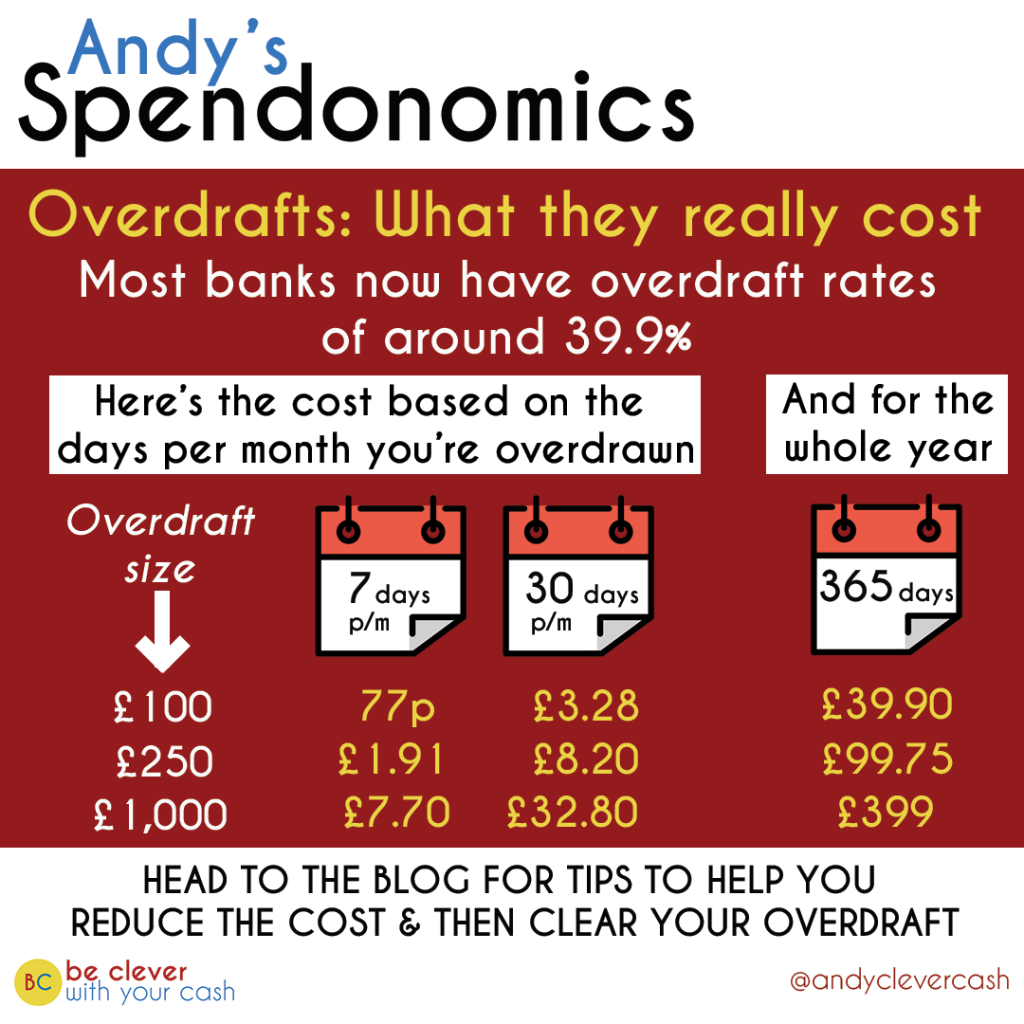

You could be paying as much as 40% interest each time you dip into your overdraft.

Last year the banks were made to bring in a simplified single interest rate charge for overdrafts. The hope was this would make it easier for people to work out how the cost the existing mix of daily fees, interest and other charges.

Well, it’s certainly a lot clearer – but sadly it’s not necessarily going to be any cheaper to go overdrawn. The banks pretty much all decided to charge around 40%.

For those that only rarely use an overdraft it’ll actually be cheaper. But for people who “live in their overdraft” it’ll probably cost a lot more.

In fact, at 40%, an overdraft is now one of the most expensive ways to borrow money! So if you regularly use one the best way to beat these costs is to clear the overdraft and get your bank balance back in the black.

Reducing the cost of your overdraft

Of course, wiping out hundreds or thousands of pounds isn’t going to be quick – so don’t wait. Every day you’re in an expensive overdraft it’s costing you cash. You want to first of all find a way to reduce the interest that gets added.

I’ve shared a few tips in this video, or keep reading.

Move to a cheaper overdraft

You can switch bank accounts even if you have an overdraft – though the new bank has to agree to offer you a new overdraft. This can be dependent on how large your overdraft is and on your wider credit report.

The best overdrafts are obviously 0% ones. These tend to be quite small. M&S Bank has a £250 0% overdraft, but there aren’t many others out there (First Direct account are still closed to new aplicants).

For a larger interest free overdraft you can apply for a Nationwide FlexDirect account. New customers who’ve not had the account before can get a one year 0% overdraft, giving you more time to pay it off. The size of the overdraft will be dependant on your credit report.

You can check out the best overdraft deals at the banks here.

Ask for a £500 interest-free buffer

One of the support measures introduced during lockdown was a £500 interest-free overdraft for all banks. It was set to last just three months, but you can ask for a further three months.

This ended with most banks last year, but a handful extended this. You have until 31st January 2021 with Halifax, Lloyds and Bank of Scotland to make your initial or extension request. At Santander it’s until 4th May 2021.

If £500 isn’t enough to cover your debt, or you’re with a differen bank, then ask for other ways they can help you. This could be temporarily reducing or waiving the rate you’re charged, or perhaps looking at a loan to help you clear it at a lower rate.

Failing that you might look at Monzo or Starling which have cheaper overdrafts for some customers.

Get a 0% Money Transfer credit card

These credit cards work like a balance transfer credit card but instead using a new credit card to clear a credit card debt, you’re using one to clear your overdraft. So you’ll still owe the cash, but it’ll be on a 0% deal for a set amount of time, usually 18 months or more.

There’s normally a fee to transfer the money from the new credit card over to your bank account, and of course you need to make the minimum repayment on the new card (at least) each month.

Here’s more on how Money Transfer credit cards work.

Get a loan

For large amounts, you could look to a cheaper loan to clear your overdraft. You’ll obviously need to make sure you pay that loan off. The best rates will depend on your credit file.

How to clear your overdraft

Once you’ve reduced the cost of the overdraft you need to start paying off the money you owe.

Use savings

If you have savings, you’re better off using them to clear your overdraft. The interest you’re earning on them will be far, far worse than what you’re being charged. If are worried about what would happen if you have an emergency later on having cleared out your savings, you can then look to borrow money. But there’s no point borrowing, and being charged for it, when you don’t need to.

Open a new bank account

The big tip from Sara Williams at Debt Camel when she guested on my podcast was to open a separate account for day to day spending – essentially starting afresh.

This helps you split out the overdraft you owe and the money you have coming in. So the old account would now work more like any other debt you have. You can see the balance owed going down as you clear it rather than see it reduce you get paid and increase as you pay the bills.

Ideally set up a set amount to transfer over to the debt each month, and top it up with more cash when it’s available.

Use the money that would have been interest payments

If you’re now paying 0% interest, you’ll be saving the cash that would previously have gone on those overdraft charges. Make sure that money is still going towards the debt to help clear it faster.

Have some leaner months

If the overdraft isn’t huge, then it might not take long to clear it by drastically cutting back your spending over a few months. Once it’s back to zero, make sure you don’t dip back into it.

You can also look to earn extra cash, such as selling unwanted and unused items online or taking on extra work.