The outage is worldwide and impacts flights, payments and banking systems

If you’ve been impacted by the global IT outage and you’re out of pocket as a result, here are some of the things you can do to help yourself in the meantime.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What’s happened?

Crowdstrike, a cybersecurity company pushed a content update to Microsoft computers worldwide, causing a global IT outage which has impacted the NHS, airports, payment systems, telecommunications and TV channels.

When will it be resolved?

Microsoft and Crowdstrike say that the issue has been resolved, but that there may be some residual impact affecting some services. We don’t yet know how long it might take for things to return to normal.

What should you do in the meantime?

The outage is impacting companies globally, from grounded planes to NHS appointments, so you might find yourself out of pocket. The outage is very broad, so it’s impacting companies in a lot of different ways, but here are some things you can do to mitigate the impact on your finances.

Take screenshots and notes

If you experience issues on your mobile or computer, such as in a banking app or while trying to make a payment, take a screenshot of the issues you’re having. These will go a long way in helping you provide evidence if you need it down the line.

This can be helpful when trains are delayed as you can snapshot the actual delays you experience.

Alongside this, take notes of any other issues you encounter – a log can be useful evidence if needed later on.

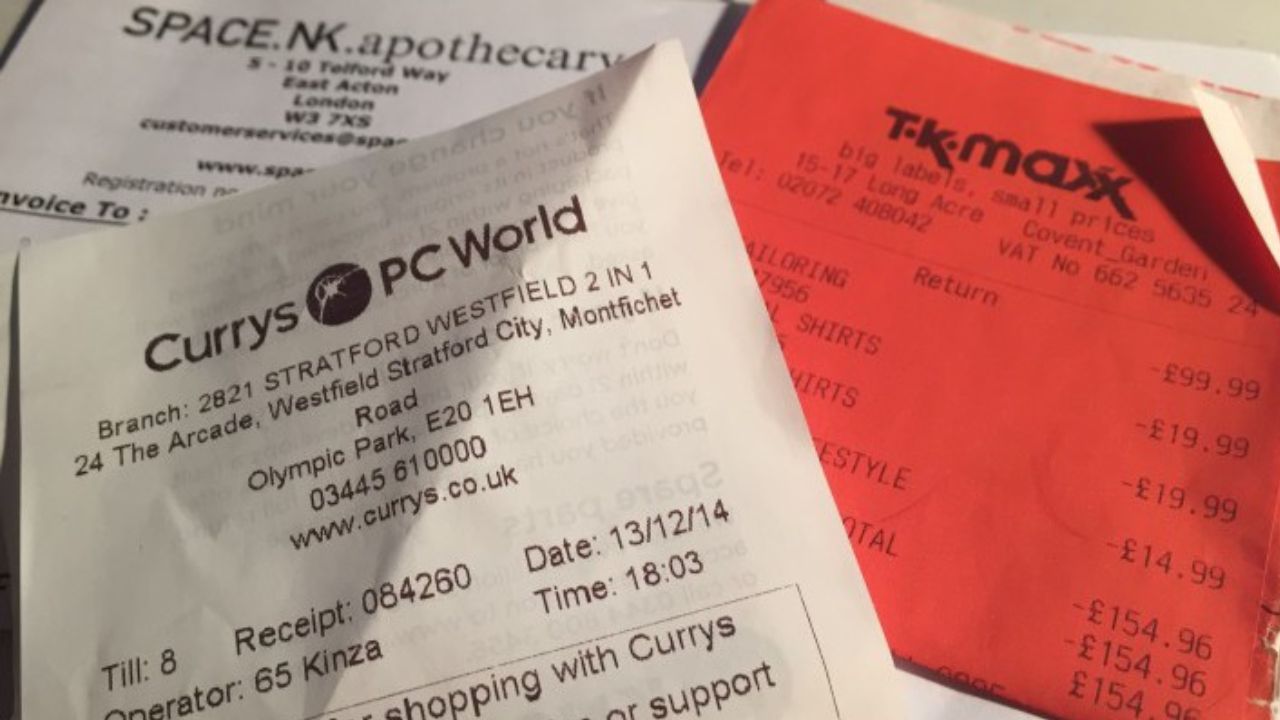

Keep your receipts

While there are IT outages like this one, it’s best to keep hold of all of your receipts, such as when you pay for fuel, parking or tolls. This can give you some cover if it’s claimed down the line that you failed to pay for something. The same goes for any declined payments – just in case they actually do go through.

Keeping your receipts is also essential if you’re affected by a flight delay. You’ll need this for any essentials you need to pay for. For example, food, drinks and accommodation. It’ll be easier to claim back these expenses from your insurance or the airline if you have your receipts.

Contact your insurer

If you’re impacted while travelling, look out for communication from your insurance provider. You may be able to claim for a delay to your travel or where your travel is cancelled.

Be careful, as the insurance provider and airline may try to push the responsibility to the other party — check the policy wording to see if your insurance will cover you in instances like this. If all fails and you paid with a credit card, consider claiming on Section 75.

Get the best of our money saving content every week, straight to your inbox

Plus, new Quidco customers get a high paying £18 welcome offer

Take more than one card

Sometimes an issue exists with just one card provider, such as Visa, Mastercard or Amex. We’ve written before about the importance of having more than one bank account. It’s best to take out a mix of debit and credit cards with different providers to make sure you can make payments on the go. This probably isn’t the time to rely solely on using Apple Pay.

Take out cash

If all else fails, most places should take cash, although we are seeing a lot more cashless companies nowadays. I wouldn’t advise running to your nearest ATM and withdrawing all of your money, but it’s a good idea to carry a little bit of cash to ensure you can still pay for things.

If this issue spans over the weekend then there’s the possibility that ATMs may run out of cash entirely.

We have another guide on ways to pay during the outage.

Keep essentials in hand luggage

With systems down and check-ins being done manually, there’s a higher chance that baggage will be lost at airports. If you’re jetting off on holiday then pop essential items like medication in your hand luggage rather than your hold luggage. It’s probably best to do this with any valuables as well.