It’s taking up to five weeks for accounts to be opened.

If you’re waiting to open a Chase current account, you’re probably worried about news the £20 refer-a-friend offer is ending on Tuesday 7 June 2022.

Here’s what you need to know about whether you’ll get the cash or not if you’re mid-application, and whether there’s still time to start from scratch.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the Chase £20 refer-a-friend offer

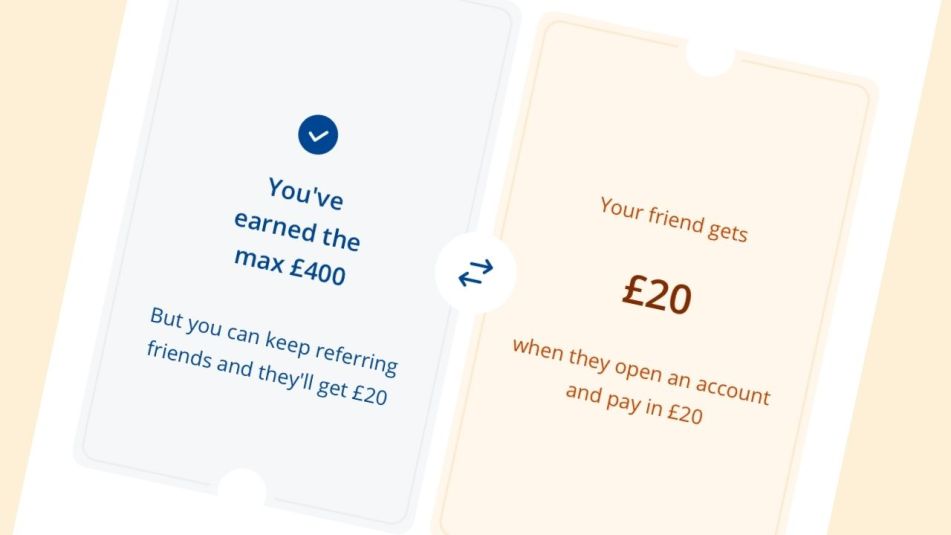

From mid-May until 7 June 2022, Chase Bank has been running a refer-a-friend scheme where new customers get £20 for signing up via a friend’s link (they also get £20 each, up to £400). Here’s everything you need to know about the offer, and the referral link you need to get the cash.

When will the Chase offer end?

On the morning of Monday 6 June, Chase announced that the refer-a-friend scheme will the next day – at 23:59 on Tuesday 7 June. That’s not much notice!

If you apply to open an account via a referral link before this date (and add £20 to your account) then you will still get the £20 added to your account.

You can also share your own link with friends until then, and as long as they sign up, you’ll get your £20 referral too.

Will being in a waiting room stop me from getting the £20?

Due to the demand in new applications for the Chase account since the £20 offer launched, there have been a number of delays in opening an account – at one stage the whole joining system crashed for most of a day.

Even at the best of times, it’s been inconsistent. I know people who have had their account up and running within minutes, while others have taken a few days. But since late May applications have been batched together on a first-come, first-served system.

And now people have been placed in a “waiting room”. After downloading the app you’ll see a holding screen, and will only be able to progress further once you get a text from the bank. This is how it worked when the account launched last September.

Chase says it can now take between three and five weeks to even get to the stage where you can begin an application.

However, as long as you used a refer-a-friend link to download the app before the 7 June deadline, you will still get the £20 offer, even if it does take weeks for you to actually get the account open.

If you didn’t use the link, but instead have a code, you should also be ok. You’ll have 14 days after opening the account to add a referral code. Note that’s successfully opening an account, not starting your application. That means you can still do this even if you’re waiting five weeks for that to happen.

Don’t forget you will need to follow the other step of adding £20 within 30 days to your account before the £20 referral cash will be credited.

Also, make sure you don’t delete the app while you’re in the waiting room as this will cancel your place in the queue.

Get the best of our money saving content every Thursday, straight to your inbox

+ Get a £24 Quidco bonus (new members only). More details

Is Chase Bank any good?

There are a few reasons why Chase has been popular recently. Along with the £20 welcome offer, there’s 1% cashback on purchases for 12 months, 1.5% interest on savings and 5% interest on roundups. Plus it’s free to use abroad. Here’s my full review.

I opened a Chase account a couple of months ago and deposited a fairly large chunk of money. Now I’ve requested some money to be returned back to my other bank account with virgin as the rate on their M Plus Saver has just gone slightly above the 1.5% at Chase. The transfer has been put on suspense (for “a few hours”) and remained there for 3 days (& counting!). I have contacted Chase and they are looking into it but that doesn’t help me if I required the money urgently. There is nothing on their website to warn of this delay and feel let down by the time it is taking to deal with such a relatively simple task. Maybe I should’ve tested a smaller withdrawal first before attempting a bigger one but how was I to know?

Perhaps we should take heed of the current fiasco at Chase. If they are having difficulties with the ‘demand’ how reliable are they going to be looking after your money?

No use to me as I don’t have a mobile.