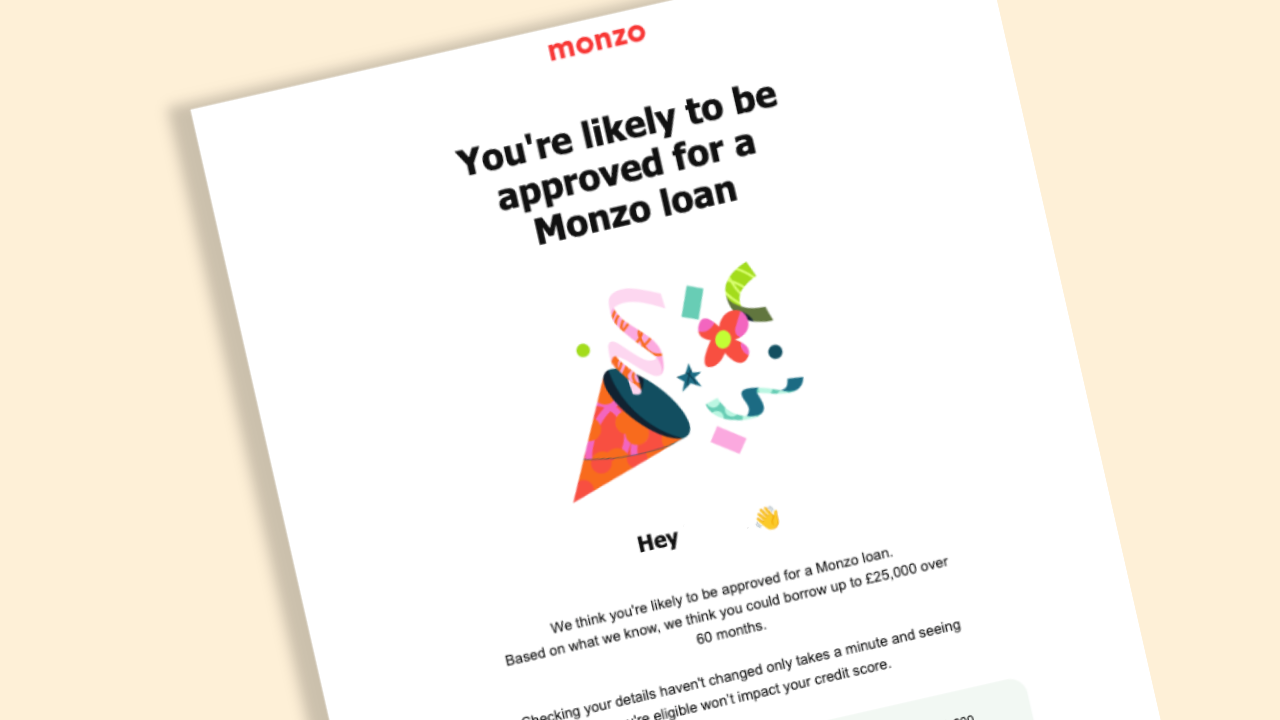

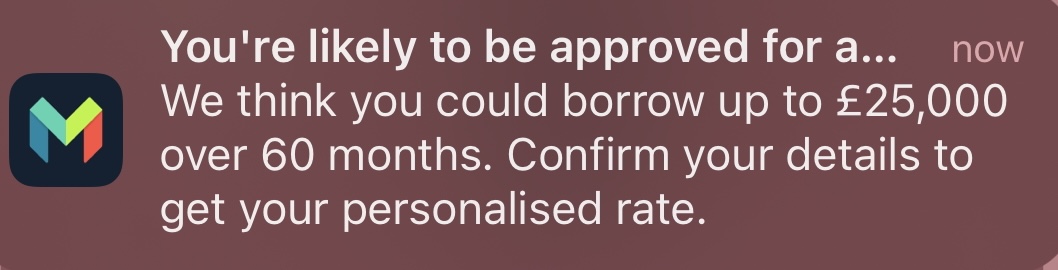

A notification flashed across my screen from Monzo – I assumed it was the usual spending overview. But when I looked closer, I was stunned.

“We think you could borrow up to £25,000 over 60 months,” it read.

For context, I’ve been a Monzo user for a while and think it’s great for budgeting and travel spending. However, I’ve never shown any interest in taking out a loan with them, so it all seemed very out of the blue.

And, I’m not the only one. Zoe, on the team, received a similar notification and email promoting the same thing.

Although neither of us was able to see what rates we could be offered by Monzo, they prompted us to check out their external partner loan deals.

It’s not the first time we’ve noticed Monzo’s push towards easy borrowing and a few other services like budgeting app Emma have also been reported to promote loans as of late.

Trailblazer turns to traditional banking tactics

Monzo is one of the UK’s fastest-growing digital banks, with around 7.5 million people banking with them.

It has long been branded a trailblazer in the financial world, introducing easy-to-use money management features that make taking control of your finances simple. Things like budgeting insights, automated savings, and gambling blocks have now been adopted by traditional banks.

With that being said, over the years we’ve also seen Monzo pivot towards traditional banking tactics to make money. This includes the introduction of Monzo Premium – it’s paid for packaged account.

And most recently offering a buy now, pay later style credit card with Monzo Flex and unsecured personal loans.

Typically traditional financial services make their money through the interest charged on credit products like credit cards, loans and mortgages to make a profit.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- Extra bonus£25 Amazon Gift Card

- FSCS Protected? Yes

- Switch bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

- £25 Amazon Gift Card requirements To qualify for the gift card, you need to complete a full switch using CASS, and make five debit card transactions within 30 days of opening the account

A new crossroads for challenger banks

Monzo, along with other challengers, has driven a lot of much-needed change in the financial industry. Born out of the 2008 financial crisis when people became increasingly sceptical of long-standing financial institutions, they offered a way for customers to take control of their finances.

However, are these challengers now reaching a crossroads where profitability outweighs their people-first approach?

Monzo’s strategy to “continue to invest in and grow” its lending offerings has become a core part of its strategy to hit profitability – partly because for years there were concerns about whether it would make it as a business

But finally, the digital bank turned a profit for the very first time this year after its lending volume almost tripled to £759.7m according to its 2023 annual report.

With many people facing financial challenges amid the cost of living crisis, heavily promoting loans and other forms of borrowing could hinder rather than help customers.

Although Monzo – and digital banks alike – offer a lot of transparency when it comes to their operations.

You can’t help but wonder if we’re just seeing the same cycle repeat that we’ve seen with older banks and financial services. Which is that ultimately, lending becomes necessary for the business to make money.

If this is the future of digital banks, how they balance that against the financial wellbeing of customers will be crucial.

Andy’s Analysis: Has Monzo lost their way?

The messages Brean and Zoe in the team received aren’t the first time Monzo has been keen to push borrowing on their customers.

Last year I spoke on our Cash Chats podcast about an email I received which told the story of a customer taking a loan out from them to pay for a flower arch at their wedding. That was hardly a financial decision to celebrate, especially during a cost of living crisis.

Of course, all banks are at this, so as Brean says, this is just Monzo moving away from their challenger beginnings and doing what the rest do.

But I think these activities hurt more coming from Monzo than they would from Barclays, HSBC or even Chase Bank. They started off with a mission to help us understand our spending. Now they just want us to get into more debt so they can turn a profit.

Is now the right time to borrow money?

The main thing to ask yourself when it comes to borrowing money is “can I afford the repayments?” If you need help working out how much you can afford, for example Money Helper and lots of other online platforms offer free calculators that can help you get an idea. Keeping on top of paying off your debt is really important.

Late or missed repayments can have devastating consequences for your finances including damaging your credit history which affects your chances of borrowing in the future. And in some cases may lead to legal action if you can’t repay at all.

And remember, having debt isn’t a bad thing if you can manage it. In fact, borrowing and paying off your debts on time can boost your credit score and help you access more competitive rates in the long term.

Our podcast

Listen to Cash Chats, our award-winning podcast, presented by Editor-at-Large Andy Webb and Deputy Editor Amelia Murray.

Episodes every Thursday.

How to find the right loan

Shopping around is key to helping you get the best personal loan deal. You might find there are far cheaper options out there than the one offered to you by your bank, such as Monzo.

Price comparison websites are a great place to start and can help you compare lots of loan deals quickly. They’ll use a soft credit search to line up your quotes, which won’t show up on your credit file.

Some sites also include an eligibility checker which shows how likely you are to be accepted for each deal. This can help you reduce the chance of rejection, which would hurt your credit file.

It’s also worth comparing the flexibility each loan deal offers when it comes to repayments. For example, some lenders might charge an early repayment fee if you want to clear your debt earlier.

How do Monzo loans work?

Monzo customers can apply for a loan of up to £25,0000 through the app. They’ll check your eligibility for a loan first with a soft credit search. If you meet their criteria you can make an official application, which will affect your credit score.

Bear in mind that just because the notification we saw suggested we could get £25,000, it’s just a promotional offer and you may get less. In fact, when I tested the process it turned out I couldn’t get an offer due lack of information about my income! (That could be because I don’t use it as my main account so they didn’t have my salary details).

If your application is approved, you’ll receive your loan on the same day. There’s a flexible repayment option and you can pay off your loan early without being charged extra. Monzo also won’t charge late fees if you fall behind on repayments.

Similarly, with other forms of borrowing, late or missed payments will negatively affect your credit score. If you’re ever worried about keeping up with your repayments, get in touch with your lender as soon as possible to see what support is available for you.

Alternatives to taking out a loan

If you’re not keen on taking out a loan or would like to weigh up your options, here are some alternatives to consider:

Use a credit union

Credit union loans tend to be more affordable loans and offer lower rates of interest. You’ll need to be a member of one to apply though. Websites like Find Your Credit Union, can help your local union to register with.

Try a 0% interest credit card

Using a 0% interest credit card could help you spread the cost of your purchase interest-free.

You could also use it to help reduce your debt from other higher-interest credit cards using something called a balance transfer. You can find out more about how 0% balance transfer credit cards work here.

Borrow from trusted family or friend

If you have any trusted family or friends that are in a position and willing to help you out, borrowing from them could be an option. This can become complicated quite quickly though, especially if you run into trouble repaying them. So as you would with a lender, it’s really important to make sure you can afford to pay back what you borrow. Because unfortunately, not doing so could cost you your relationship with a loved one.

Save (if you have the time)

Saving up for your purchase can help you spend without racking up debt. Of course, this totally depends on your timeframe. And how much you’ll need to put away. The best easy-access savings account right now pays around 4.52% and locking your money away for a year could earn around 6.1%.