Should you ditch and switch?

Chase’s saver account is popular with our readers, largely due to interest rates boosted by special offers earlier this year and a good app. However, there have been three reductions to the rate this year, and another is coming soon. Here’s what you need to know.

Some articles on the site contain affiliate links, which provide a small commission to help fund our work. However, they won’t affect the price you pay or our editorial independence. Read more here.

What is the Chase Saver?

The Chase Saver is an account open to anyone with the Chase current account. You can open up to 10 different savers, each with their own sort code and account number. You can also customise the account names, making it a handy way to work towards multiple savings goals. It’s quick and easy to move your money between the savers or your current account.

How much does the Chase Saver pay?

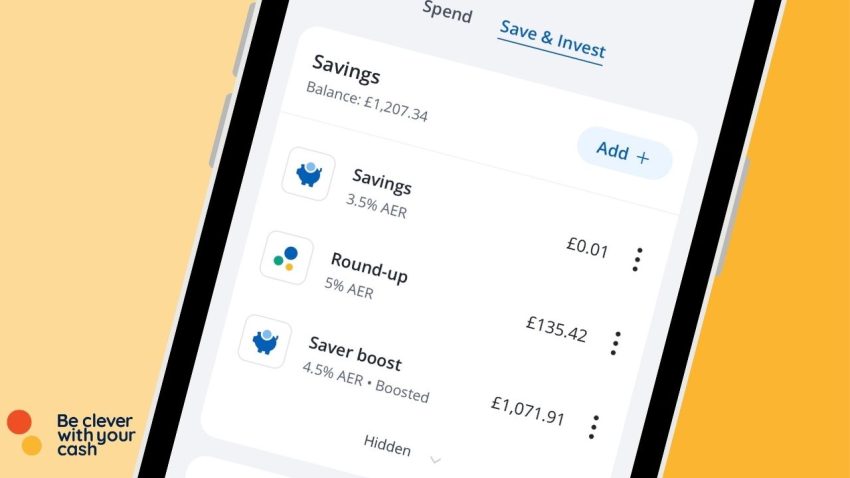

Right now there are three or four different rates you could be earning – it all depends on when you signed up and whether you triggered a booster rate.

The standard rate right now is 3.5%, which is actually a tracker rate of 1.25% below the Bank of England base rate (currently 4.75%). This means if the Bank cuts that base rate, as it did in November 2024, this will automatically fall by the same amount.

However, many customers will be earning a 1% bonus on top of this, bringing it up to a decent 4.5%. These bonuses ran in April and August 2024 and are no longer available to existing customers. They only last for six months, so savers will have only a few months left before that expires, if it hasn’t already.

And there’s a new boosted rate for brand new Chase customers that’s recently been introduced. It’s worth 1.5% and lasts for six months. That’ll mean you’ll get a table topping 5% if eligible. We’ve details over on our savings best buy tables.

What will the new Chase Saver rate be?

From 19 February 2025, the tracker rate that all savers will get, whether they receive the bonus or not, will change from 1.25% below the base rate to 1.5% below.

Assuming the Bank of England doesn’t change the base rate when it next meets in early February, that’ll mean you’ll get 3.25% before any bonus. If it does, you’ll be getting just 3%.

Chase’s four rate cuts in 7 months

When the tracker rate was first introduced in May, moving it from a standard variable rate, it was set at 1.15% below the base rate. That means savers received 4.1%.

The base rate itself was cut in August from 5.25% to 5%, meaning Chase savers (before or without a booster) were getting 3.85%.

Then in October, Chase changed the tracker to 1.25% below the base rate, meaning the return was down to 3.75%.

Another base rate cut in November reduced the return to the current 3.5%.

This new cut to the tracker rate means over the seven months of August to February it’ll have fallen by a total of 0.65%. But with the two cuts in 2024 added on, that actually means savers will be down a combined 1.15%.

That’s versus a 0.5% drop that would have been a fairer decrease. Though for many the 1% bonus will have offset this, that’s still a hefty cut.

And of course we could see a fifth cut in early February when the Bank of England next meet.

Can you beat the rate elsewhere?

Let’s assume you’re getting a 1% boost right now, meaning an overall rate of 4.5% at the moment, dropping to 4.25% in February.

Neither are actually not too bad, and if your use Chase as your main current account and like the simplicity of the app, it could be we worth sticking with them rather than move your cash about.

However if you have sizeable savings, it can be worth getting a higher rate. At the time of writing you can get 4.9% in a Cash ISA from Trading 212 or 4.86% in a normal easy access account.

With £20,000 saved, an extra 0.65% (4.9% vs 4.25%) is worth £130 over a year. Not to be sniffed at.

If you aren’t on the boosted rate then you’ll be getting 3.5% now, dropping to 3.25% in February 2025. In this case you absolutely should be shifting your cash.

Featured switching deal

Featured switching deal

Customer rating

3.8/5

Customer rating

3.8/5

- Switch bonus£200

- Offer endsUnknown

- FSCS Protected? Yes

- Bonus requirements Switch using the Current Account Switch Service and close your old account within 60 days of starting the switch

- Deposit requirements Deposit £1,500 in the first 60 days from opening the account

- Direct debits transferred over Set up two Direct Debits before or after the switch from a selected list of household bills

- Existing customers? Can't have held any Santander current account on 1 January 2025

- Restrictions Can't have received a switching bonus from Santander already, offer limited to once per person

- Eligible accounts Open a new or hold an existing Everyday, Edge, Edge Up or Edge Explorer current account

Anyone else think that Chase (after being a fine and professional bank when they began trading in the UK) now seem to be dipping in quality? Not only are rates dropping (often) but I find their MANY rates confusing, contradictory and complexI worked out there are over 20 different rates depending on when you began, if you are new, if you have a Bonus, or a Top-Up, or work in APR, AER or Gross! When I questioned what my rate actually was in November, staff (abroad) gave me wrong information and would not admit they were wrong – despite the correct rate being shown. They eventually admitted a mistake but the matter took 3 weeks, many hours and literally dozens of messages back and forth to Manilla!? Not impressed any more and I don’t see the point of sticking with them when there are many others offering better, higher and clearer rates elsewhere! Sorry to say this but Chase needs a revamp.

I use my Chase account as my spending account, so I keep around £1000 in it each month for spending and move it from the savings account to the current account as I need it. It’s easy and instant to transfer money over.

To be honest, I don’t know why Chase don’t just give you the 3% on the current account now, I can’t see anyone using the savings account as anything other than an extension of their current account and it would save the fiddling around.

I’ll keep my Chase account as long as they do the cashback. That’s made me about £300 over the 2 years I’ve had it, with no admin whatsoever.